Micro-LED Primer

Over the years there have been many developments that have kept this relatively older display technology from disappearing, such as quantum dots and LED backlights, along with a very substantial infrastructure, with competition from an alternative display technology, OLED, challenging LCD’s leadership, at least at the small panel level. OLED displays differ from LCDs in that they do not have a backlight, as the pixel material itself emits light, and in the case of small panel OLED, there is also no color filter. That said, the process for producing OLED is newer and more challenging, and while OLED displays are far more versatile in form than LCDs, OLEDs are still more expensive to produce.

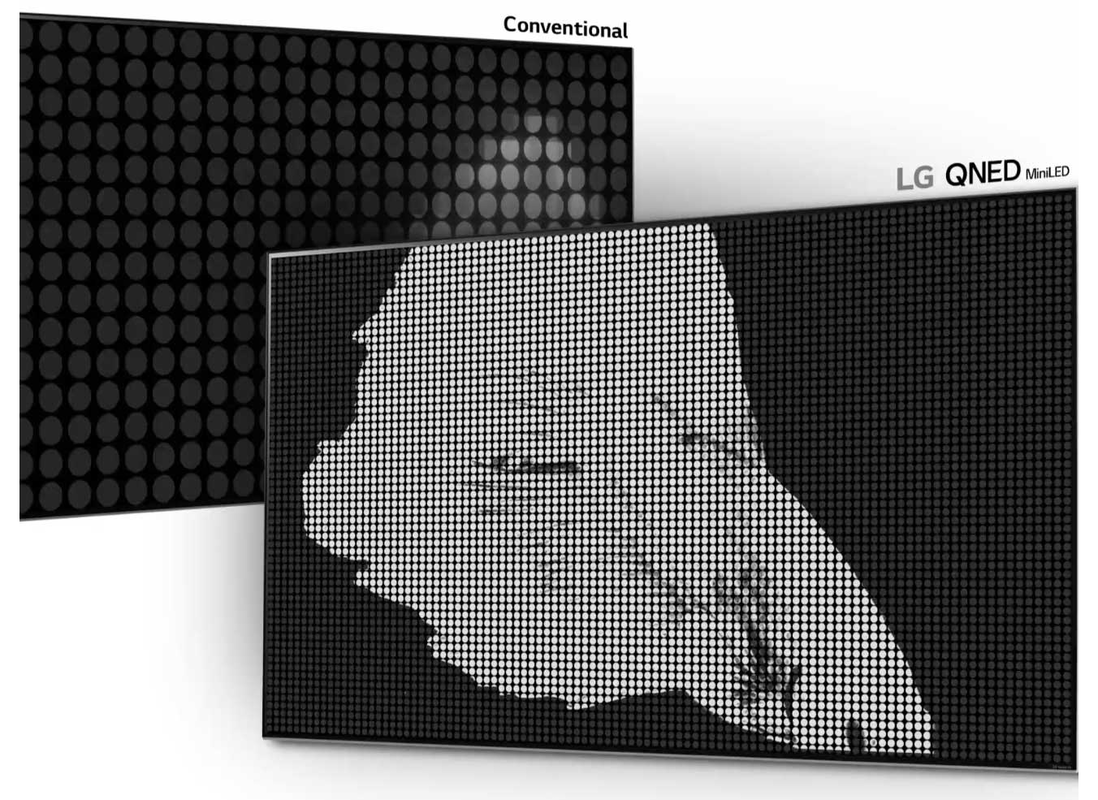

As we noted, LCD stakeholders have a vested interest in maintaining the technology’s dominance, and to that end have continued to enhance the LCD backlight, a key part of the LCD display. While there are almost 25m pixels in a 4K display the LED backlights in medium and large panel LCD displays have anywhere from a few to a few hundred LEDs to provide light to these pixels. This means that if an area of the image displayed is relatively dark, the LEDs behind the dark pixels should be off, while the LEDs in areas where the image is bright should be on. Given the mis-match between the number of pixels and the number of LEDs there are many instances where the light from those LEDs that are on leaks into areas where they are off, causing blacks to become grays, causing ‘halos’ around dark areas, or washing out colors.

In order to remove these issues, display and backlight manufacturers have continued to increase the number of LEDs in large panel displays, offering high-end displays with hundreds of LEDs to help to manage those problems. Last year however, manufacturers took it one level further, introducing mini-LED backlights, which are LED backlights using smaller LEDs enabling 10,000 or more LEDs and giving display designers more control over trying to match pixel counts with LED counts.

