BOE gets loan against OLED assets

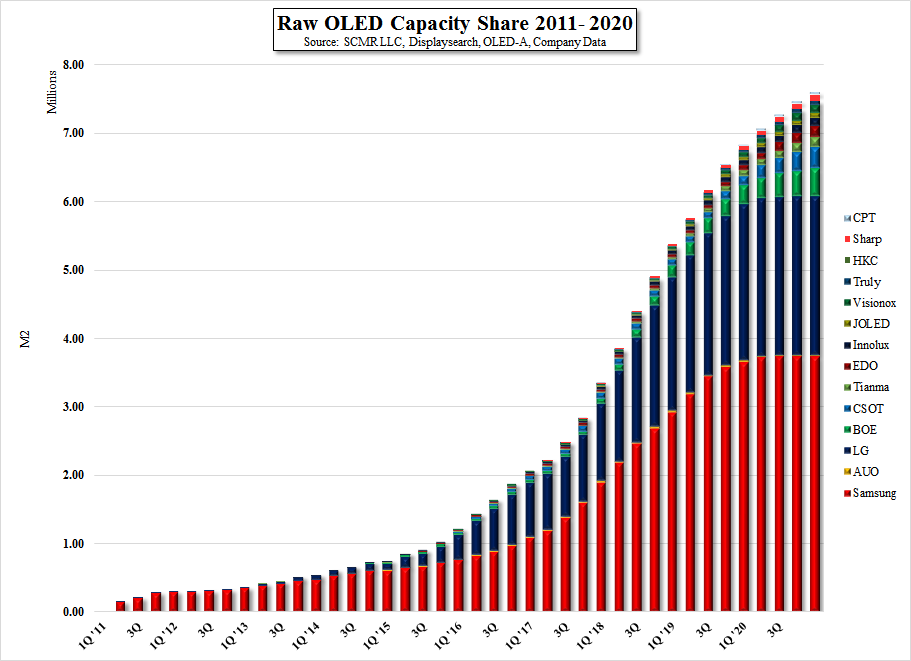

BOE has been aggressive in developing OLED assets, with a Gen 8.5 pilot line in Hefei, a small Gen 5.5 line running in Ordos, and construction of Gen 6 OLED fabs in both Chengdu and Mianyang. The Ordos fab is expected to have capabilities for 54,000 sheets when fully built out, with fully built-out capacity at the other two Gen 6 fabs reaching ~93,000 sheets/month. If BOE completes these plans, we believe it would give them a 5.5% share of the OLED market on an m2 basis by the end of 2020. While this is still small relative to Samsung Display and LG Display, they would be the 3rd largest OLED producer by capacity at that time.

While BOE has been extremely aggressive as to adding OLED assets, they have had a difficult time with OLED production, particularly with yield. We believe this points to a rather large stumbling block for Chinese OLED producers, a lack of experienced OLED engineers. BOE has poached OLED engineers from Japanese OLED developers, and sponsors a number of Chinese university programs for R&D, but the lack of experienced production engineers has slowed the growth of OLED manufacturing in China. There are producers in China, with Everdisplay (pvt) and Visionox (pvt) both having some commercial display product, but the large capacity panel producers such as BOE and China Star (pvt) have had limited commercial success. We do expect these issues to be overcome eventually, and as the OLED display market moves toward flexible displays, where the playing field is slightly more level, Chinese OLED manufacturers should be playing less of a ‘catch-up’ game than currently.

RSS Feed

RSS Feed