Kiss of Death

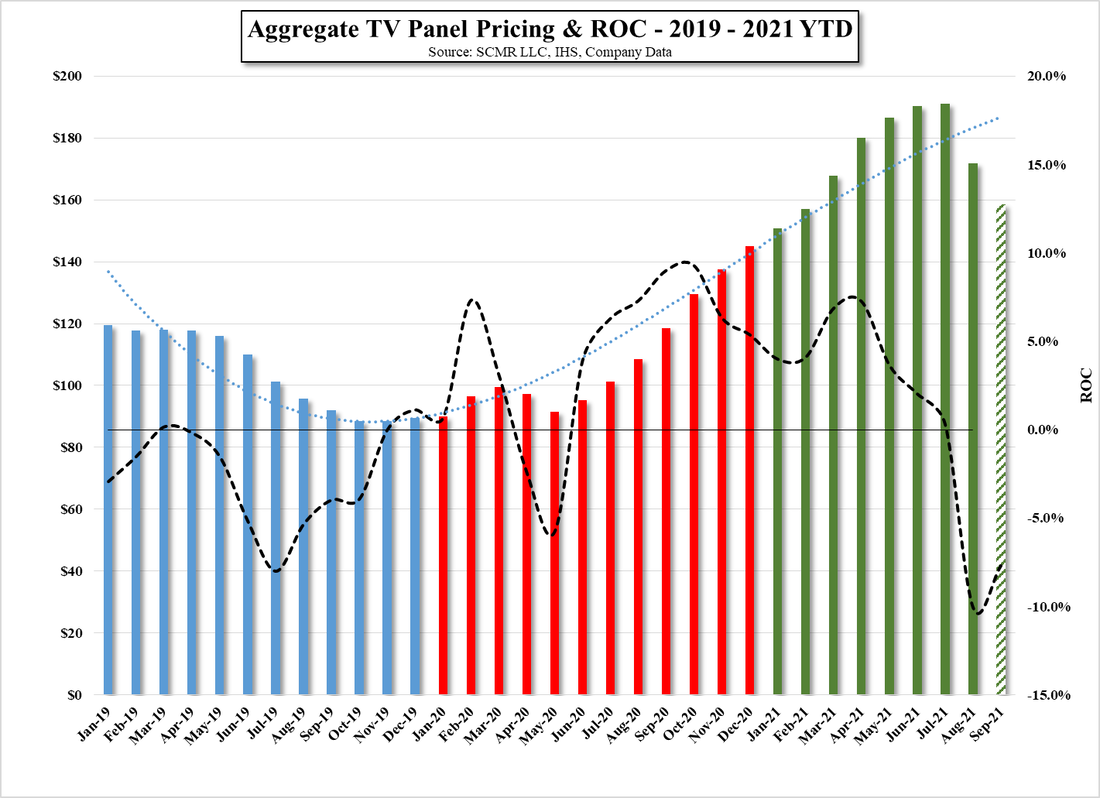

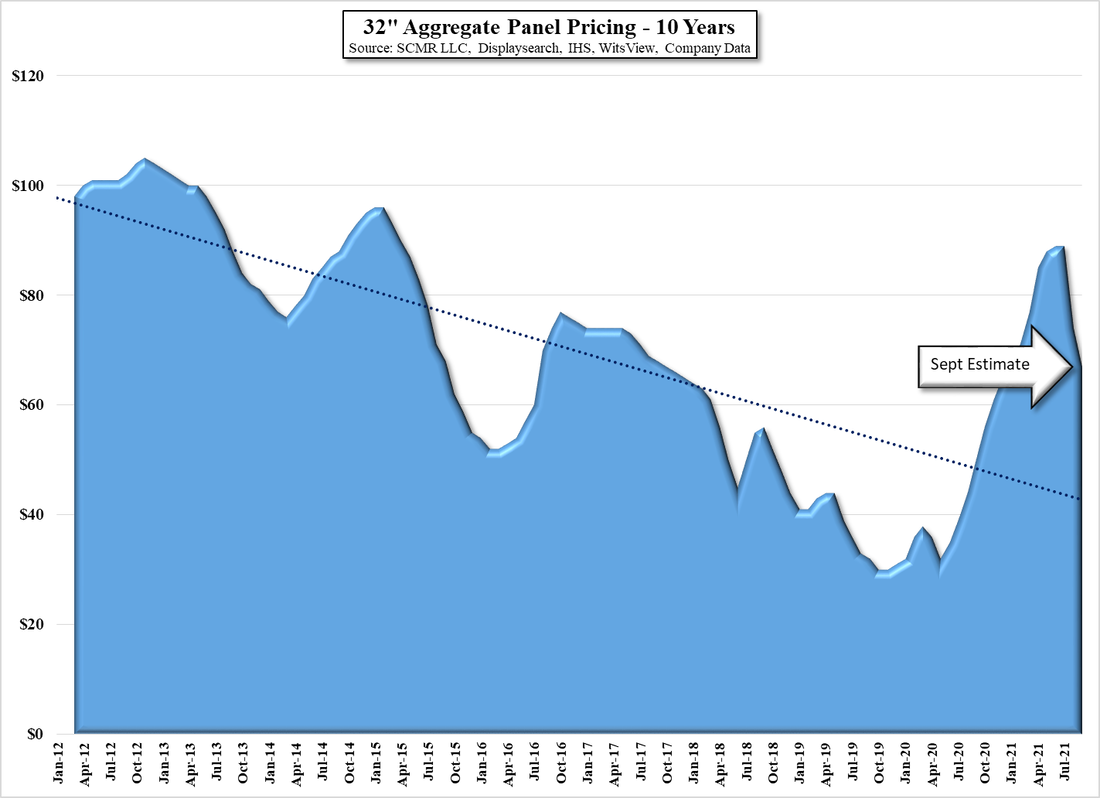

“Chances are slim for LCD TV panel prices to plunge to the cash cost level and Taiwan panel makers are now much more immune to the ongoing round of price falls amid changing industrial structures and their increasingly robust financial strength, according...”, and we assume more details are given as to why this cannot happen again, despite the fact that it happens regularly. Based on estimates for TV panel prices in September, TV panel prices are down 16.7% from their peak in July of this year, but to put that into better perspective, looking at the low point for aggregate TV panel prices back in 2019, TV panel prices had risen 117% as of July. By the end of September, if estimates are correct, that gain will have been cut to 80.2% and if the same rate of decline were used (8.9%) through year end, the gain from the 2019 low would be 36.3%.

Don’t get us wrong, that is still a very strong gain for TV panel prices over that period, but is there really anything that will protect panel producers from a continuing decline in TV panel prices? In some instances, panel producers have lowered their exposure to TV panel production in lieu of more lucrative IT product production, but much of the demand for IT products has come from the lifestyle changes brought on by COVID-19, and while that seems to be a much more persistent problem than thought back just a few months ago, it will become diminished over time, leading to more normalized demand for notebooks, monitors, and tablets, while TV demand remains relatively weak. With both major demand lines weakening, there is really little to prevent panel prices to decline back to cash costs and history proves that out.

We certainly do not rule out any of a number of panel pricing scenarios, but whenever folks in the industry say something cannot happen it makes the hair on the back of our neck’s stand up. It is easy to be feel comfortable when profitability has filled a company’s coffers but it has no bearing on whether the next cycle will be a winning one for panel producers or a losing one.

RSS Feed

RSS Feed