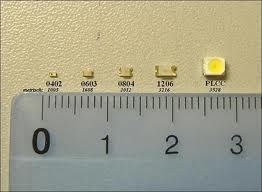

Along with this concept of smaller and more LEDs come some issues, particularly bottlenecks in producing these mini-LED backlights due to the smaller sizes and higher LED count. Aside from the inherent cost of a larger number of LEDs and the driver circuitry needed to make them work, tools that move these mini-LEDs from wafers to a mini-LED substrate need to move these tiny LEDs at a rate that makes the process cost effective. Given that mini-LEDs tend to be ~.1mm or smaller, with the smallest ‘standard’ size LED being twice that (smaller than a typical grain of sand), standard pick and place tools are less than effective from a time and cost perspective.

We have noted that Kulicke & Soffa (KLIC) has been marketing a higher speed mini-LED transfer solution (Pixalux) and is expected to release a faster version later this year, which gives mini-LED producers a shot at bringing mini-LED backlight costs down relatively quickly. This will allow mini-LED displays to move down the price curve and into high volume production as adoption increases this year and next, but display producers understand that even with the display enhancements that mini-LEDs produce, the technology is still based on LCDs, and the inherent limitations in LCD technology will eventually lessen the impact of any upgrades.

While panel producers are as eager to make money in the near-term, they also understand the limitations presented by LCD technology, especially given how OLED has impacted the small panel portion of the display space. To that end, a number of panel producers, LED manufacturers, and CE companies are developing micro-LED displays, which is a self-emissive technology that competes directly with other self-emissive technologies such as OLED. While mini-LEDs and micro-LEDs sound similar, they are quite different, not only in size, as micro-LEDs are an order of magnitude smaller than mini-LEDs, but are not dependent on LCD technology.

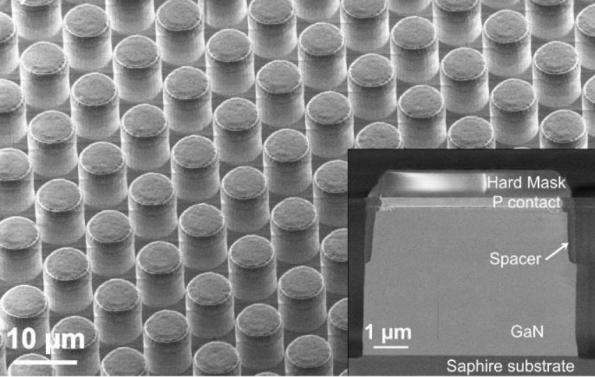

This has good points and bad points from an industry standpoint in that mini-LEDs capitalize on existing LCD infrastructure and are therefore not overly capital intensive, while there is no industry infrastructure for micro-LED display production. As the process for producing micro-LED displays is more like semiconductor production, the initial capital costs to build out the technology will be relatively high, but more focused on assembly rather than process, but the bottleneck problems mentioned earlier for mini-LED backlight production are multiplied more than a thousand times, given that every one of the ~25m sub-pixels in a 4K display would be a single micro-LED.

Aside from the capital cost mentioned above, the two biggest issues that face micro-LED display development are that same ‘pick & place’ bottleneck faced by mini-LEDs, now magnified from ~10,000 to 25m, which means that standard pick and place tools, even the faster and more sophisticated ones developed for mini-LEDs, would not suffice for micro-LEDs. While high-speed P&P tools could produce 5 or 10 mini-LED backlights/hour, it would take about 25 hours to produce just one micro-LED display. In order to bring such numbers into the world of eventual profitability, a number of companies are trying to develop ways to move vast amounts of very small LEDs at much higher rates, with a number of very different and novel approaches to the problem.

Along with the issue of placement speed, there is a secondary problem that also must be addressed, that of reliability. Even at 5 9’s, there would be 248 bad sub-pixels on each display, and that is assuming there was no damage to the LEDs during transfer, and that they were all placed correctly. There can be no ‘bad’ pixels in a display, so there must be some way to either eliminate bad LEDs before they are transferred or replace non-working LEDs after the transfer and no matter how fast a transfer system can operate, removing and replacing bad LEDs will markedly slow the production time.

