LG Display 4Q Notes

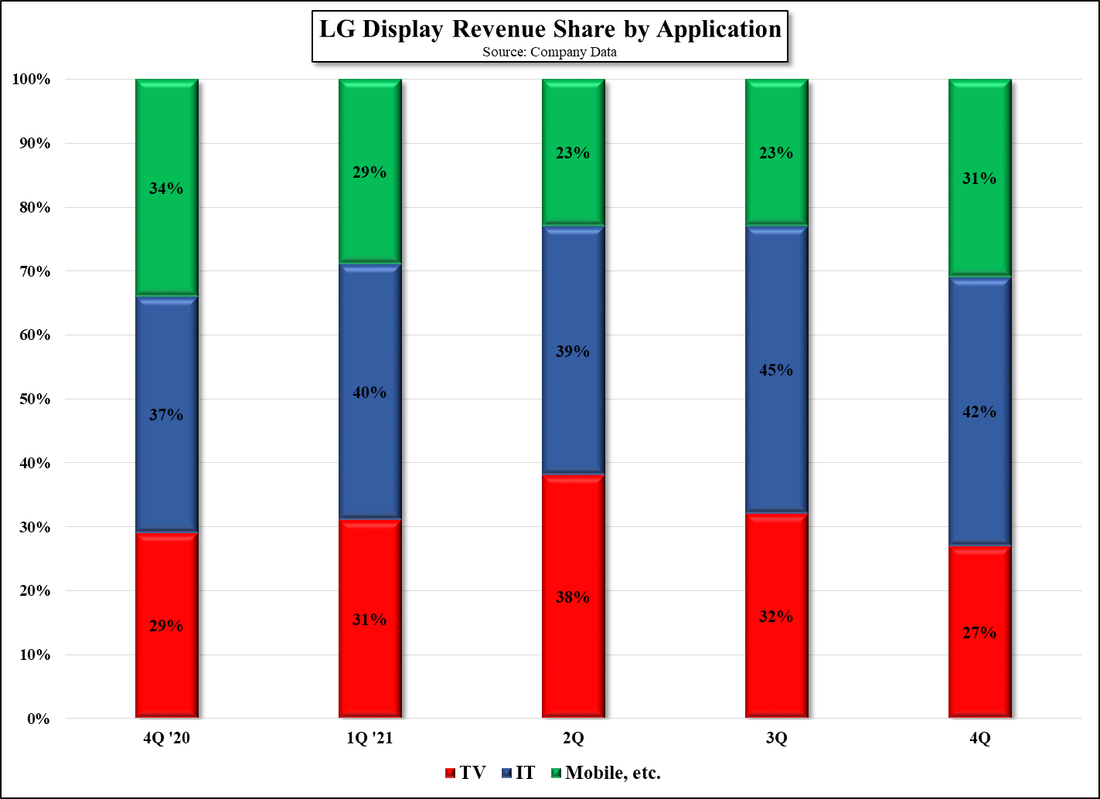

As most panel producers continued to shift panel production from TV panels to IT panels, LG Display did the same as seen below, and saw shipments (on an area basis) increase by 12% q/q and 8% y/y while total capacity declined by 2.5% q/q although up 7.45% y/y as OLED TV production capacity expanded in 2021, while 4Q operating profit came in below consensus, LG Display has been profitable on a net income basis for the last six quarters and while the overall TV market saw a decline of 10% in 2021, OLED TV set sales (LG Display is the sole panel supplier) grew 60% y/y, reaching more than a 30% share of the premium TV market in 4Q, which also grew ~30%. The OLED TV panel business became profitable during the 2nd half of 2021. CAPEX was 3.2t won ($2.675b US) in 2021 but will increase in 2022 as the company expands its small and medium OLED production capacity, as we have described in earlier notes.

1Q 2022 guidance was for area shipments to decline mid to high single digits while ASP (m2 basis) are expected to decline by mid to high teens q/q, as mobile sees its seasonally weakest quarter and broad guidance for for panel shipments, which came in below full-year targets in 2021 are for an increase of ~20% in 2022. The company indicated that January sales were similar to the 4th quarter rate. Some color on IT panel price expectations leads one to believe the company expects IT panel prices to decline, not quite a radically as TV panel prices did last year, but more oriented toward low-end IT products, with consumer demand declining as COVID-19 eases, and a corresponding increase in B2B demand. On a more general basis, LPL expects overall panel demand to remain flat in 2022 with the shift away from TV panel production toward IT panel production creating continued pressure on IT panel prices, although they are quick to point out that the company is oriented toward premium IT products which will see stability in 2022.

During Q&A it was asked if the company could clarify whether Samsung is going to purchase OLED panels from the company, and while they gave no comment specifically, they did indicate that their target of 10m OLED panels for 2022 was based on existing customers, leaving one to believe that negotiations have yet to be completed and if eventually completed, would be incremental to the company’s growth forecast for OLED TV panels. When quiried about the Samsung QD/OLED product that got press at CES, the company echoed its mantra about welcoming an additional OLED participant as it would help to promote OLED overall, but gave no comment on any quality comparisons between the two technologies given that the Samsung QD/OLED product remains unreleased.

LG Display’s OLED TV panel business is capped by capacity, with yield and cost improvements the way in which it hopes to gain top line growth, however the company did indicate that it would also be expanding its OLED IT business, which carries higher margins than TV OLED TV panels. Much of that growth will come from the expansion program mentioned above, which will become a contributor in 2024, but we expect at least some shift from large panel OLED TV panel production to at least some higher margin gaming monitors and/or laptop OLED panels.

All in, 4Q, excluding profit participation was a good quarter, although dividend and bonuses are a part of doing business and should be considered legitimate expenses. 1Q will be weak, and while the company expects that weakness to be perhaps ‘less than seasonal’ we are a bit less optimistic as IT panel concentration remains high as panel price declines shift to that category. It is incumbent for LG Display to make decisions about how they plan to expand or contract their LCD TV panel business and whether they will expand their OLED TV panel capacity along with their already approved small panel expansion plans, but we expect such decisions will not come until mid-year, as the outlook for panel production heading into 2022 is opaque, however the company’s LCD panel business could become a burden if IT panel prices continue to fall and building OUT additional OLED TV capacity could take at last a year from onset. Time’s a wastin’.

RSS Feed

RSS Feed