Did TV panel price increases hurt holiday sales in China?

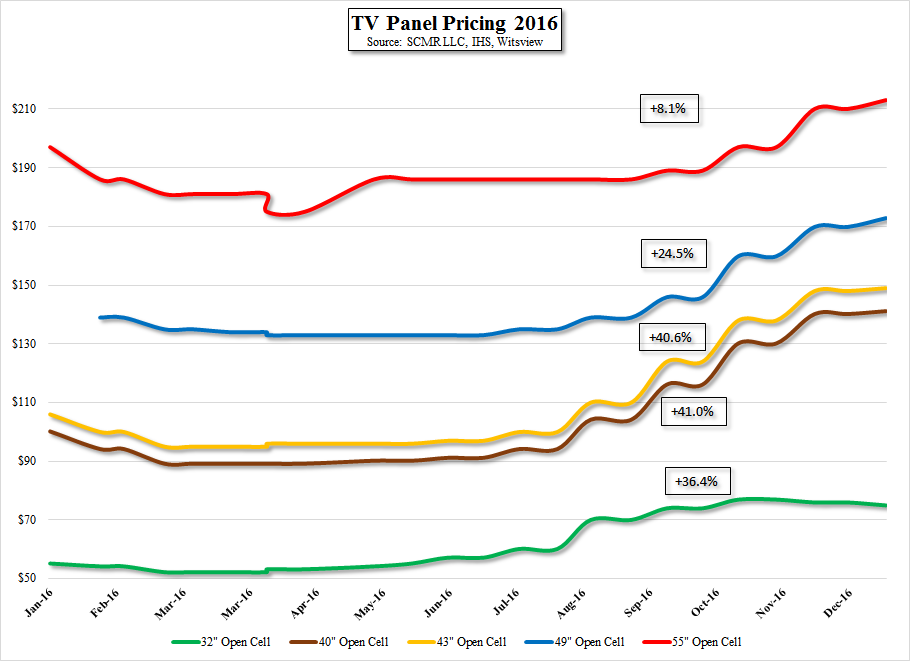

Expectations for the Chinese TV market this year (2017) are for a decline of ~2.8% in units (1.7m units) making the sensitivity toward TV panel prices extremely high. A continuation of price increases could further damage the growth of the Chinese TV market, and while brands and panel producers all focus on large screen sizes and 4K/HDR premium oriented sets to maintain margins and dollar volume, the industry, particularly China is facing negative growth as a result of the TV panel price increases.

Would we expect panel producers to altruistically lower prices to help brands generate profitability? Not really, especially as they were on the other side of the ‘seller’s market’ for quite some time, but as TV set producers struggle to burn through inventory and lower expectations for quarterly and yearly shipments, a lack of buyer enthusiasm might spark a little price competition among panel producers, who need to keep fabs at near 100% utilization or see rapid declines in margins. Should that occur, and we believe it is a possibility for those TV panel sizes that have not seen increases from artificial supply issues, TV brands might have a chance to see profitability improvements later this year, with the tradeoff being lower margins at panel producers. There is potential for a balance, with panel producers still seeing profits, albeit not peak level, and brands seeing margin improvement, but it is a fine line that is rarely walked in the display space.

RSS Feed

RSS Feed