January Panel Sales – Taiwan

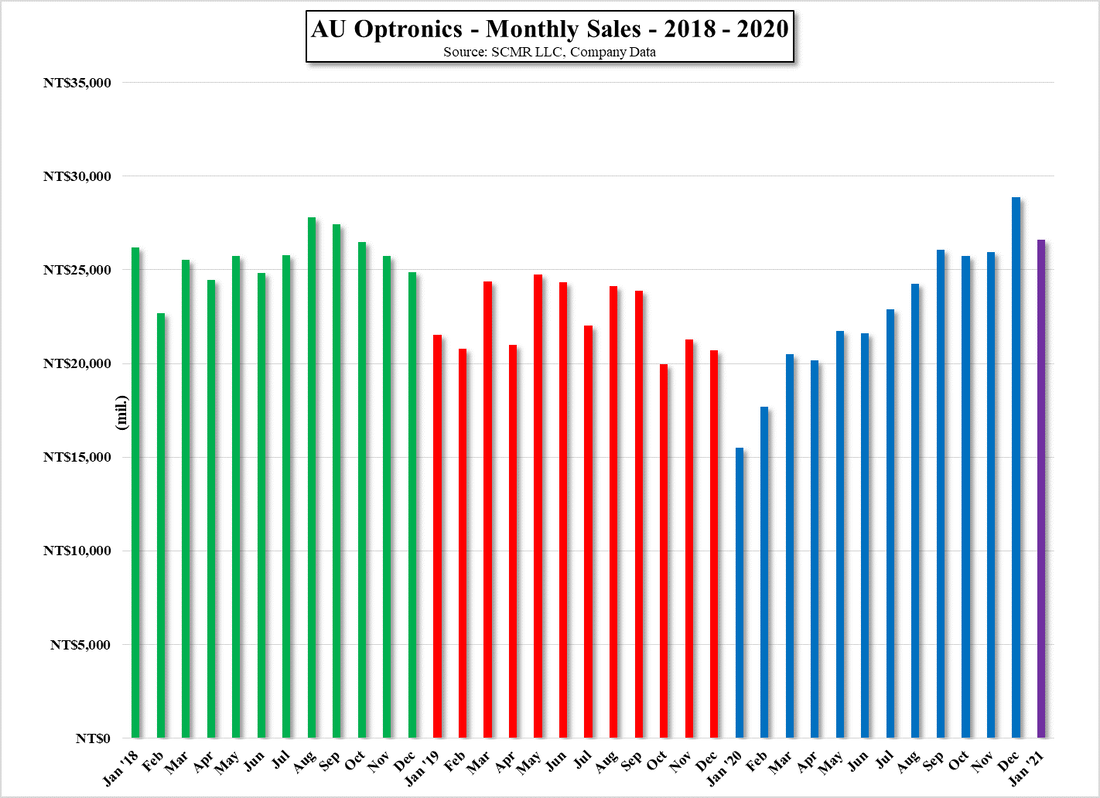

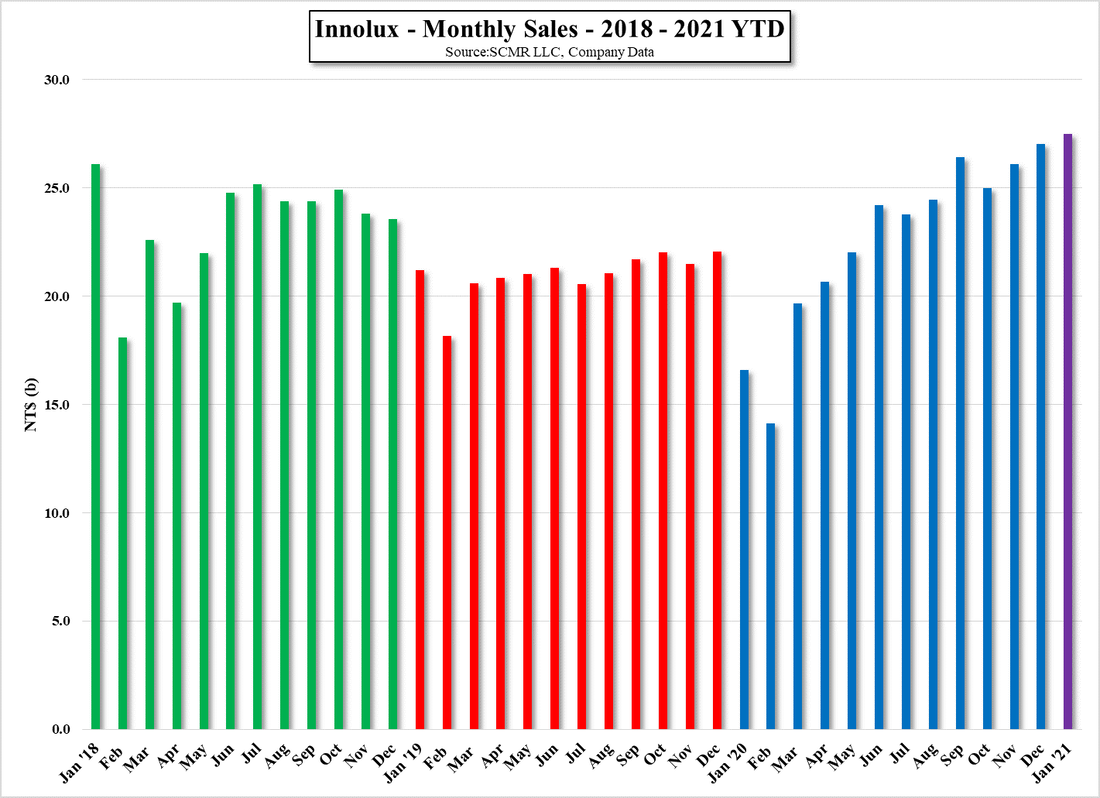

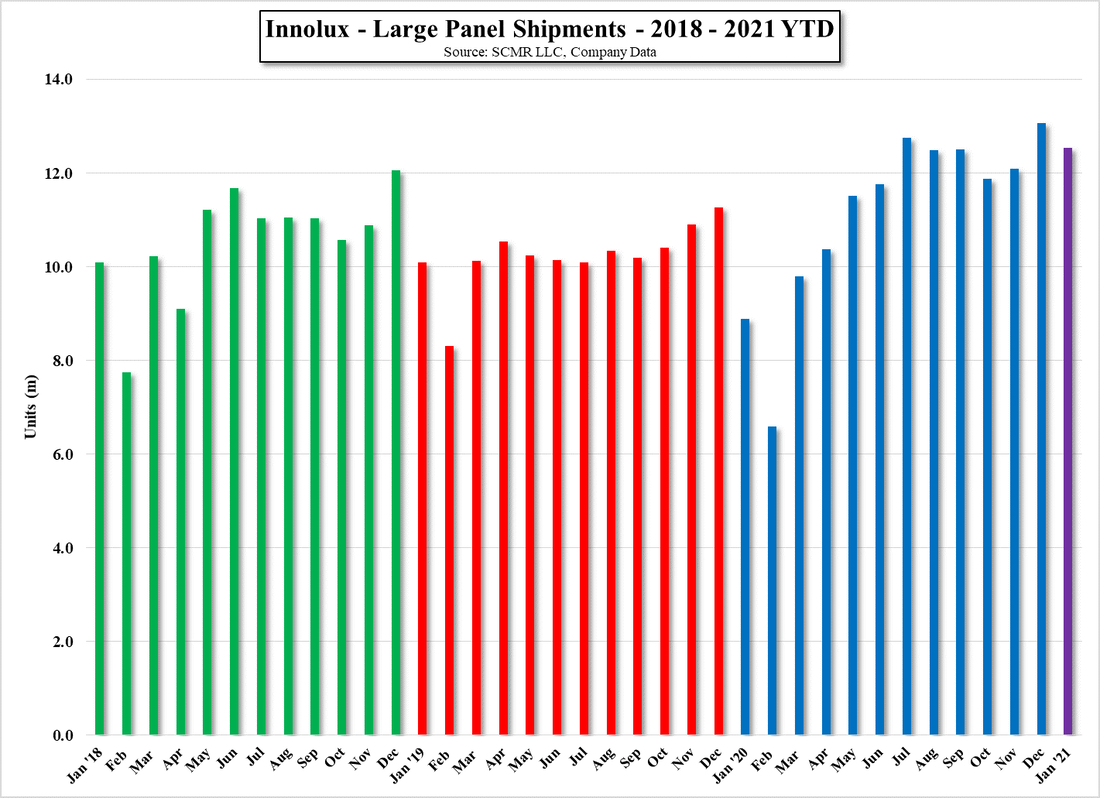

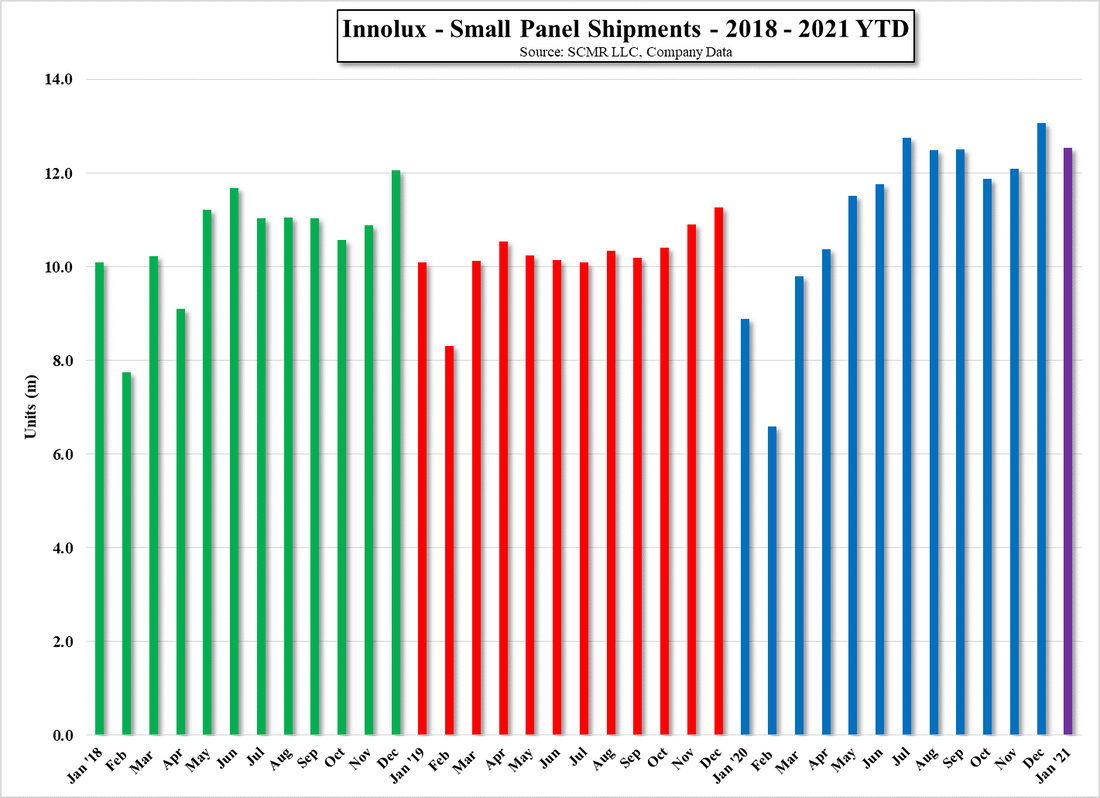

Given the unusual circumstances seen in 2020, due to COVID-19, y/y comparisons will look a bit more out of line that might be normal for January, and will likely remain so through 1Q when the virus was severely limiting production. As 2020 progressed, those limitations decreased and demand from a sequestered global population increased, and panel producers began to see high utilization rates as 1H progressed. By 3Q capacity issues returned, but this time not because of staffing limitations, but due to a lack of capacity, which caused some panel producers who had previously decided to end large panel production, to postpone those plans. While 4Q 2020 was a strong one, new issues faced panel producers as some components could not meet panel demand, and as such continues into 2021, panel producers have been able to pick and choose which customers they will supply and customers are therefore willing to pay higher panel prices for that guarantee.

