TV Shipments weak in 1Q on poor China results

China will be entering the Dragon Boat Festival holiday at the end of this month, which might help to stimulate TV sales, but the malaise that has hovered over China has been primarily caused by high panel pricing, which has led to low margins for TV set producers. These low margins have reduced the set brands ability to offer significant discounting, which Chinese consumers have become used to. With some stability in TV panel pricing, set manufacturers could cut costs a bit further, although they have been doing same for the last few quarters to offset panel price increases, and see a bit more room for discounting, but it will take TV panel price declines to give set manufacturers the room they need to price TVs for the 4th quarter holiday period, and panel producers are not quite ready to give in to that theory. Panel producers have seen high utilization rates and strong margins, the ultimate goal in such a cyclical business, and do not want to change the profit balance, but a continued push toward holding TV panel prices at these levels will eventually stifle the TV set industry and reduce overall panel demand, which in turn, will not be good for the panel producers. No one wants to kill the golden goose, but sometimes it is necessary to keep the goose egg retailers in business…

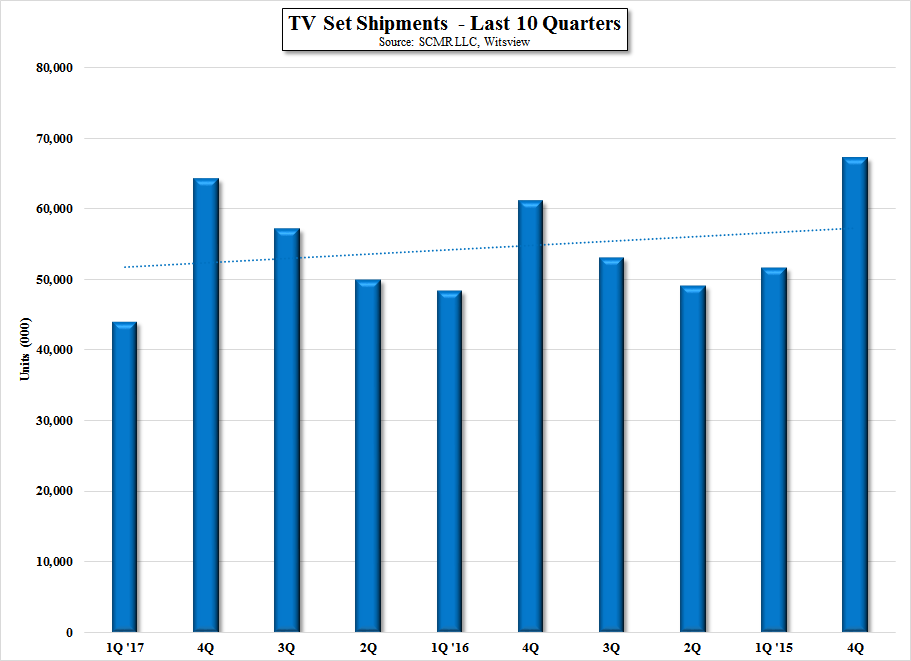

[1] Last two year average

RSS Feed

RSS Feed