Sharp said to be increasing TV panel capacity at two fabs

According to our calculations, the Sharp Gen 10 fab would see an increase of 8.3% of available capacity, which if using a ratio of 66% 60” and 33% 70” would see an increase in production from 384k 60” and 144k 70” TV panels to 416k 60” and 156k 70” panels respectively. On a yearly basis that would be an increase from 6.335m to 6.864m panels in total. At the Gen 8 fab, the increase would be 20% in terms of m2 and on a yearly basis would indicate an increase in unit volume from 3.6m to 4.32m combined 45” and 55” units (3:2 ratio). Sharp is expected to use the increased capacity at their Gen 8 fab for internal brand use only.

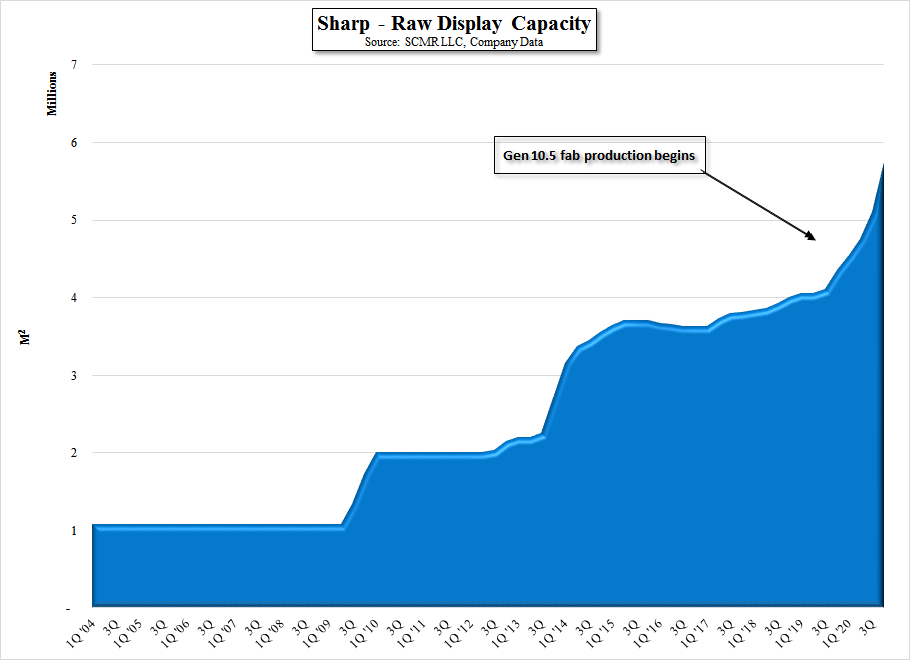

Our display industry model has already built in the Gen 8 line increases, but the Gen 10 fab increases are equivalent to a 2.86% increase in Sharp’s overall capacity for 2017. As noted a number of times previously, Sharp has discontinued supplying TV panels to Samsung and Chinese brand Hisense (600060.CH), in order to focus on developing the Sharp brand, as these changes would reflect. That said, these increases will remove the necessity for Sharp to have to buy panels away from its own production to meet its internal brand goals this year, which will, to a small degree, reduce demand for those panels (mostly 45”) that are in short supply, but given the relatively small increases at Sharp, we doubt the changes will have a significant effect on the overall supply/demand balance. What will have a significant effect, is the construction of Sharp’s Gen 10.5 fab slated for September 2019 (phase 1) and phase 2 construction finishing in 2020, as can be seen in Fig 6. This fab will also focus on large panel TV display production, likely augmenting the increased capacity at the Sakai Gen 10 fab. If Sharp’s new owners are able to resurrect the Sharp brand worldwide, they will have ample supply by 2019/2020, if not, and the fab is still built, there will be an increasing amount of very large TV capacity available to the overall market.

RSS Feed

RSS Feed