Tablets – A Race to the Bottom?

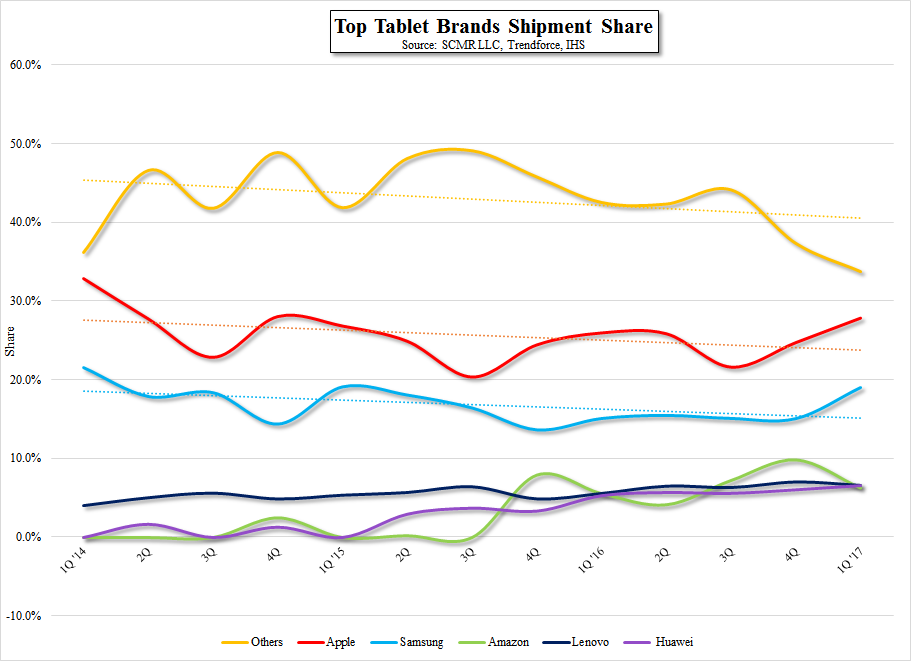

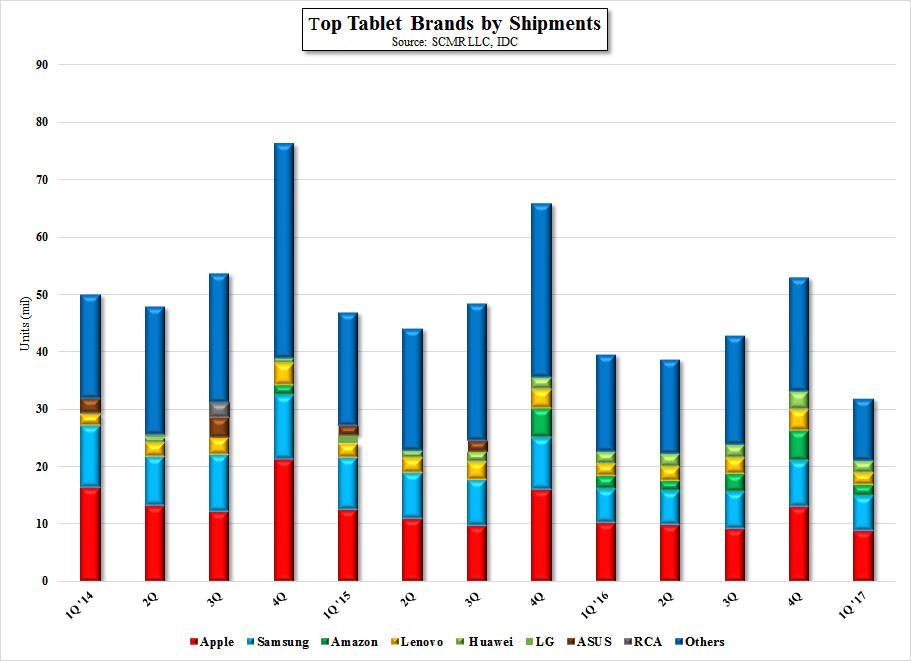

While it is obvious that the tablet market is contracting, we note that share trends, while positive in the short run on a y/y basis (see Tab.1), have been trending down for the larger brands (Apple and Samsung Electronics (005930.KS), while the smaller brands have been picking up share (see Fig.1) since 2014, especially Amazon (AMZN), who could be the only brand to see positive y/y growth in 2017.

Tablets remain a CE category, and even at declining volume levels will represent ~150m units this year, so the category will not disappear in 2017 or 2018, but the risk to vendors is whether it is profitable enough to stay viable relative to other mobile and emerging CE products. Apple and Samsung, purely from a competitive point, will likely maintain positions regardless of a continued unit volume decline, but others, especially the white box brands (represented by ‘others’ in the charts), will have to contend with larger, low-priced smartphones that encroach on the tablet space, and the eventual foldable smartphone, which will open from smartphone size to tablet size and perform at least, if not more, functions than inexpensive static tablets. Buy a nice new tablet and put it in a glass case next to your plasma and 3D TVs; it might be a collectable someday.

RSS Feed

RSS Feed