May Panel Pricing and April Panel Shipments

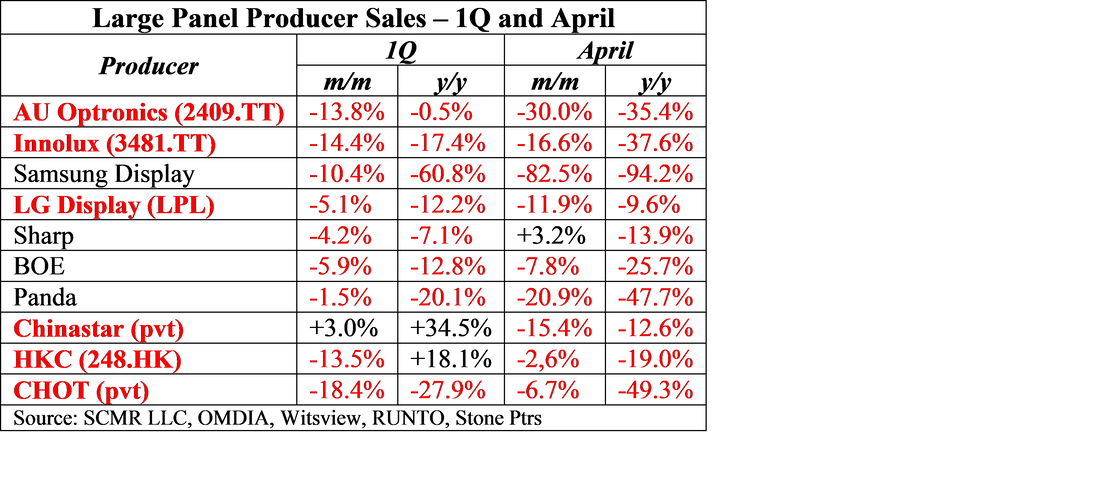

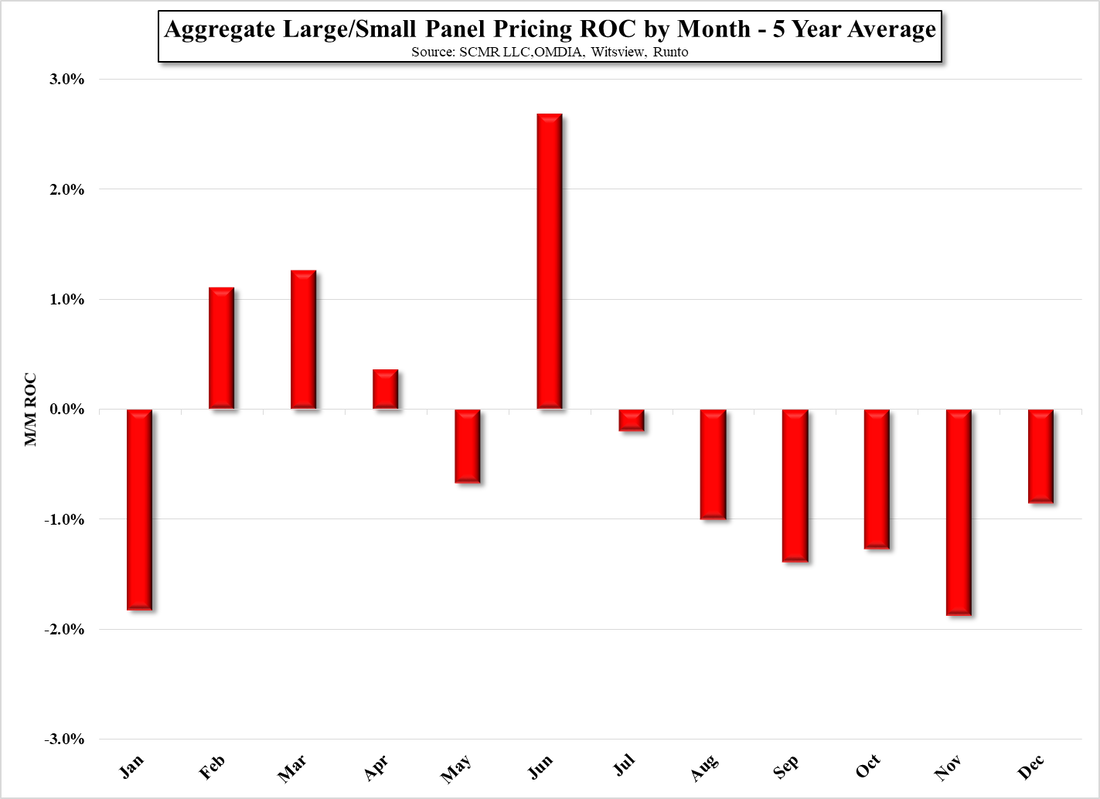

A can be seen in the tables below, TV panel prices fell far more than we expected, putting the aggregate TV panel price at the lowest point seen in the last 5 years and down 58.8% from the high reached in June of last year. Aggregate IT panel prices are now down 34.9% from the high reached in August 2021 and only 8.6% from the 5 year low seen in November 2017. April industry panel shipment data saw large panel revenue decline 13.6% m/m and is now down 25.9% y/y, with all categories showing lower shipments on y/y basis other than monitors which saw a severe shipment decline last year in 1Q and 2Q. While China’s share of overall large panel revenue increased to 51.8% in April, China’s large panel producers saw revenue decline 9.5% m/m and decline 24.1% y/y, while Japan (Sharp (6753.JP)) saw the only increase in large panel sales. We break out major large panel producers in Table 3, which shows the severity of the revenue decline in April. We note that Samsung Display (pvt) is in the process of closing its last large panel LCD fab, so the decline in that case is exaggerated and Panda (pvt) sold two of its fabs to BOE (200725.CH) last year, making the y/y comparison less relevant.

RSS Feed

RSS Feed