MLCCs – Fallout

MLCC unit count in various CE & Automotive products:

- Laptops – 400 – 800 units

- Smartphone – 200 – 1000

- LCD TV – 500 – 800

- Gas Engine Vehicles - ~5,500

- EVs - ~12,500

- ADAS - ~15,000

- Autonomous Vehicles - ~17,500

That said, electrode and termination materials in MLCCs are Nickel, Copper, Tin, and Palladium, and while very small amounts are used in all but the high voltage MLCCs used in EVs, the fact that over 1 trillion MLCCs are produced yearly, makes raw material price swings quite significant, with the cost to produce MLCCs representing ~75% of industry sales. However, given that MLCCs have the lowest cost structure for all capacitors, they represent the highest profitability levels for capacitor producers.

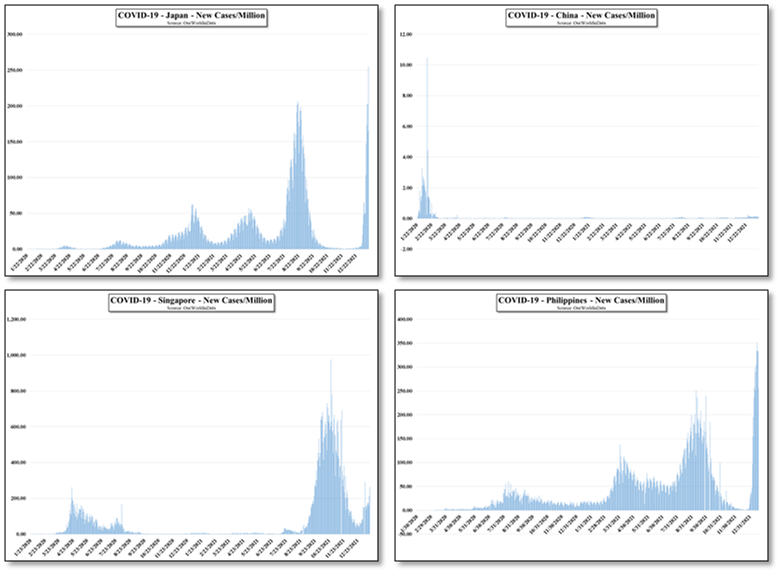

Early this year many CE companies had an optimistic view of 2022 product prospects, much of which was based on the demand levels for a number of CE products due to COVID-19 in 2021, but there were a number of red flags underlying that optimism, particularly the deterioration in LCD TV panel prices, which began in July of last year. While this was specific to a particular CE segment, leaving IT (monitor, notebook, and tablet) prices to continue rising, if foreshadowed the more general decline in panel prices seen in recent months, despite the insistence of most panel producers that the weakness was limited to only TVs. Concerns about semiconductor supply shortages coupled with this optimistic view, caused CE companies to overestimate demand and build component and product inventory based on 2021 results and 1Q ’22 results, which were still being driven by the optimistic 2022 targets.

Now that reality has set in and targets are being lowered, we see component demand weakening and prices following which heads us back to MLCCs. Taiwan-based Trendforce is now estimating that MLCCs will see 2Q prices decline by 3% to 5% and by 2% to 4% in 3Q, citing the continuing decline in TV panel prices as an indicator, along with the continuing weakness in smartphones, which include both LCD and OLED. While those quarterly price reductions will likely do little to affect the long-term growth trendline for MLCCs seen in Figure 2, it will serve as a cautionary note toward plans for MLCC capacity expansion, with most of the large suppliers having been through at least one over-expansion cycle.

Around July of 2021 there were thoughts that MLCC’s were heading into a shortage situation and some manufacturers were beginning to plan capacity increases, especially for automotive oriented MLCCs, but the industry as a whole does not seem to have fallen into the pattern of over expanding into the demand inflection point, which gives us reason to maintain a positive long-term view of MLCC growth, despite the near-term weakness. For component suppliers MLCCs are still one of the best places to be and will continue to see application growth over the long-term.

RSS Feed

RSS Feed