AUO reports strong February results

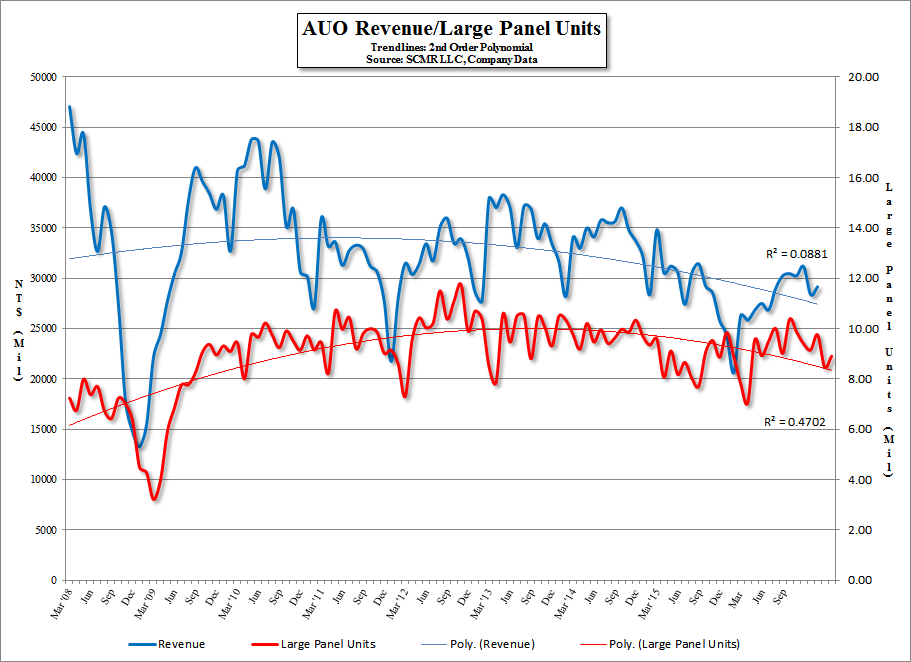

Large panel shipments were 8.91m units, ~6.6% better than the 5 year average, up 5.1% m/m and up 26% y/y, while small panel shipments were 11.76m units, down 1.5% m/m but up 1% y/y. The consensus estimate for AUO’s 1st quarter 2017 is NT$85.454b, which implies March results of NT$27.945. Given that the average March results (5 year) have been NT$32.89b, we would expect AUO to come in ahead of consensus for the quarter, particularly, as we mentioned above, the 2016 1H results were very weak, skewing the average downward. As a reference point, Hannstar Display (6116.TT) also reported February sales, down 10.9% m/m but up92.3% y/y, again indicating how severe the 1H 2016 pricing downturn was.

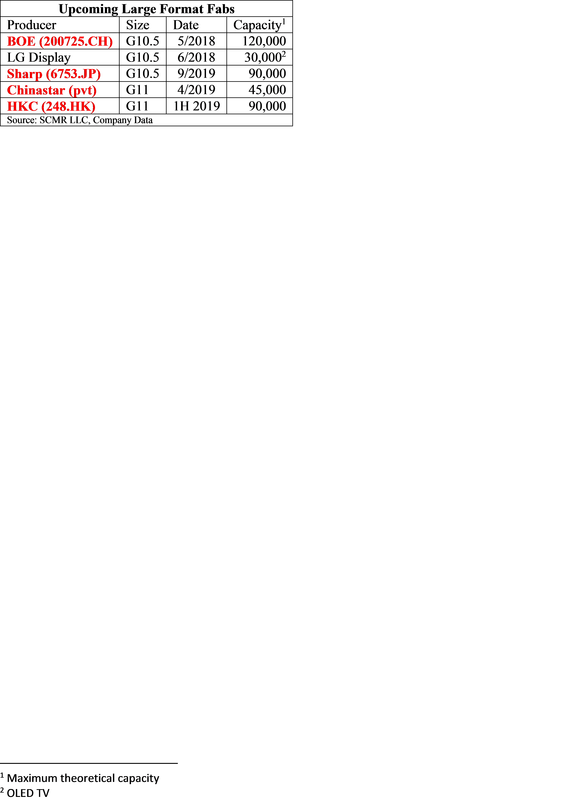

AU Optronics has been able to take advantage of both the shortages seen in certain TV panel sizes and in the trend toward ultra large TV panels, where it has been one of the few panel suppliers to hold a position in the 85”/86” 4K market, (against LG Display (LPL), Samsung Display (pvt), and Innolux (3481.TT)), where premiums are still high. In the near-term, other than the risk of falling TV panel prices, AUO’s position in the large format TV panel market is sound, however as a number of new large format TV panel fab open in 2018 and 2019, AUO will face increased competition from suppliers with more efficient production. The company has mentioned that it is considering a Gen 11 fab to offset such competition, but no decisions have been forthcoming.

RSS Feed

RSS Feed