India on Crypto – Yes and No

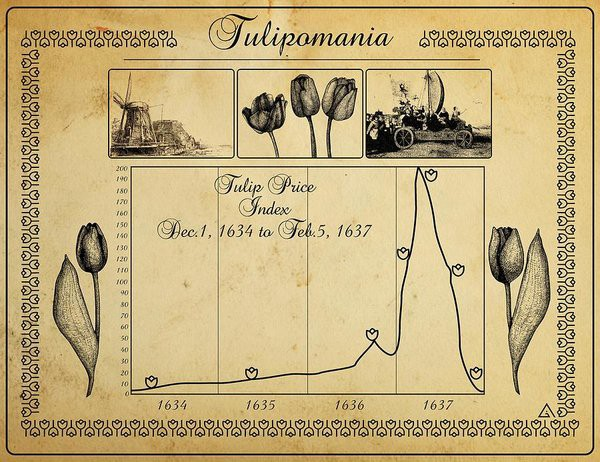

That said India’s Central Bank has voiced concerns over the instability of cryptocurrencies and a number of banks cut ties with crypto companies, but the Indian government also indicated that the Central Bank will introduce a cryptocurrency during the next financial year (2023?) using blockchain and other technology. But late last week the head of the Reserve Bank of India stated that “Private cryptocurrency is a huge threat to macro-economic stability and financial stability...investors should keep this in mind that they are investing at their own risk, and these cryptocurrencies have no underlying (value) - not even a tulip”, referring to the Dutch tulip mania that gripped investors in in the early 1630’s until its collapse in 1637. This seems to be the mantra of many governments, including the US, where stern warnings about the risks of cryptocurrencies are given but fear that the government will lose revenue or be seen as ‘technically outmoded’ push them toward issuing some sort of government sponsored cryptocurrency as we noted on 01/21/22. It’s a very complicated issue that is hampered by both a lack of understanding and greed. Back to the gold standard?

RSS Feed

RSS Feed