Taiwan trade organization says China to expand OLED

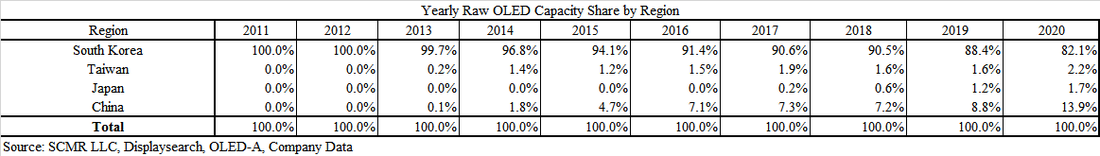

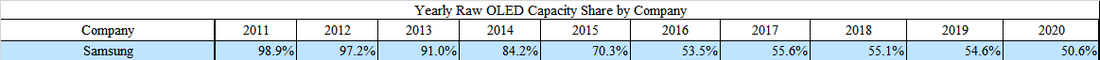

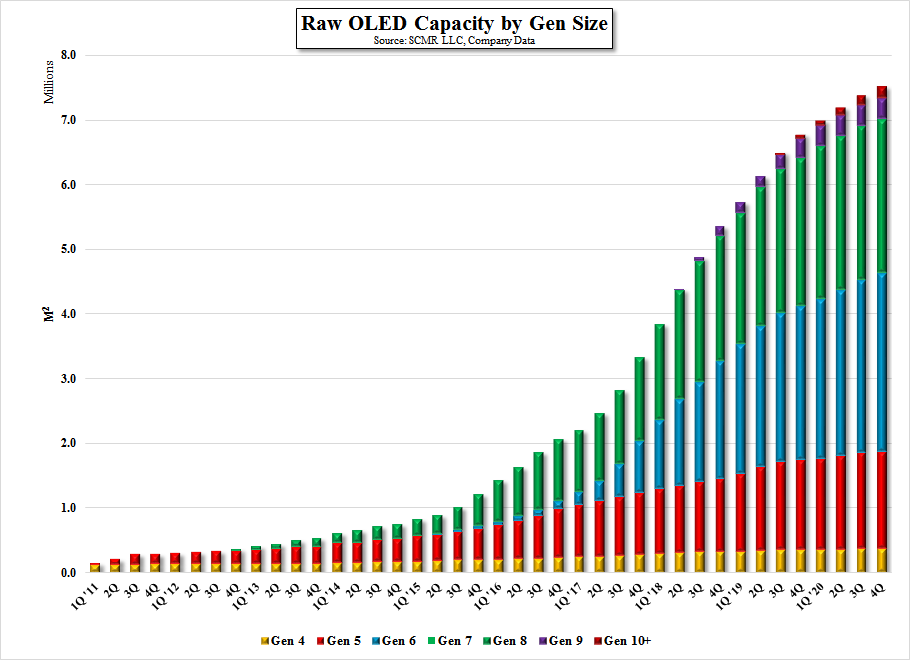

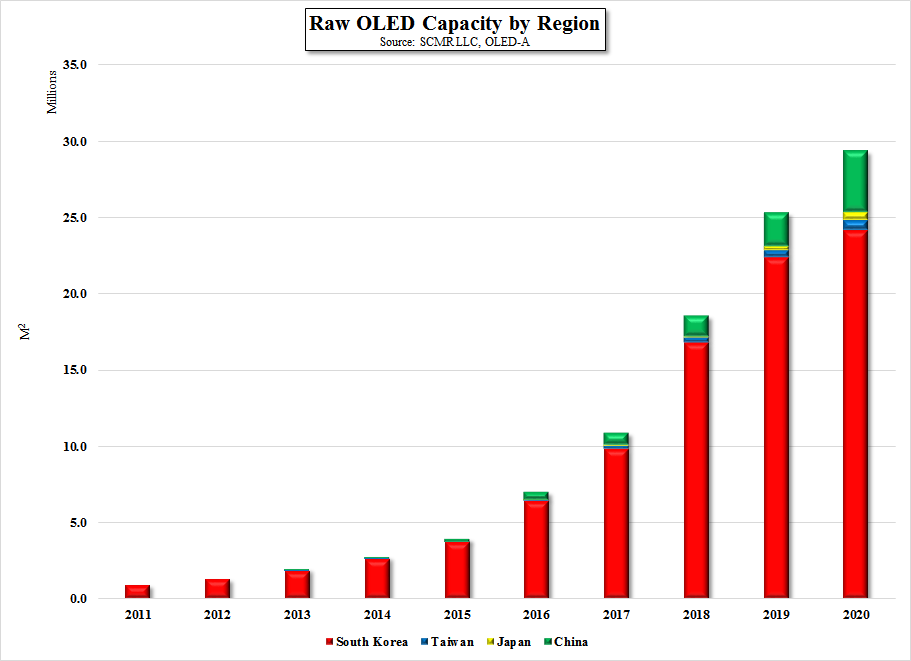

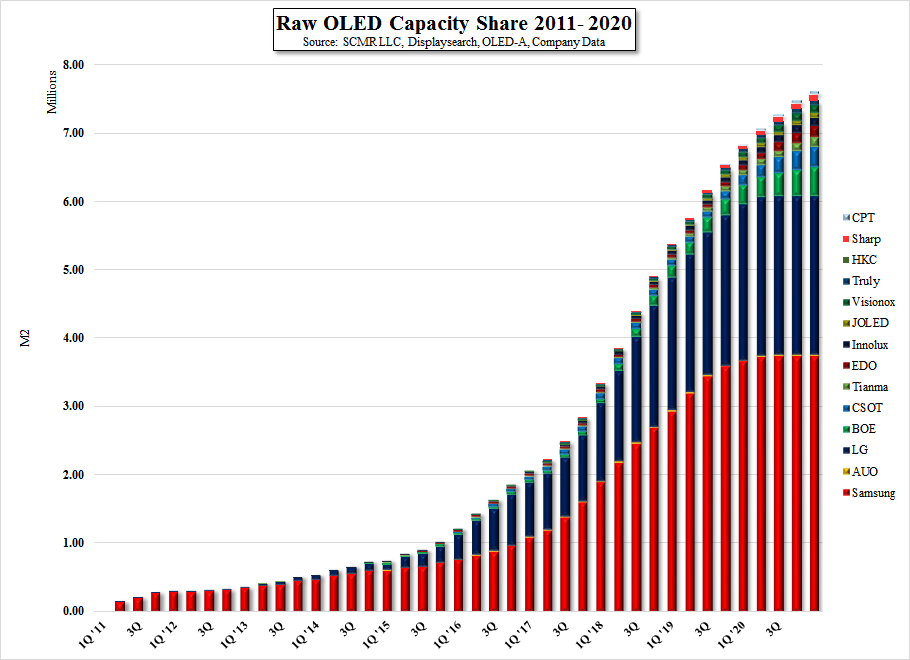

While it is nice to see statistics from trade organizations, this information is not new, and the data presented does little to paint a real picture of the industry. As glass substrates can be vary in size from Gen 1 (.12 m2/1.3 ft2) to Gen 11 (11.52 m2/124 ft2), and each fab chooses what glass substrate size it will use, the sheet metric tells investors little. That said, when looking at each producer and each fab actual relevant information can be derived. As we track 15+ OLED producers and over 80 individual OLED fabs and lines, we look at substrate size on a more specific basis. Figure 1 indicates raw OLED capacity by generation (glass substrate) size, Figure 2 shows raw OLED capacity by region, and Figure 3 shows raw OLED capacity by producer share.

But to the point, the relevant data, rather than the number of sheets produced by China, would be the square meters of capacity, given that this will determine the maximum number of units that can be produced. Looking at the underlying data for Figure 2, we can see how each region stacks up, and while China will see very significant growth in share, particularly in 2019 and 2020, the share maintained by South Korean producers Samsung Display and LG Display (LPL) remains dominant, and breaking down share further, as in Table 2, Samsung Display will remain the dominant supplier of OLED capacity through 2020 with over 50% in 2020.

We note also that raw capacity, or the stated maximum capacity that a fab is able to produce, is a relatively poor metric for actual display production, as fabs take considerable time to get to such metrics, with build-outs usually done in two or three phases, equipment utilization, overall factory efficiency, and a variety of other factors reducing raw capacity to what we call ‘utilized’ capacity, or the actual amount of capacity available to the producer at specific moments in time. This metric and another key variable, product yield, are what drives unit volumes across the industry and are far more important than the number of glass sheets.

RSS Feed

RSS Feed