OLED display shortages – Something old or something new?

Is this something new? Not really, as even when Samsung Electronics (005930.KS) was the only smartphone brand using OLED displays, they faced OLED display shortages that caused delays in shipments and apologies to potential buyers. While Samsung Display the primary supplier of OLED displays for smartphones continues to expand its OLED production capacity, their largest customer remains Samsung Electronics, their parent, which makes them a semi captive supplier. In fact, this issue was responsible for the delays seen in adoption by other smartphone brands, who knew that they would be in a secondary position to Samsung Electronics, holding many from adopting the technology.

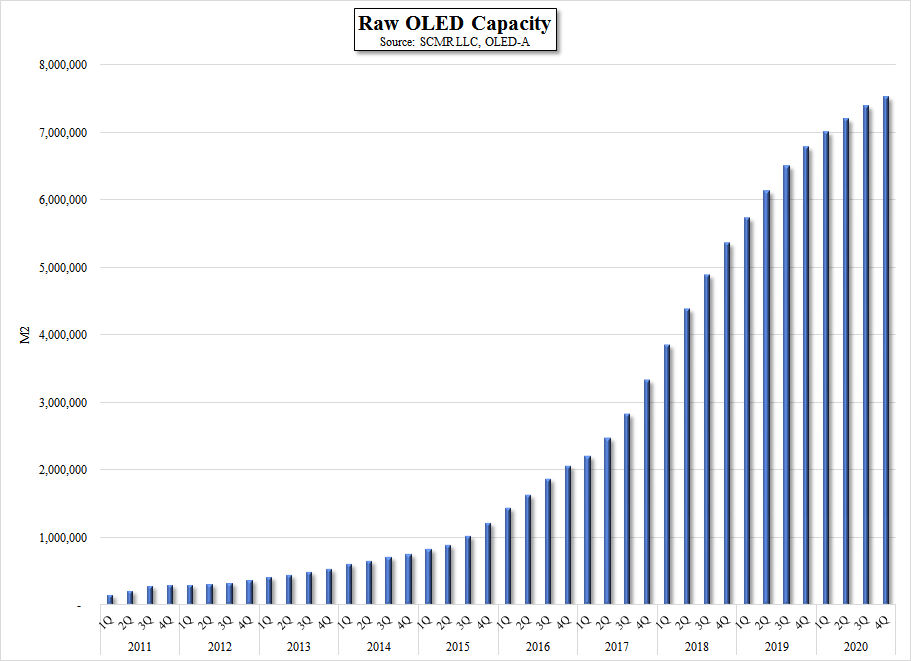

That all changed over the last few months when the industry concluded that Apple (AAPL) would be adopting OLED displays for its iPhone line this year. Suddenly brands rushed to adopt the technology to keep themselves at least in line with Apple, and the display industry responded with announcements of new OLED capacity plans and accelerated timelines, but the question remains, ‘Will the industry be able to meet demand?’ Raw capacity (see Fig.1), the measure most used to evaluate the supply/demand balance in the display space, is a poor metric for understanding what the industry can actually produce, and while the growth of capacity looks just like investors would want to see, it does not correlate to industry results.

