Inventory Intimidation?

Our assumption would be that if inventory levels for notebooks are now returning to normal (at least for some brands and product types) there should be a bit more stability in the retail market as to pricing, however pricing notebooks is a difficult task as there are an almost infinite number of variations as to type (laptop, Chromebook, 2 in 1, etc.), display size (13.3”, 15.6”, 17.3”, etc.), memory, drive size, and a host of other characteristics, which makes price comparisons difficult. That said, we went to Best Buy (BBY) and listed the ‘most popular’ notebook models and cross referenced that list against Amazon (AMZN) pricing for the same models. If we could not find an exact model match on Amazon, we eliminated that model, but we were able to come up with a list of 10 models that were on the Best Buy ‘Best sellers’ list that were also represented on Amazon. We note that in some cases the reason some of the Best Buy models do not appear on Amazon is that they are either too new, too old, or have an unusual configuration, which throws a bit of a question as to how Best Buy determines the ‘Best seller’ list, but that is a question for Best Buy.

All of that said, the average discount from list price for all 10 models at Best Buy was -26.7% and in comparison the average discount from the highest price on Amazon was -18.4% and the change from the lowest price on Amazon was a slight increase of 0.2$, with the detail being all but two models were at or below their lowest price on Amazon, which, as a single datapoint would indicate that recent discounting to move inventory has not quite ended. For reference, and this was a bit of a surprise to us, all but one notebook model saw higher current pricing on Amazon than at Best Buy, with an average difference of +14.1% higher on Amazon. We had assumed that Amazon pricing would have been equal to or lower than Best Buy, but that was not the case, although the basis for the lest was Best Buy’s ‘Best sellers’ which implies that list is attractively priced. That said, Amazon tends to be lower priced for such items in most cases, unless the Amazon pricing comes from 3rd party sellers, rather than Amazon itself, which was the case for a number of models. These are anecdotal data points that are, at the least, helpful in checking direction and momentum.

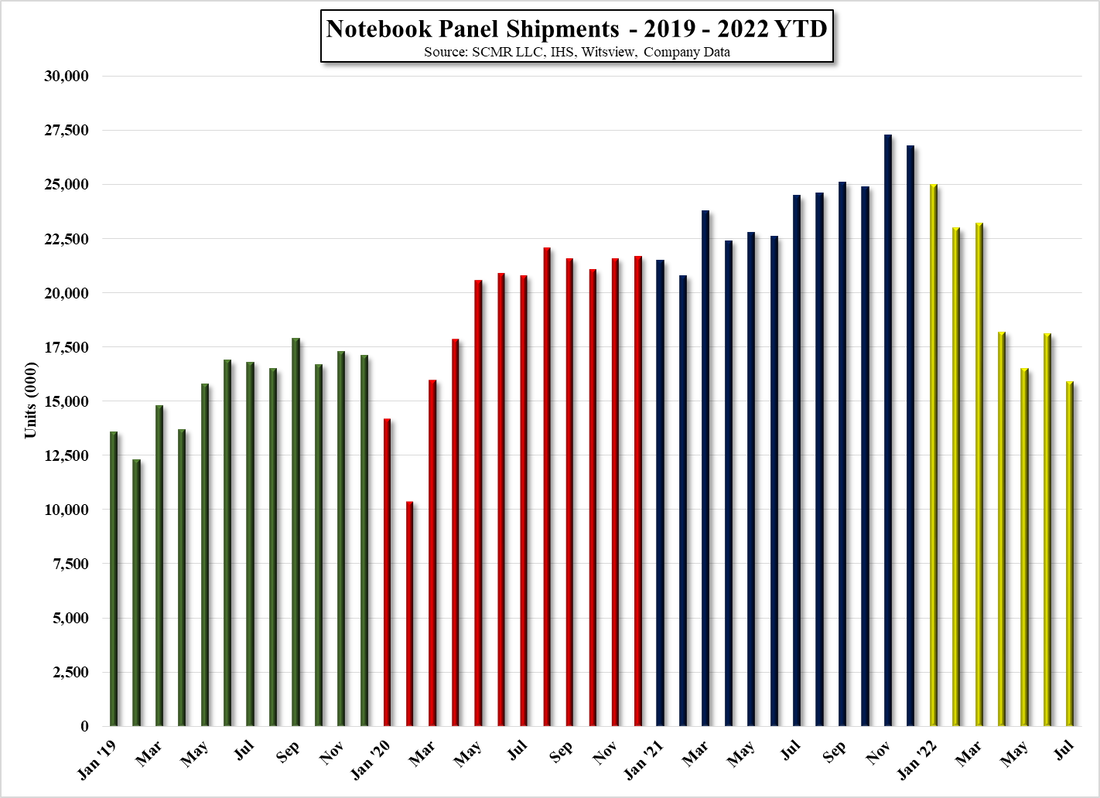

All in, our conclusion is that it is a bit early to be calling for a return to what has been ‘typical’ ordering for notebook brands and CE products generally, and while we expect seasonality will help to stimulate some additional ordering as of late August early September. Typical 3Q notebook panel shipment seasonality (5 year average) calls for an 8.3% increase q/q, although that same 5 year average for 2Q was +13.8% while the industry saw a 25.8% decline, so we only use those seasonal averages as reference. There have been a few signs that the rapid increases in inflation might have leveled off a bit but as an incentive to consumers who deal with ‘non-seasonally adjusted’ prices for essentials, expensive CE products are likely not high on the list of things they ‘need’ to purchase over the next few months, so we see a more gradual demand recovery that could easily extend into 2023. Especially given the aggressive demand cycle the industry went through in late 2020 and early 2021 as a result of COVID.

Bringing inventory levels back to normal is only half of the problem, with the other half being the stimulation of a new demand cycle, and that we expect will take lower prices. Whether that comes from a disinflationary environment next year, or a desire for CE brands to dump high cost inventory before year-end (a practice not unfamiliar to many CE companies, particularly those outside of the US where the focus is on asset quality over sales growth), will determine how the holiday season plays out. While we expect some cost relief across the CE supply chain over the next few months, we expect that the holiday season this year will be mediocre for most CE products.

RSS Feed

RSS Feed