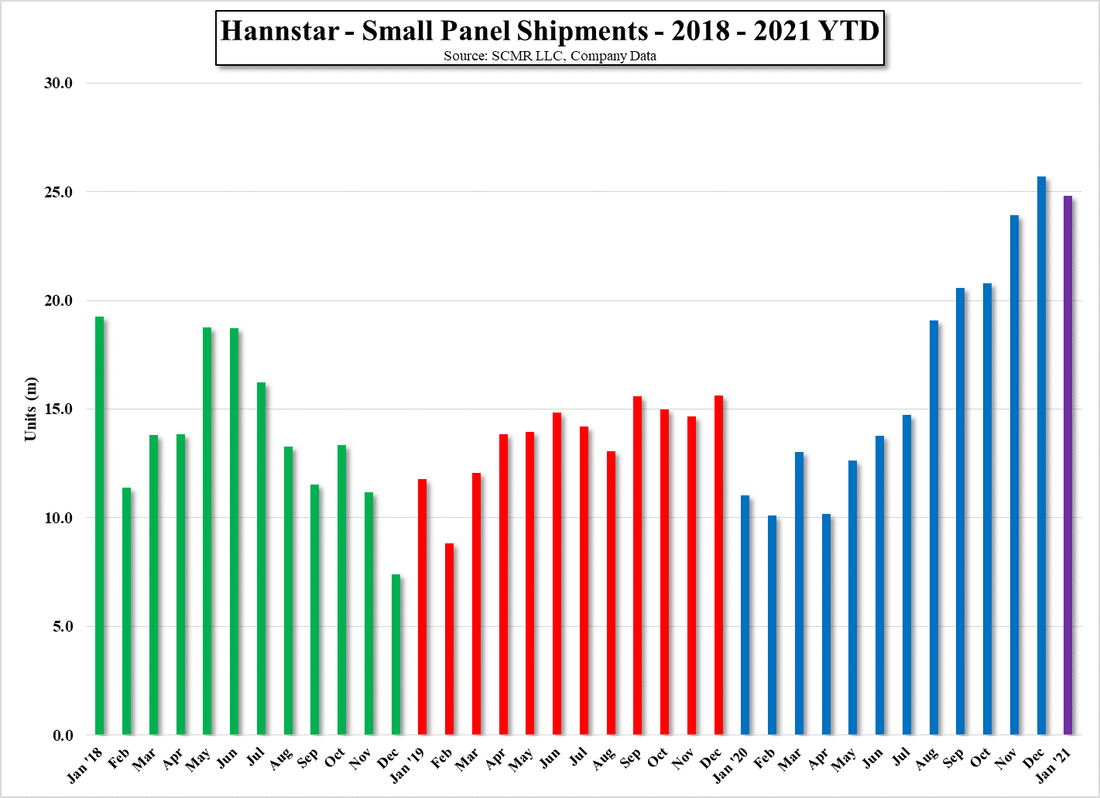

January and February are typically the weakest months of the year for panel producers, as holiday devices have been built and the Chinese New Year holiday causes low display production output, however given the unusual nature of the past year, and the ongoing pandemic, we expect norms this year to be ‘un-normal’, with only AUO showing January m/m results close to the 5 year average. The charts below give a visual understanding of how panel sales have progressed at the three Taiwanese panel producers indicated above and we summarize results in the table below. We note that AU Optronics did not provide large and small panel shipment data for January.

RSS Feed

RSS Feed