Samsung Display denies construction of new OLED fab

As we noted previously, we have not included such a fab in our OLED industry model, as we need confirmation from at least two sources to make such an inclusion. That said, we note that if the fab were built to those specifications and fully built out, it would add (by 4Q 2018) 17.8% to Samsung Display’s OLED capacity, not an insignificant amount. Given that we believe the small panel OLED space will remain capacity constrained for a number of years, the idea that Samsung Display would want to build out as much capacity as possible is not a strange one, but at the same time Samsung Display management has to evaluate the impact of new fab construction, low initial yields, and changing demand, before adding a new fab to its OLED construction schedule.

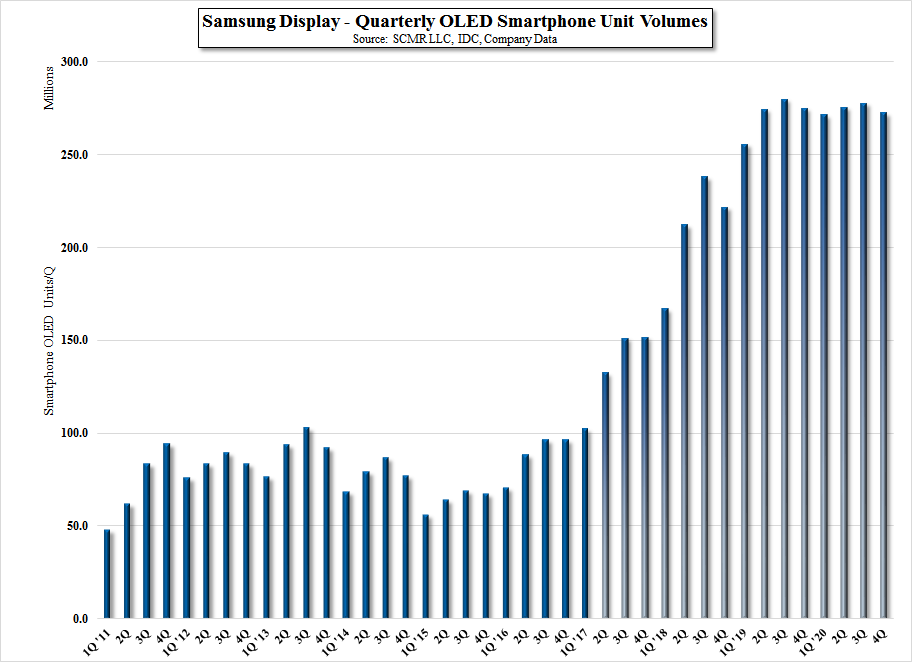

Filing the story under “The lady doth protest too much, methinks”, we expect Samsung Display has an idea for the land in mind, but is not ready to reveal such plans to the public. We could speculate that they are negotiating with Apple (APPL) for a dedicated OLED fab, or are thinking of establishing an OLED line that uses non-traditional deposition techniques, but with Apple a new entrant into the OLED space and other smartphone brands in the early stages of OLED adoption, it would seem a high risk venture, even for Samsung Display, at this time. We note our Samsung Display quarterly smartphone unit volume estimates[1] in Fig. 1, which do not include the A4 fab.

[1] Details of assumptions available on request

RSS Feed

RSS Feed