Is LG Display playing hard to get with Samsung?

According to the Korean trade press, the two companies were expected to finalize the negotiations by the end of March or early April, with the initial panels being delivered in July and total commitments between 700k and 1mil units. However, thus far no specification changes have been made by Samsung for TVs to be based on the LGD panels, which is typical when a TV producer changes display suppliers, indicating that negotiations are still underway. Samsung Electronics, and rightly so in our opinion, needs a formal contract before completing such a deal, while LGD is comfortable with an MOU, but the clock continues to tick toward the July timeframe, when panels must start being delivered or sets will not be able to be built and delivered before the holiday season begins, in particular Black Friday (November 24th).

Samsung does have other suppliers including Innolux (3481.TT), AU Optronics (AUO), BOE (200725.CH), and China Star (pvt) along with its subsidiary Samsung Display (pvt), but Innolux’s ownership by Hon Hai/Foxconn (2354.TT) makes that a hard sell, and while AU Optronics has supplied panels to Samsung in the past, we believe they are so capacity constrained that they would be unable to supply the quantities needed. BOE has been a supplier and does have the capacity to make such a deal, but their expertise is in producing large volumes of a relatively limited number of TV panel sizes, particularly 55” and larger, which makes it more difficult for Samsung to feel comfortable that they will be able to meet the quality and quantities needed for Samsung’s panel demand.

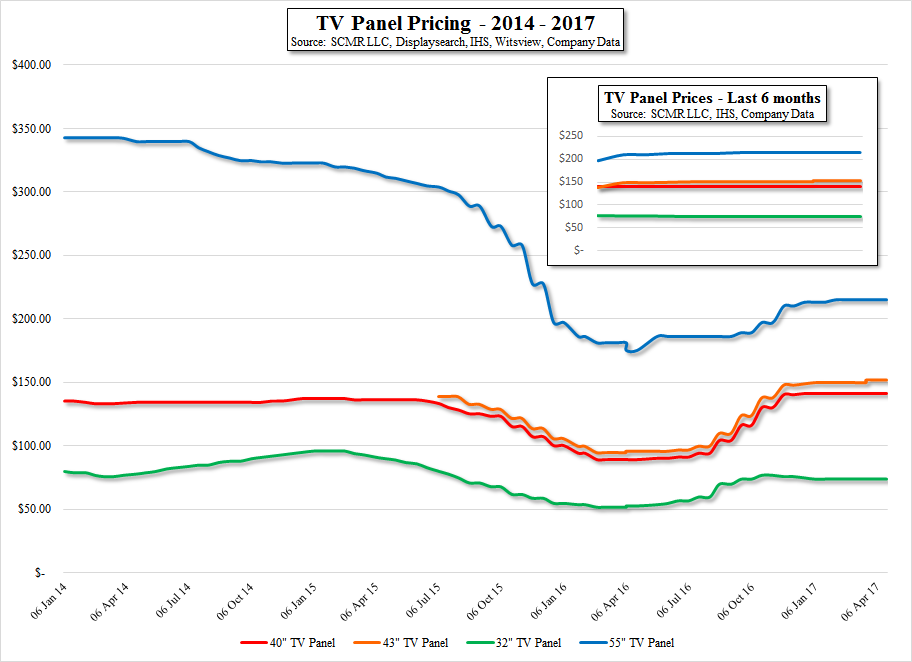

We believe that the lack of a deal with LGD has kept certain TV panel prices a bit higher than they might have been should Samsung not be hunting for an alternative panel supplier, although other factors are primarily responsible for the overall price increases, but it is essential that Samsung Electronics nail down a supplier soon, or there will be a significant shortfall in the company’s TV sales this year. If negotiations with LG Display fail to produce results, we would place bets on BOE, especially since their Fuzhou, China Gen 8.5 fab was lit toward the end of February, giving them the incremental capacity needed to help out a fellow CE brand, but from a reliability standpoint, LG Display would be the 1st choice, as they have the capability and experience to produce what Samsung needs. Likely, the balance between LG Display’s desire to fill their fabs and charge a premium to rival Samsung Electronics and their commitment to other customers is a tough one to reconcile, as is Samsung’s necessity to deal with its biggest rival. “Misery acquaints a man with strange bedfellows”[1]

[1] William Shakespere – “The Tempest” – Act 2, Scene 2, 33 - 41

RSS Feed

RSS Feed