March Large Panel Display – Winners and Losers

Hannstar (6116.TT)

InfoVision (688055.CH)

Japan Display (6740.JP)

Tianma (000050.CH)

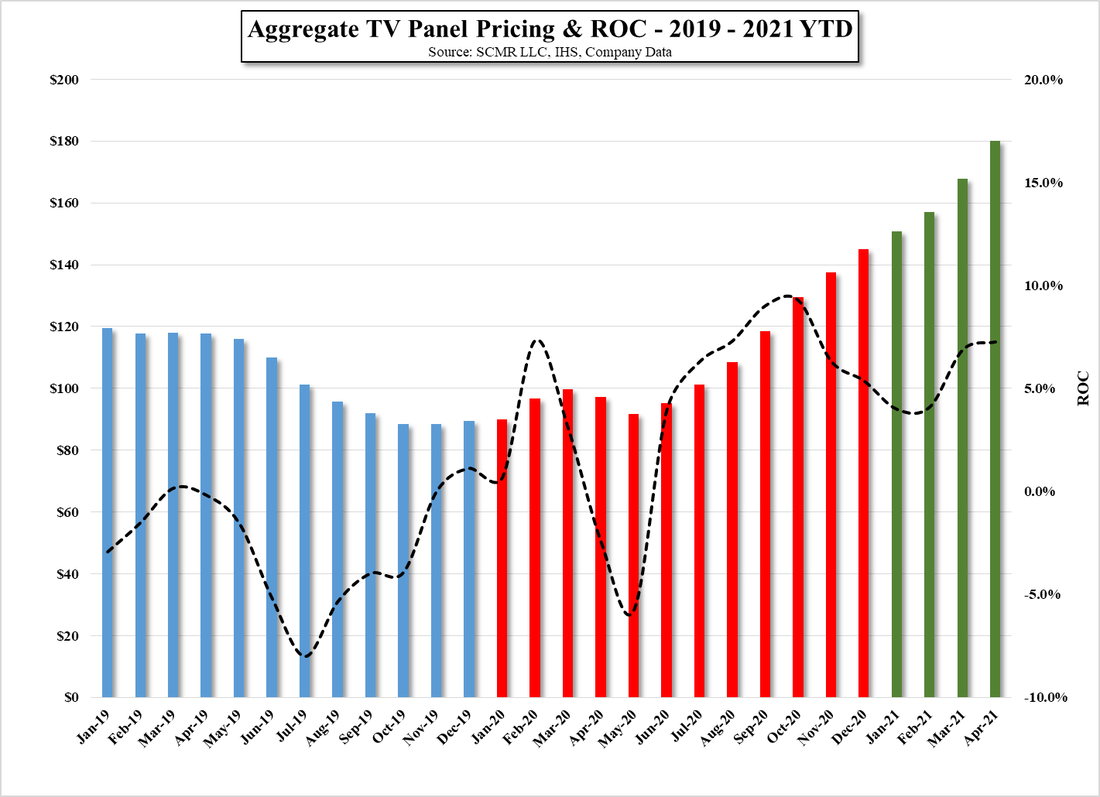

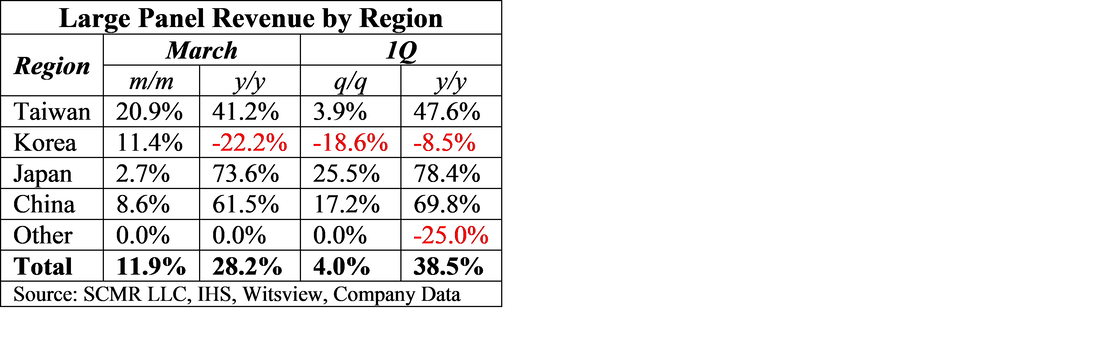

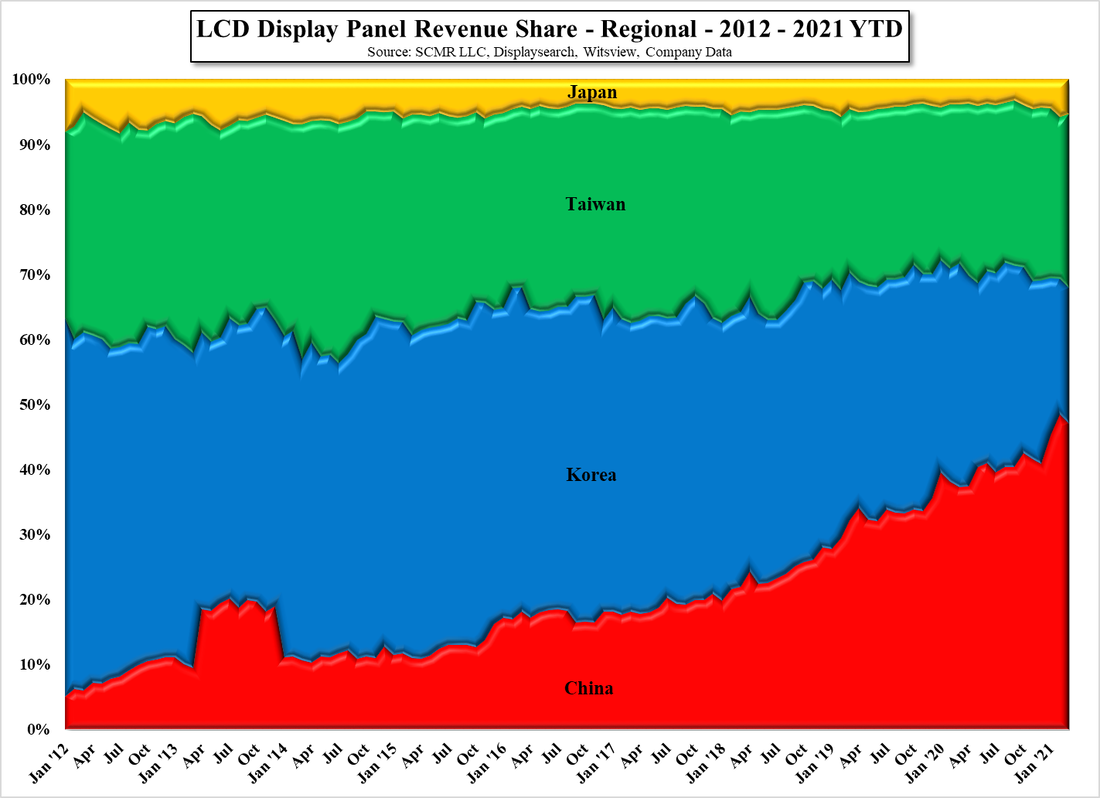

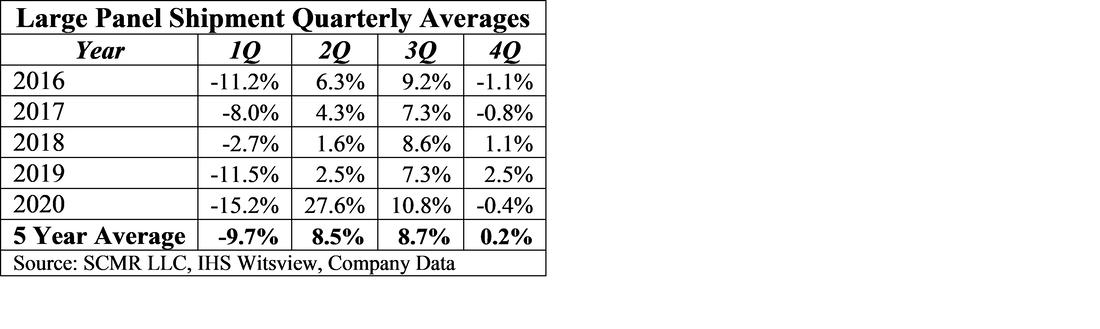

Given the relatively unusual circumstances of last year, most of the y/y comparisons don’t give much new information, and the negative results from Samsung Display and Panda have more to do with the sale of LCD fabs than actual performance, with BOE and Chinastar being the receivers of those fabs. That said, Sharp stood out with its best monthly revenue (Feb./Mar.) since mid-2014, and Chinese large panel producers HKC and CHOT saw their best quarters since inception. While capacity increases are embedded in some of the more positive monthly and quarterly results, higher utilization and large panel price increases would be the root for much of the gains

RSS Feed

RSS Feed