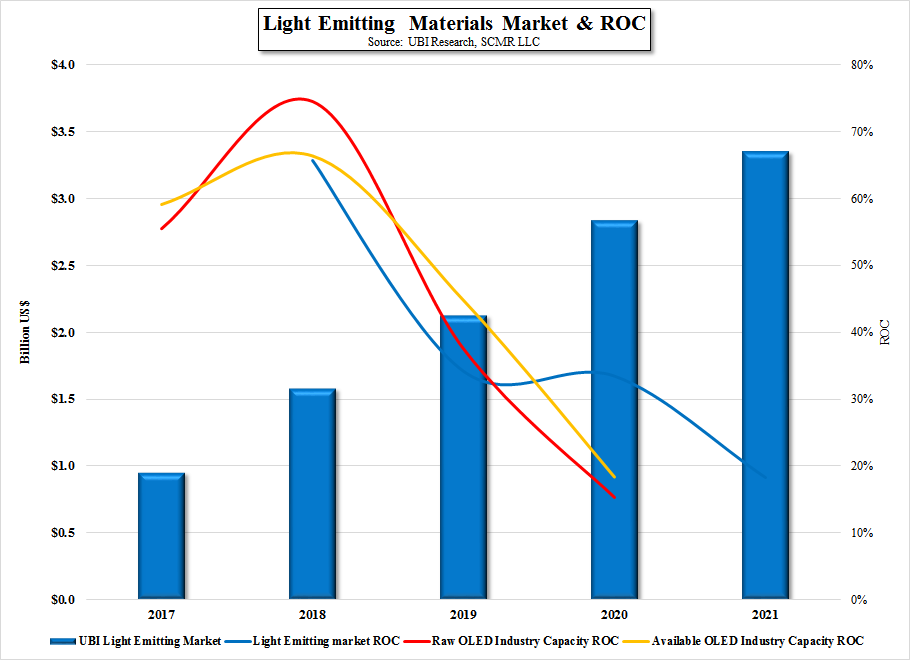

UBI Predicts substantial Light Emitting Materials market growth

We note that UBI predicts that the ASP of light emitting materials will drop by 5% to 10%/year and that there is a 5% to 30% recycle ratio on LE materials, however we are not as sanguine as they are on both the price decline and the recycle ratio. As Universal Display (OLED) is the largest supplier of OLED materials, and they have an emitting material discount program that is based on volume, we believe that the ASP on some materials will decline faster than the 5% to 10% that UBI predicts. Green emitting material, which is part of an RGB OLED stack in many small to medium sized OLED displays, is used in a higher proportion than red emitter material, and consequently travels down the volume discount timeline faster than red material. To UDC’s credit, new light emitting materials, when adopted by OLED producers, reset the discount timeline back to starting ASP levels, such as what happened with the adoption of a new red emitter material for the Galaxy S8, but such changes do not happen quickly, and as capacity at dominant producers increases, so will the speed at which volume discount points are reached.

Another factor that was not mentioned by UBI, that we consider in our OLED industry and company models, is efficiency. In typical OLED evaporative processes, much of the emitter material is wasted, either on the metal mask used for patterning, or on the walls of the evaporation chamber itself. Efficiencies of 25% or 30% were not uncommon for older deposition equipment, although newer tools can see production efficiencies to 60%, but a primary focus of OLED panel producers is to both increase overall yield and reduce cost, with the latter being focused on reducing material waste. As new deposition equipment is designed and implemented, material usage efficiencies will continue to increase and will offset some of the industry capacity growth, but the real increment would come from a singular change in the OLED production process itself, by changing from evaporative deposition to a roll-to-roll process or an ink-jet printing process. These alternative methods are being researched and tested by Samsung Display (pvt) and others, and have efficiencies in the 90% range. While the light emitting materials used in these methods will be somewhat different than those used by current evaporative processes, it would be difficult for OLED material suppliers to offset the higher efficiencies with substantially higher ASPs. While putting these processes in high-volume situations has not yet happened, we expect that by 2021 a portion of the light emitting materials market will be focused on materials for these high efficiency processes, which gives us a bit of caution in predicting LE material dollar growth in the out years.

We also believe that UBI is optimistic about the light emitting materials recovery rate. While lower efficiency deposition tools should be ripe for material recovery, we believe that the purity of the materials needed for OLED deposition is so high that the cost of refining emitter materials is too high to make it worthwhile currently, and the use of higher efficiency processes will reduce the amount of recoverable materials substantially. We do expect some of the less expensive materials are recoverable, but separating out the high cost emitter materials from a lower cost host and refining it back to original specs does not seem to be a cost effective way to reduce costs currently. We do believe the light emitting materials market is poised for substantial growth over the next few years, but our optimism is tempered somewhat by the prospects for higher efficiency toolsets and volume based material pricing.

RSS Feed

RSS Feed