It’s Beginning to Look A Lot Like Friday

On a more general basis, an Offers.com (ZD) survey indicated that 20% of shoppers expected to increase spending during the holidays this year while 21% expected to reduce spending, so the overall consumer spending pattern will likely remain on track with recent years. That said, now that the press has taken up the story on supply chain issues that might affect holiday deliveries, Black Friday early discounting serves the purpose of lengthening the time when orders might be placed, which gives retailers more wiggle room on delivery schedules, so said supply chain issues do lend some legitimacy to an extended holiday season, but at the same time consumers have also become used to those last minute ‘Super Savings Discounts’ that pop-up on peak buying days, which might not look as attractive if discounting has been in place for over a month. That, coupled with consumer electronics’ inflationary characteristics this year could make it a bit more difficult for consumers to find the bargains they have become used to, especially if there are delays in delivery times.

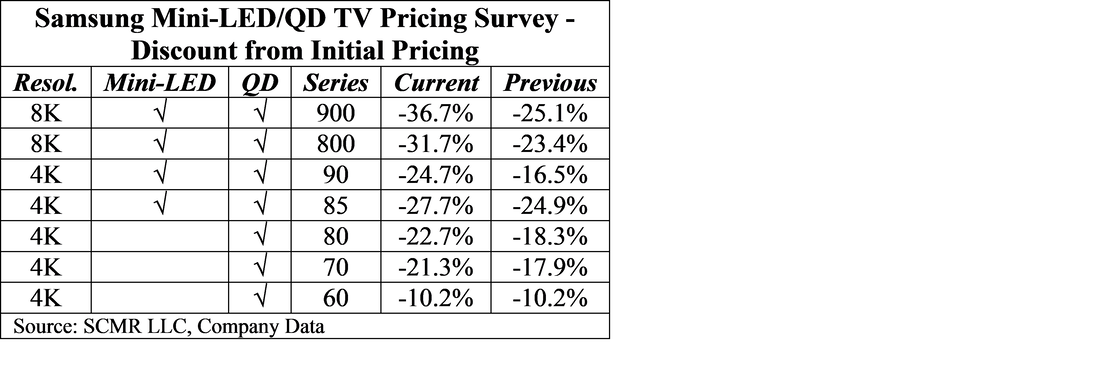

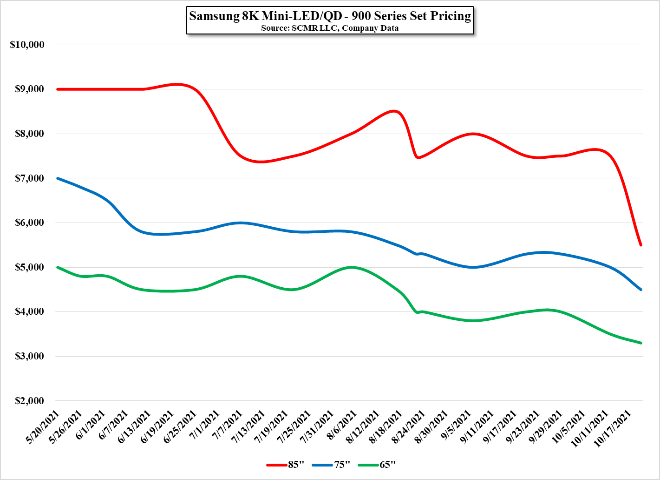

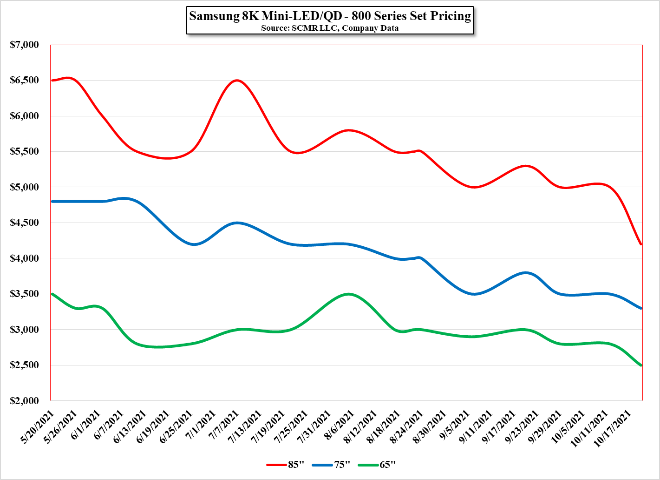

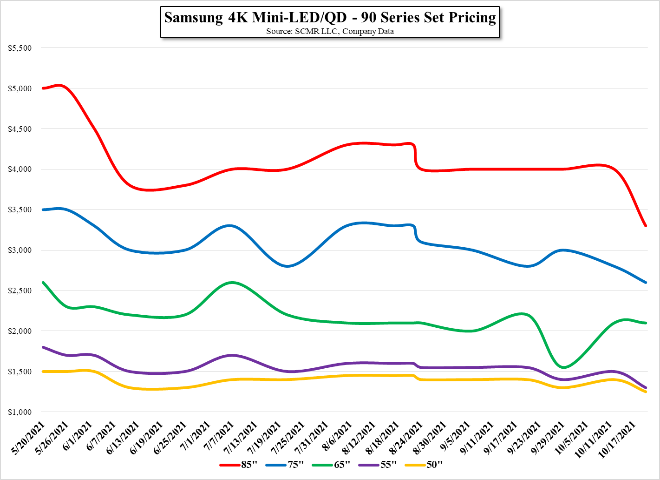

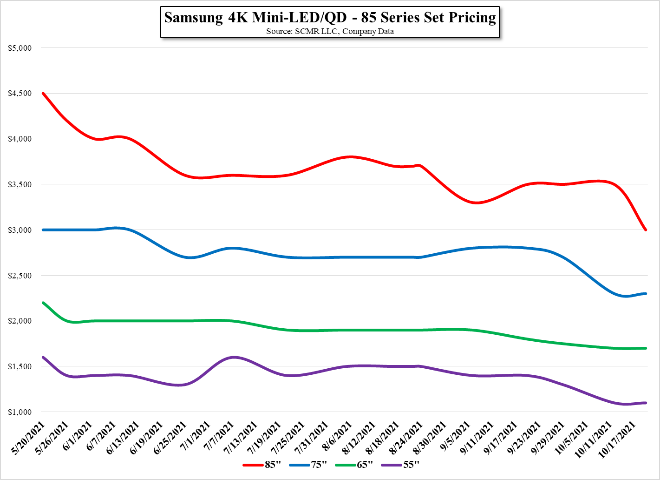

Based on our data, it seems that Samsung has already begun its holiday discounting program, at least for its Mini-LED/QD TV line, as the most recent tally has indicated that prices for much of the line have again reached their lowest point since release in late May. In