How far along is the iPhone 8?

As we have noted previously, Apple is expected to release at least three variants for the tenth anniversary of their iPhone product line. Speculation that one of the variants will be based on OLED screen technology has lit a fire under panel producers, and led to a variety of press releases and/or ‘leaks’ indicating how much capital said producers would be spending on the technology. What is most relevant however, is the experience that each panel producer has toward the development and production of small panel OLED displays, and the timelines associated with the increase in small panel OLED capacity.

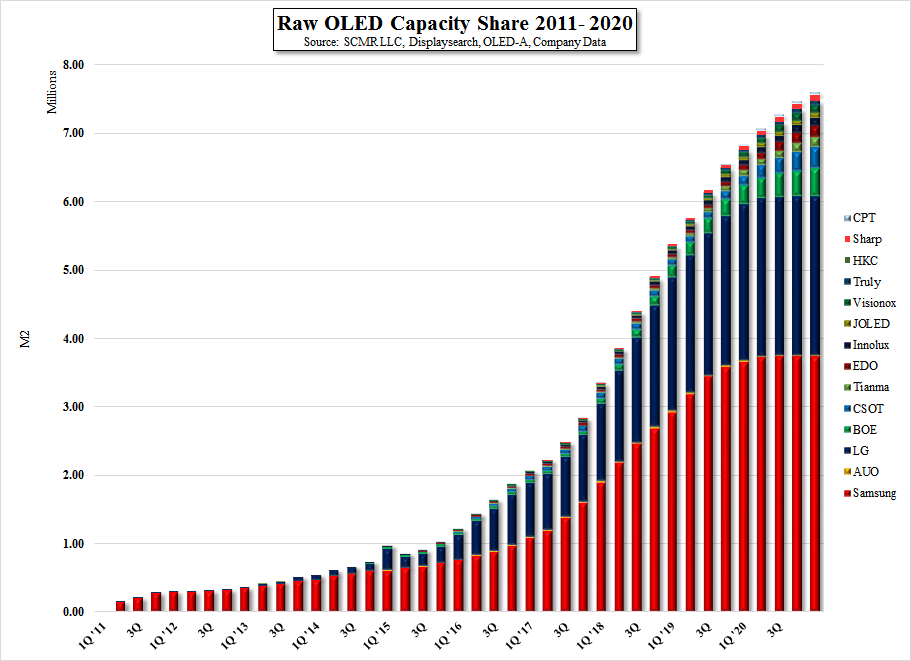

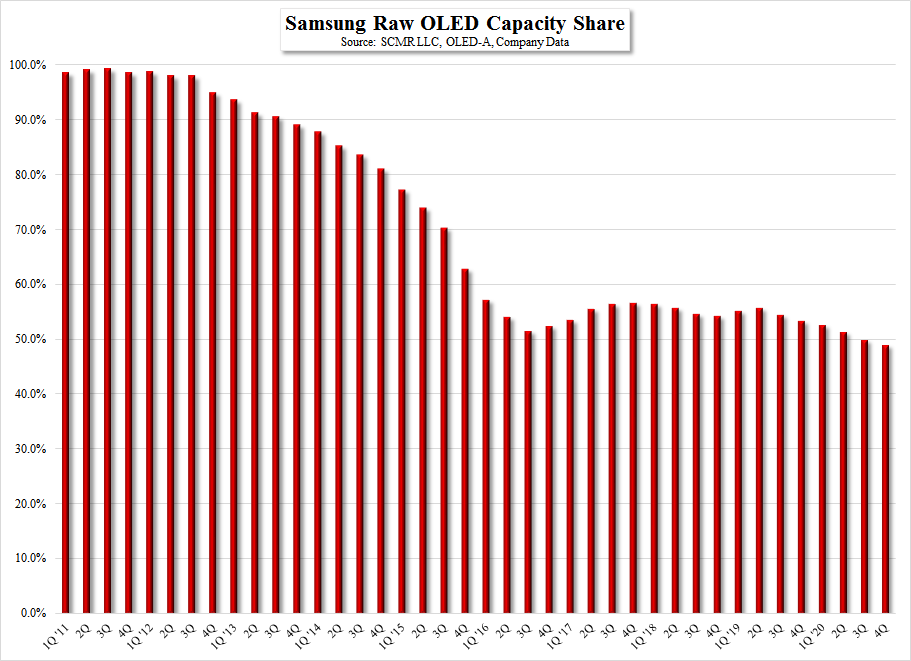

Based on our comprehensive OLED industry model, we believe that Samsung Display (pvt) and LG Display (LPL) currently account for 90.7% of raw OLED capacity (Feb 2017) and 92.7% of utilized (available) OLED capacity, which leaves only modest capacity for other producers. Given that much of LG Display’s OLED capacity is oriented toward large panel (TV) production, the numbers are skewed even more toward Samsung Display and as Samsung builds out its A3 and L7 fabs, we expect their share to increase, peaking in 1Q 2018. But with all the speculation and ‘increased spending’ toward OLED that hits the press each day, Apple has little choice but to use Samsung Display at least in the first year that they might make the shift, and is likely still evaluating various display modalities, both for LCD and OLED before locking down any specific variant details.

Other producers have promoted accelerated build-out schedules for OLED projects, both large and small, but we believe there are no producers other than Samsung Display that have the expertise in small panel OLED manufacturing to be a primary supplier in the iPhone 8 timeline. We note that a number of panel manufacturers have running OLED lines, most of which are producing samples, but matching Samsung’s costs and efficiency are above the capabilities of most. Further, we would expect Apple to want more than average specs for such displays, and potentially some sort of ‘flexibility’ in the design for a 10th anniversary variant, making it more difficult for new producers to compete with Samsung Display’s established flexible resources. We would expect that Apple is inundated with OLED display samples and designs from a myriad of producers, but when it comes down to a very high profile product, taking a chance on a small or inexperienced producer would seem far too risky. As Apple gets closer to a design lockdown and an eventual product spec lockdown, we will have a better idea of what to expect from such a display, and panel producer talk about OLED capacity expansion will be pushed out another year for all but Samsung Display. We certainly don’t doubt that other OLED small panel producers will eventually be able to enter the market, but investor expectations for alternate OLED suppliers should be tempered with the understanding that a board funding allocation or an agreement with a regional government is a far cry from gaining a very demanding customer who has been working with the industry leader who has years more high volume small panel OLED manufacturing experience than the rest of the industry. It will happen eventually, but not on the timeframes that alternate suppliers dream about.

RSS Feed

RSS Feed