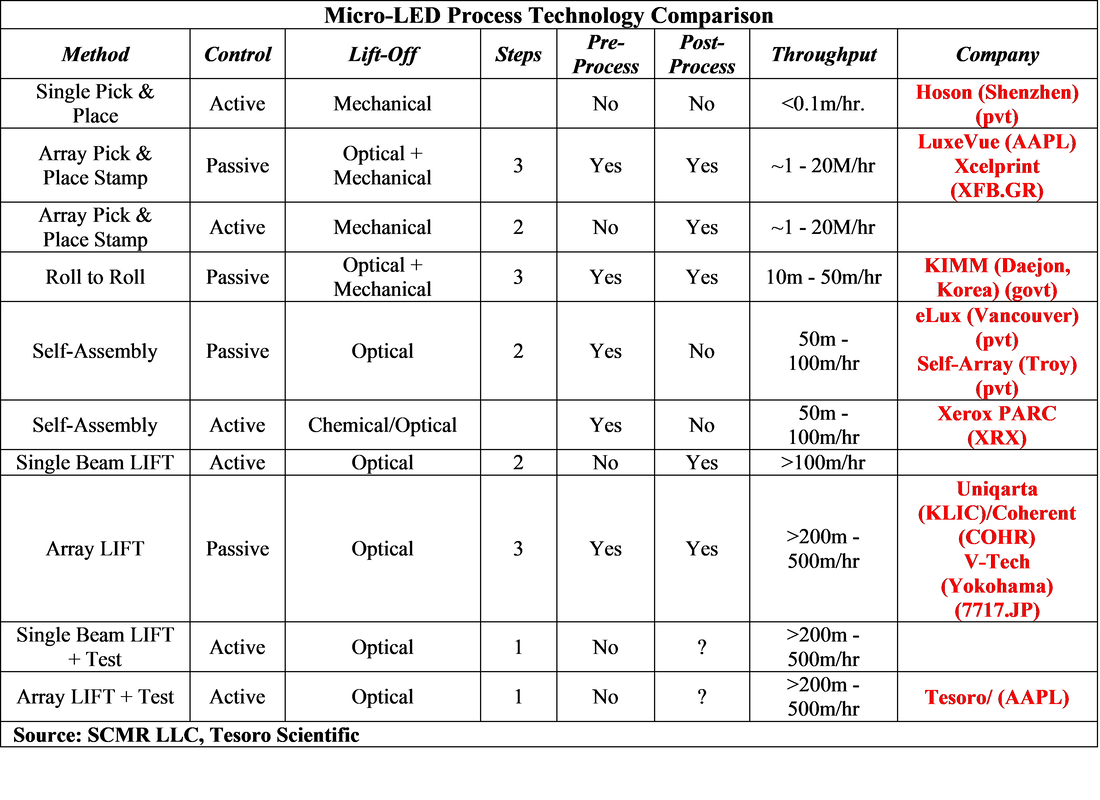

Each of the development paths that companies have taken for the development of micro-LED displays has plusses and minuses, with some requiring pre-processing steps or post-processing steps, some faster or slower than others, and some are still in the realm of the unknown with tools and processes still in development. The companies supporting each of the various processes are believers that their technology will be the winner, and while most are small, just as KLIC found themselves in the mini-LED beneficial ‘first-mover’ situation, it is still anyone’s game.

The table below was taken from IP surrounding micro-LED tool development and shows most of the current processes being developed for micro-LED production. While this is the simplified version of the table there are still a few points that need to be clarified. The first is ‘active’ or ‘passive’, which indicates whether a system allows a mass transfer to take place unassisted, or whether the process is adjusted as it is happening. Taking ‘Self-Assembly’ as an example, passive self-assembly would be the equivalent of ball bearings rolling across a surface that had indentations wherever a ball needed to be placed. As the balls roll across the surface they fall into the indentations without guidance, but any that reach the other side without filling a hole must be returned to their initial position and the process repeated until all spaces are filled. An active representation of that same system would be one where the indented surface was tiltable, which would move on axis until all the balls that did not initially find a hole were placed.

There are also characteristics such as the mechanism for actually removing the micro-LED die from the wafer onto the new substrate. This can be done mechanically, either individually (slow) or as a group (faster), or can be done with a laser, which would tend to be faster but could cause heat damage, and as noted above, the number of steps for each process and the amount of pre-processing and post-processing are big factors that would contribute to the cost effectiveness of each potential process. In reality absolute speed is not the only factor that could make the difference between a costly and cost-effective micro-LED process tool, especially when one considers that some of these processes, usually the passive ones, require that any defective die be removed before the transfer takes place, while active processes can keep from transferring those micro-LEDs that are already known to be defective.

Once the transfers have been made the entire array must be tested and any defective or misplaced LEDs must be replaced, which in some systems would mean returning the array to the tool and running it again to fill in the blanks. Some tools have the pre and post test stages built in, which allows the system to repair and replace without moving the wafer or substrate, but this also makes the tool larger and more complex, so the jury is still out on which process will wind up as the ultimate winner. That said, we expect it will take at least two years to commercialize any of these systems, which means in the interim, micro-LED displays will be an expensive novelty rather than a mass produced product. That said, once these challenges are met, we expect micro-LEDs will find their place in the world of displays and hopefully will improve quality while maintaining or reducing cost.

RSS Feed

RSS Feed