March Panel Pricing – Quick & Dirty

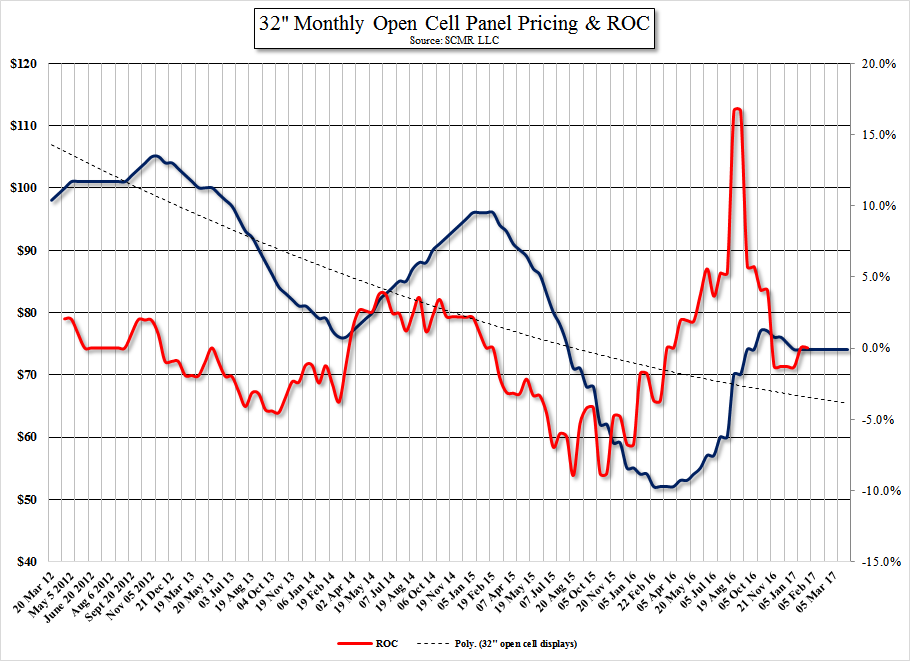

The risk of a continuing inventory build in the TV space continues to increase, and if demand proves weaker than expected as the year develops, panel producers will lose their ability to raise prices or even maintain prices, as brands lower expectations. There will remain some TV panel sizes that are in short supply due to Samsung LCD plant conversions to small panel OLED and other factors, but the massive TV panel price increases that were seen late last year have subsided, and the effect on TV brands is becoming more obvious, along with the retail malaise.

There are two possible scenarios for TV panel pricing (for panel producers) this year. One where overall panel prices remain flat or move up slightly. In that scenario brands will continue to suffer and consumers will react poorly to any set level price increases, which has the potential to negatively impact holiday 2017 sales. Alternatively, If brands react earlier to slower demand, there is the chance that TV panel prices will decline, allowing brands to at least make some profit or lower set prices to stimulate sales. While panel producers will lose a bit of margin, this scenario would be beneficial to the industry, allowing both panel producers and brands to profit somewhat and for consumers to step up purchases. Of course, there is some middle ground or variation in these two scenarios, but if the general trend continues, it looks like panel producers will have a good year and brands and consumers will not. This tends to set the stage for the following year (2018), which will likely see a more severe reduction in panel demand from brands, and a more aggressive decline in TV panel prices. Hopefully the second scenario, or something close to it, will play out this year, and the reaction in 2018 will be more positive, but it is still a bit early to tell. Right now we would weight the chances about 60% for the first scenario and 40% for the second.

RSS Feed

RSS Feed