Mini-LED Backlights Seeing Strength

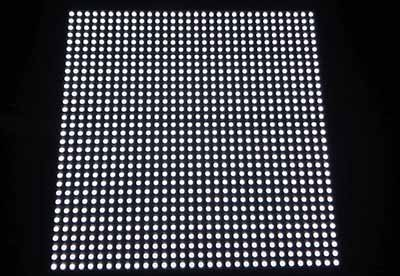

Over the last year, backlight manufacturers have been working with chip suppliers to reduce the size of the LEDs used in LCD backlights, to the point where they are able to incorporate thousands of LEDs in a backlight array, rather than a few hundred. This gives the set far more control over what areas of the image are dark or light, increasing the overall contrast of LCD displays. These ‘mini-LED’ backlights are primarily used in high-end displays, but are moving down the CE display product chain into monitors and laptops, and while 2020 was the first year when mini-LED displays were commercialized, we expect 2021 to be a year when they become a featured part of displays and will provide a better image and competitive differentiation.

There are a number of panel producers that are offering LCD displays with mini-LED backlights, with Samsung Display (pvt), LG Display (LPL), AU Optronics (AUOTY), Innolux (3481.TT), BOE (200725.CH), and Chinastar (pvt) being the most visible, with some developing in-house product and others buying mini-LED arrays from LED producers/packagers Ennostar (3414.TT), Sanan (600703.CH), HC Semitek (300323.CH), and Seoul Semi (046890.KS). As a relatively new business line for most, producers are working with a product that has no standards. There is no standard mini-LED size, no standard LED count or no standard LED spacing, and that has kept it a more ‘customized’ business, with designers trying to balance all of the factors to meet specs from panel producers.

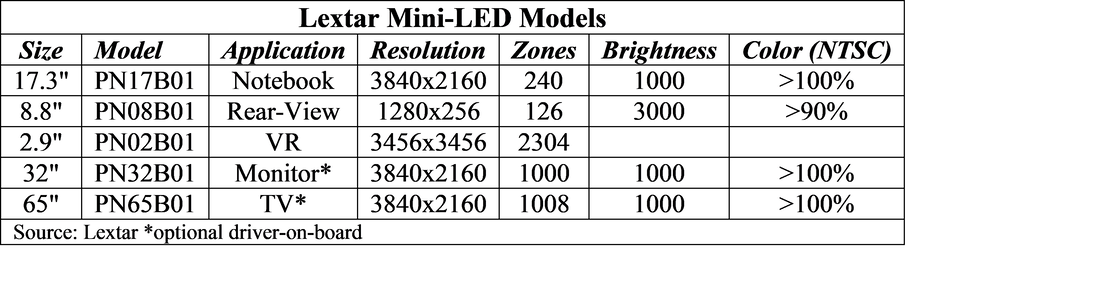

The cost to produce mini-LED backlights is high, between 30% and 50% higher than entry-level direct lit backlights, but still lower than the cost of equivalent OLED displays, but as mini-Led suppliers gain experience and refine process, the cost has been declining. Ennostar, the holding company for Taiwan based LED producer Epistar (pvt) and packager Lextar (pvt), has been producing mini-LED backlighting since late 2018 and has developed a number of ‘standardized’ mini-LED backlights that are ‘stock’ rather than having to develop custom products for each customer.

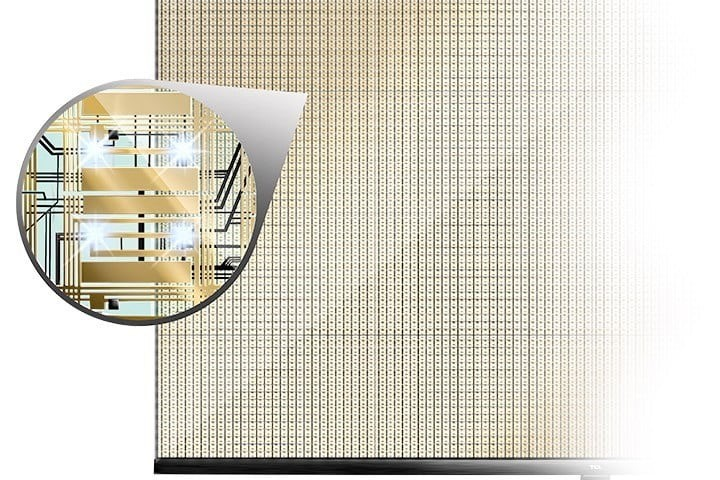

Driving the growth in mini-LED usage a number of applications where the high contrast or high brightness of mini-LEDs can justify their higher cost, and Ennostar has indicated that it has 2021 order visibility through 1H and is running at between 80% and 90% utilization, with 50% of its mini-LED production capacity booked by Apple (AAPL). Apple is already using mini-LED backlighting, albeit at a relatively low LED count, in its XDR Pro Display Monitor, but a continuous stream of rumors about the company’s adoption of the technology at the notebook level seem progressively more realistic. Chinese TV producer TCL (000100.CH) has already released a number of TV models using mini-LEDs and a number of laptops using the technology have already been released, particularly the ‘Creator’ series by MSI (2377.TT).

As LED producers and packagers expand mini-LED production, costs will decline and production bottlenecks will be eliminated (see our 1/19/21 note), driving mini-LED backlighting into mid-tier products. That said, while TCL has received considerable technology press for its rapid deployment of mini-LEDs in its TV line, the adoption of the technology by Apple will have a very significant effect on its adoption across the industry. If that comes this year, we expect estimates for $270m in mini-LED backlight sales will be low, if not, 2022 will see even greater mini-LED expansion, as it gives well-established LCD technology a bit more sustainability against OLED and other potential display technologies. Given the massive LCD infrastructure that the industry has developed, LCD panel producers are usually want to adopt anything that will add to the longevity of their investment, especially one that uses much of the existing LED supply chain infrastructure, which mini-LED does.

RSS Feed

RSS Feed