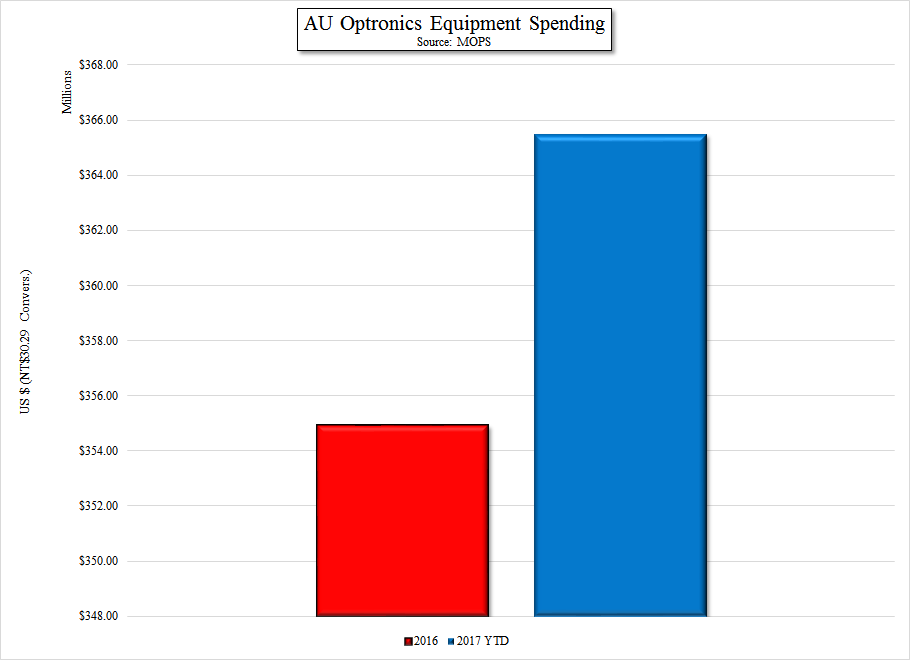

AUO buys equipment – More than last year

We note that AUO made 80% of its equipment purchases in the 1st half of 2016 (actually in the 1st quarter), while using the same metric this year (assuming no further purchases through 6/30/17) would imply a full year 2017 spend of $438.6m, 124% higher than last year. That said, it is too early to make such assumptions for 2017, but it would seem that the overall equipment spend for AUO is trending higher than last year. We note also that the new Taiwan dollar declined from NT$33.42 in January 2016 to NT$32.02 in December 2016, and is now at NT$30.29, a ~10% decline, but even against the currency change, AUO is trending far ahead of its equipment spend last year.

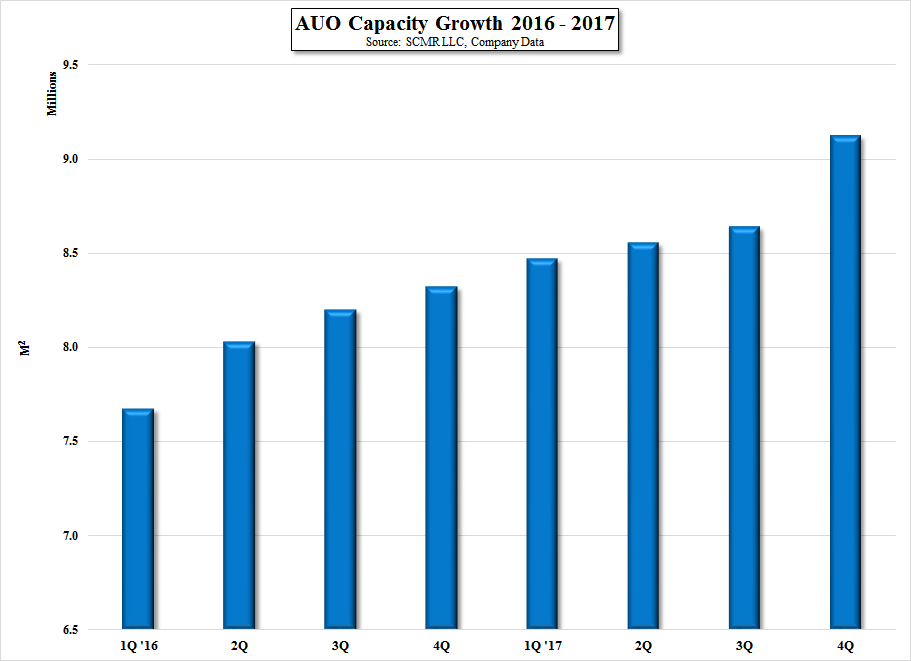

AU Optronics, based on our assumptions of both company and overall industry growth, held a 12.8% share of the industry’s display capacity last year, which we expect to increase to 13.6% this year. In 2016, AUO’s gross capacity grew 2.8% but we expect ~8% growth this year as they continue the build out of their Kunshan, China Gen 6 fab. While AUO runs with ~13% less capacity than its main Taiwan rival, Innolux (3481.TT), it has closed that gap somewhat from the ~17% in 4Q 2015, which we expect will peak around 12% by the end of this year, but aggressive build plans for Innolux will likely push that gap back to ~16% by the end of next year, unless AUO decides to build an ultra-large format display plant in 2018/2019. Such an idea has been mentioned, but no decision has been made as of yet, and we include no capacity from such a fab in our industry model for AUO.

RSS Feed

RSS Feed