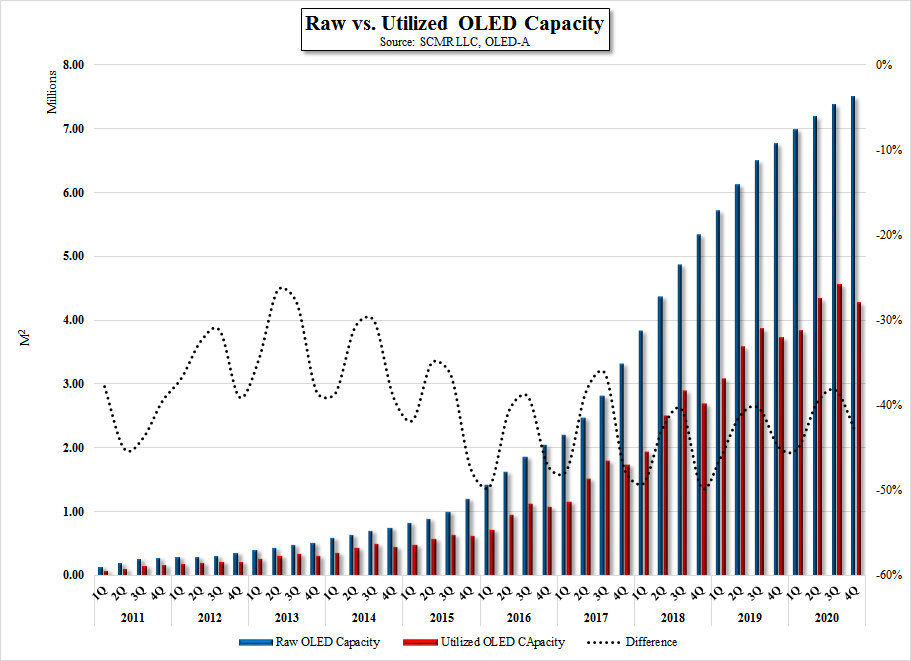

Figure 2 shows a comparison between the ‘raw’ capacity and ‘utilized’ capacity, which includes a number of variables that are far more relevant to actual industry results that the ‘prettier’ raw metric. Included in the utilized numbers are ramp times, experience of the producer, equipment tuning, and other variables, all of which come before the most important product level variable, yield. Now that the industry has decided that another major player will be entering the OLED display demand side, these simple constraints become far more important to brands that might be in contention with Apple for what is already limited OLED display capacity.

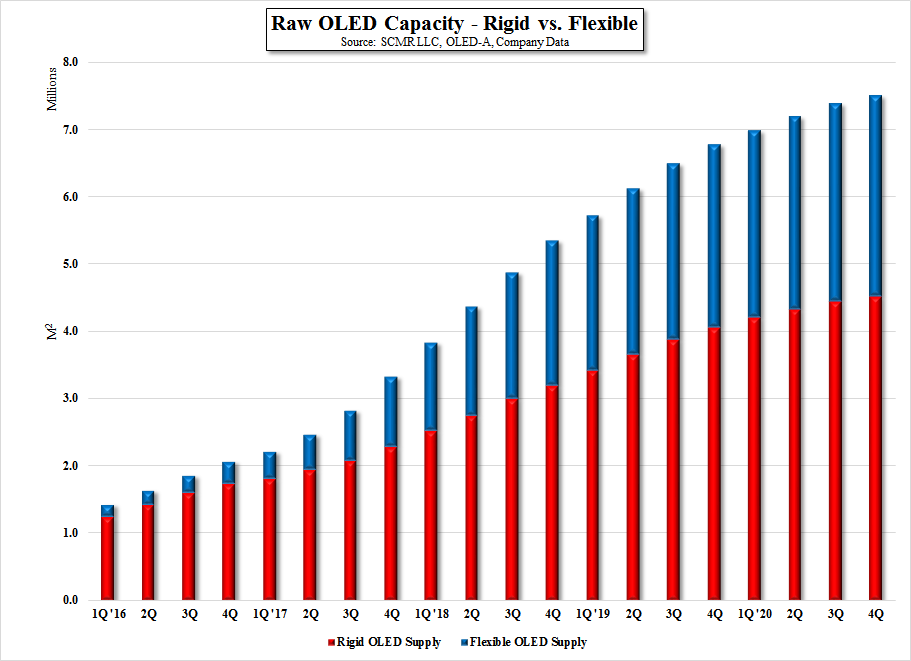

While we will not detail our conclusions here, we will add a monkey wrench or two, just to let investors understand how complex these issues are. First, OLED industry capacity is divided between small panel production fabs, such as those run by Samsung Display, and large panel OLED fabs, such as those run by LG Display for its OLED TV production. This reduces capacity available for smartphone production on both a raw and utilized basis, as those fabs designed for large panel OLED production cannot be used for OLED smartphone production in most cases. Second, drilling down a level further, what format will be used for each OLED smartphone brands? Will they be built on rigid substrates or flexible substrates? Figure 3 shows that raw OLED capacity is further defined by the type of substrate used, limiting capacity further as the industry shifts its focus from rigid to flexible OLED smartphone displays. Fret not, as we have built our OLED industry model to reflect all of these variables, which allows us to gain significant insight into Apple’s potential path toward OLED smartphones and the opportunities available to other smartphone brands as they add OLED displays to their smartphone lineups. Just the tip of the iceberg…more to come.

RSS Feed

RSS Feed