Chinese smartphone price increases leading to slower sales and weaker component orders

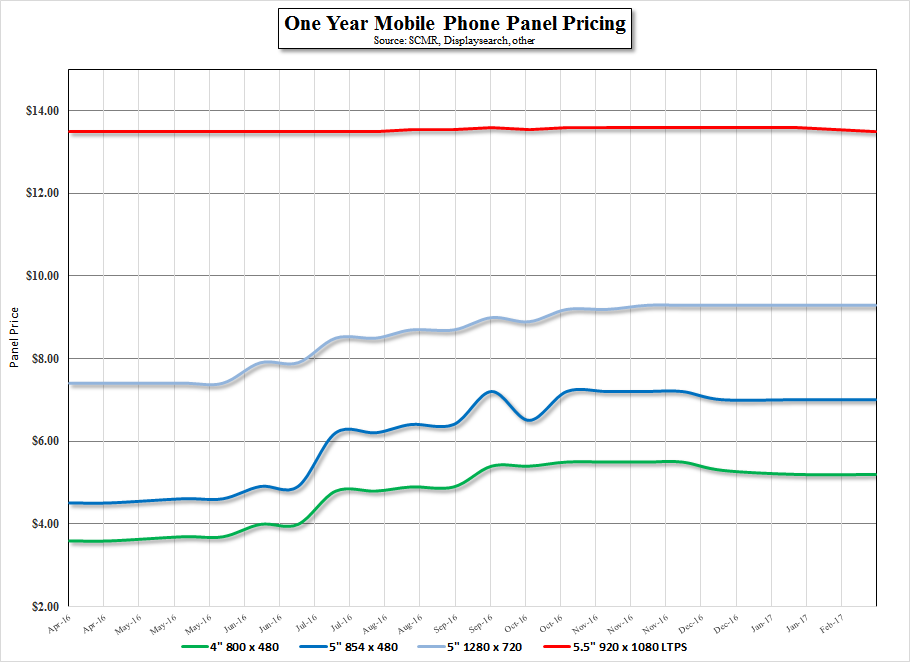

Last month we noted that component prices for smartphones and other display devices continued to see increases, and panel prices for smartphones have been rising for the last year in most cases. The combination of these factors has pressured smartphone producers to increase prices or see further deterioration in margins, as has been the case in the TV set business. The low-end Chinese smartphone market is extremely sensitive to such changes and we would expect similar declines from other vendors as price increases proliferate. According to Digitimes Research, the Chinese smartphone market is expected to decline in units shipped from 181.4m units in 4Q 2016, which was up 4.4% q/q and 12.8% y/y to 146m units in 1Q 2017, down 19.3% q/q and down 2% y/y. Seasonality, particularly in China, given its January 28 New Year holiday, says 1Q is a weaker quarter than 4Q, but smartphone price increases will continue to have a negative effect on unit sales if component prices continue to rise.

We expect a bit of weakness in smartphone panel prices during March and April, as builds for recent smartphone releases (Mobile World Congress) have ended and reorder rates will be based on actual sales rather than anticipated sales, but other component pricing tends to be a bit slower to respond, and will continue to pressure margins for smartphone vendors, especially in the low-end Chinese market, where price elasticity is high. Hopefully, lower smartphone panel prices will eventually help to stabilize smartphone prices at the low-end, while high-end prices will be determined by the success of both Samsung’s (005930.KS) Galaxy S8 line to be released next month, and Apple’s (AAPL) iPhone 8/X later this year.

RSS Feed

RSS Feed