Smartphones – Who is growing?

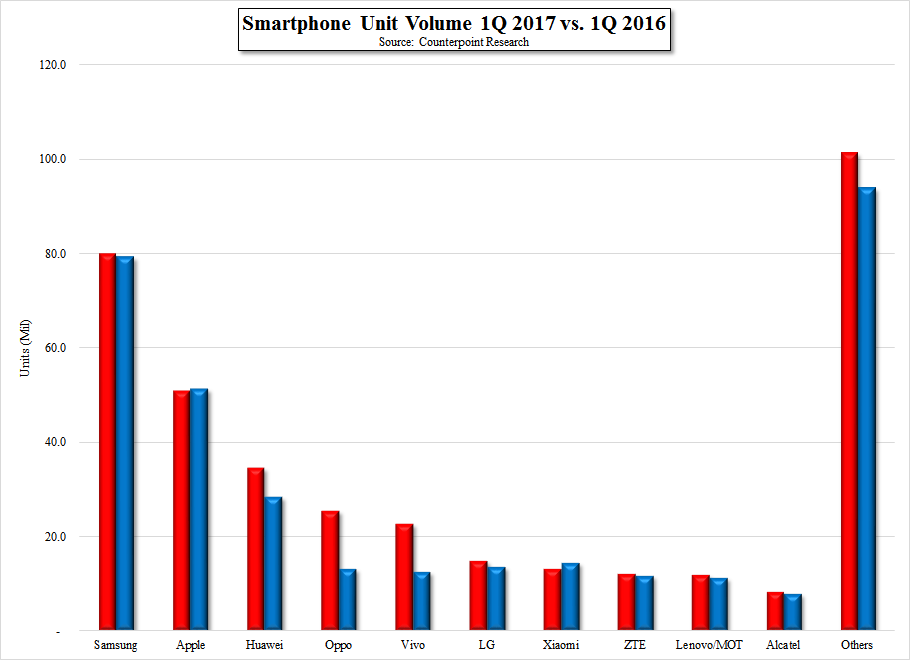

Unit volume leaders Samsung and Apple saw little, if any growth over 2016 (1Q), while Chinese brands saw 31% growth y/y, with Oppo (pvt) and Vivo (pvt) seeing 93% and 82% growth respectively. As we noted, the timing of new releases contributes to some of the weak comparisons, as Samsung’s S8 delay will push increased unit volumes into 2Q, but Chinese brands continue to gain share and increase volumes. We would expect they will have a more difficult time penetrating markets outside of Asia, and the popularity of brands can be a fleeting thing, as original Chinese upstart brand Xiaomi (pvt) has seen, but for now, despite the small individual brand unit volumes, Chinese brands continue to gain overall smartphone share. Apple and Samsung still have a 34.8% combined share of the overall smartphone market, but Chinese brands have a 31.9% combined share in 1Q 2017, and continue to challenge the leaders.

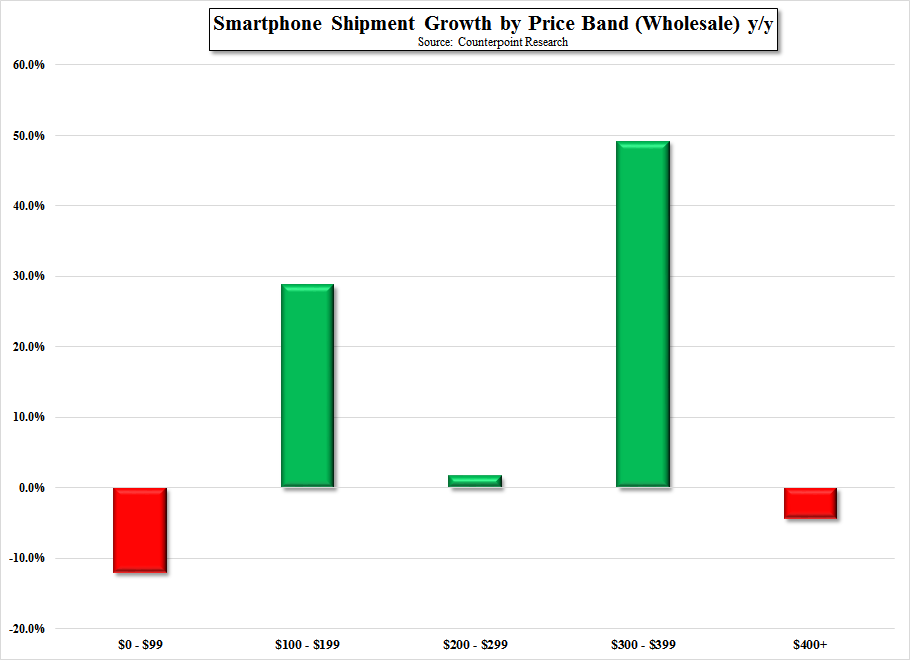

Year over year growth came in 3 of 5 price bands for smartphones in 1Q, with both the low-end and high-end seeing negative growth, while the mid-range saw positive growth. The lack of new releases from Samsung and Apple likely contributed to the negative growth in the high-end price band, but the low-end ($100 - $199) category has been showing growth for the last few quarters as almost all brands offer ‘value’ phones to those that do not need full feature sets, and what we call ‘almost premium’ phones to those that want features but do not need the Apple or Samsung brand name. Aside from China, the markets with the most growth potential for Chinese brands are India and Southeast Asia, where there is little local brand competition.

RSS Feed

RSS Feed