HKC starts up new G8.6 China LCD fab

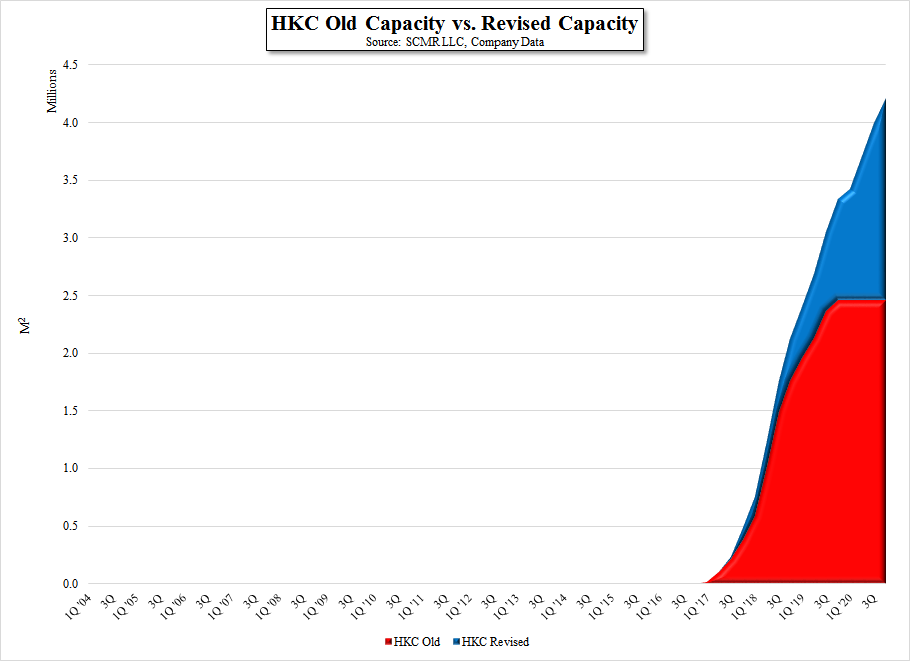

The fab will ramp production levels toward a 90% utilization rate in July and 100% in October according to the company, which is far more aggressive than our projections. We had expected the fab to open in September and to take more than 12 months to get to full production of phase 1. We pull our monthly ramp forward, but given HKC’s lack of LCD large panel manufacturing experience, we take a slightly more conservative view of the fab’s ramp, with full phase 1 capacity and utilization by September 2018, ~11 months later than the company expectations. HKC expects to begin construction on phase 2 of the project this month, with a projected capacity of another 70,000 sheets/month. Given the shell construction for phase two is likely completed, we would expect the internal phase 2 fab development could be completed in a year, which would pull forward our estimates for phase 2 by almost a year. Again an aggressive set of goals, which would put both 70k lines in full production by 9/2019, a full 18 months ahead of our schedule (see Fig.1 below). While it will be hard to monitor monthly unit volumes, we will adjust our model as both lines begin actual production.

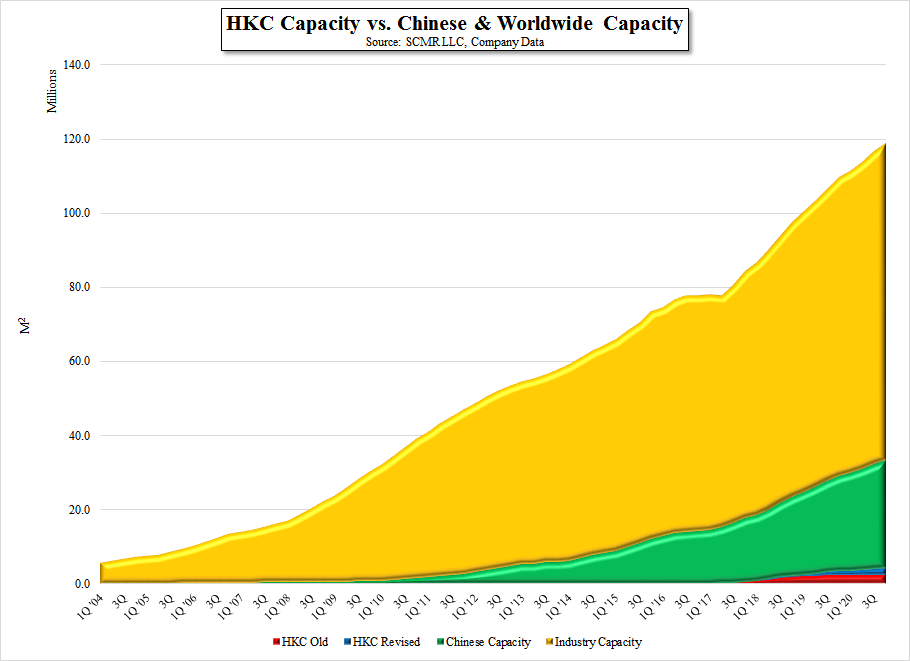

HKC is a new panel producer, but will be another semi-captive supplier to Huike Electronics (pvt), a Shenzhen based OEM/ODM that produces HKC branded TVs and smartphones and is a shareholder of HKC, while also having a subsidiary relationship with the controlling entities. The fab is expected to direct 33% of its output to Huike, with the other 67% going to local and international customers. HKC will be a small panel supplier relative to other Chinese panel producers and the top 5 giants (see Fig.2 below), but with a semi-captive customer, they will at least get a running start.

RSS Feed

RSS Feed