fact of the 33 models we track, 29 are at their lowest point since release, while 2 are at their highest (actually unchanged from the initial price) and the top of the Mini-LED/QD line (8K) is now 36.7% below the initial price, dropping over 10% over the last week, while the 4K Mini-LED/QD are down less, but also saw price drops between 2.8% and 8.2%. Samsung’s quantum dot only sets fared a bit better, down between 0.0% (low-end QD only line) and 4.4% (hi-end QD only).

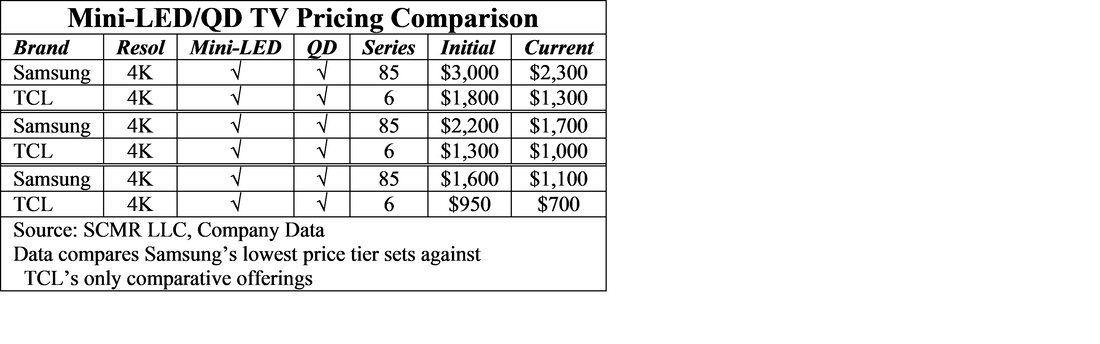

While these prices, especially at the high-end of the line are significantly discounted from initial list price, they are also competing with Mini-LED TV price leader TCL (000100.CH), who is on their 3rd Mini-LED/QD iteration, and LG Electronics (066570.KS), who has pricing more comparable to Samsung. TCL has far less name recognition in the US than either Samsung or LG, but has gained much recognition as a low-cost alternative to premium sets from other major TV brands at retailer Best Buy (BBY). While feature-to-feature comparisons are difficult, TCL’s Series 6 Mini-LED/QD line directly competes with Samsung’s 4K Mini-LED/QD line and while TCL offers a limited number of comparative models, they are priced far below even Samsung’s lowest tier Mini-LED/QD sets. TCL has already discounted their Mini-LED TV sets from list, so we would expect less discounting going forward, but with models between 46.2% and 51.9% below Samsung’s comparative pricing, the difference to consumers is obvious and continues to keep Samsung Mini-LED/QD prices under pressure.

RSS Feed

RSS Feed