Cause & Effect – IGZO

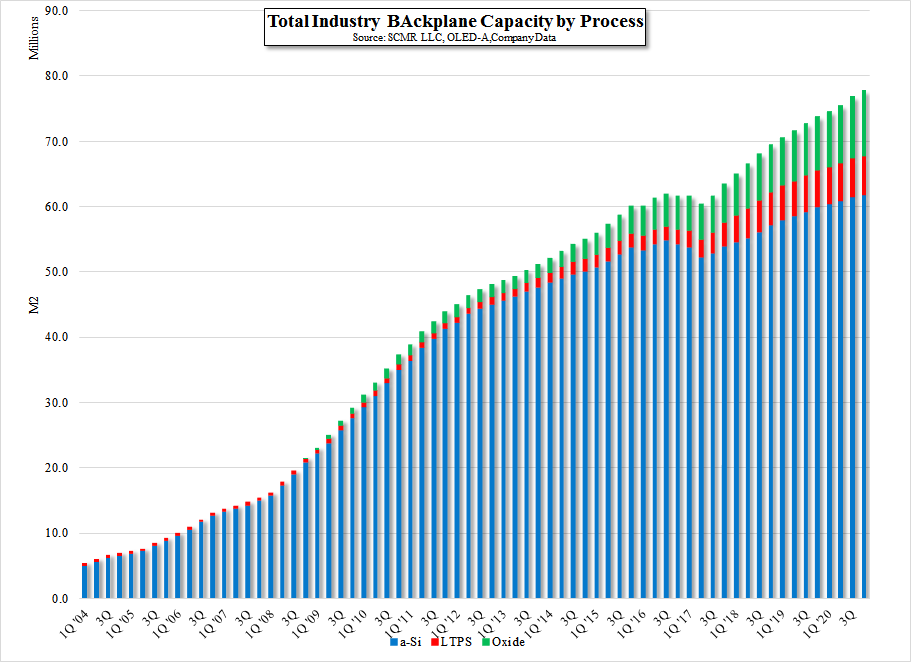

The reason why IGZO is so important to the display industry is that it has a number of characteristics that make it desirable for certain device types, particularly its electron mobility, i.e. the speed at which electrons move through the material, and its manufacturing cost relative to Low Temperature Polysilicon, which has more manufacturing steps and a higher overall cost. That said, IGZO backplane manufacturing yields have been relatively low, limiting its adoption across the industry to a relatively small number of manufacturers relative to LTPS and a-Si.

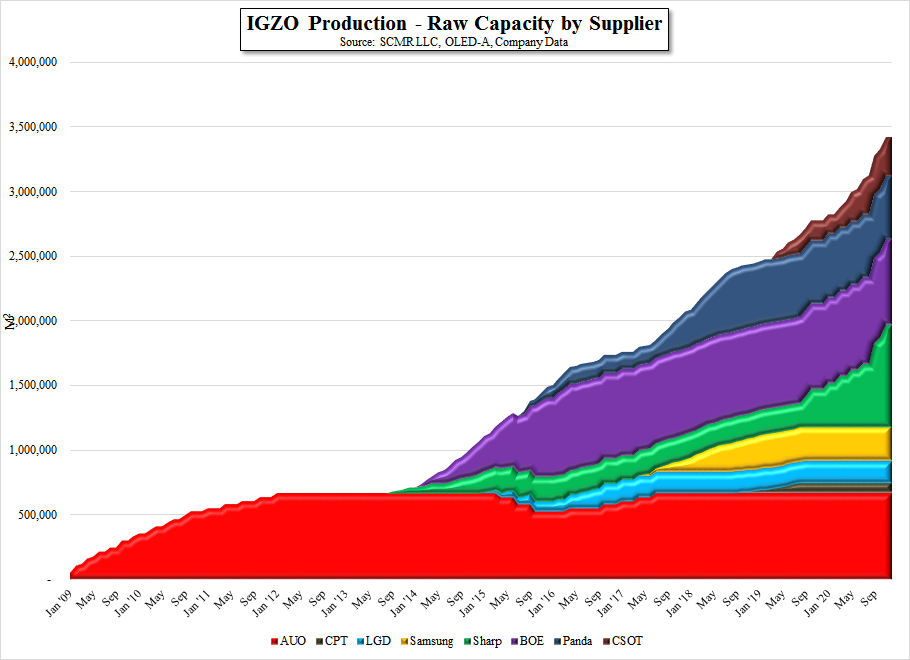

Growth in IGZO production this year has been driven by Apple (AAPL), who has been using the technology for its popular 9.7” iPad Pro (and other iPads since 2015), and by LG Display (LPL) for its OLED TV production. While a number of producers (see Fig.1) have IGZO capacity, we believe that much is not being used for commercial production currently, with the main commercial IGZO suppliers being Sharp, Samsung Display (pvt) and LG Display. What could change here is the speculation that Samsung Display will be closing its L6 Gen 5 fab later this year (see our note – 04/17/17), which would eliminate the only Samsung Display fab that produces IGZO backplanes. Looking at a more realistic view of the three major commercial suppliers, the elimination of Samsung’s IGZO capacity would reduce overall commercial IGZO capacity by 8.8%. With Apple being much of the demand this year, especially as they are expected to release a 10.5” IGZO-based iPad Pro, this would limit other brands from using the technology, particularly Microsoft (MSFT), who has used it for its Surface Pro 4 and is expected to use it for the upcoming Surface Pro 5 later this year.

We are still unsure whether the potential closing and conversion of Samsung Display’s L6 is a reality or just media speculation, but if true, the effect would be to tighten what is already a tight IGZO market, and could limit the commercial development of the technology, as brands are unable to get guaranteed capacity and look to LTPS as an alternative. We do note that if Samsung Display were to convert the L6 fab to OLED, it still has the option to use IGZO as the backplane technology, especially if the conversion is being done with the idea of dedicating some or all of that capacity to Apple.

RSS Feed

RSS Feed