MLCCs – Good News Bad News

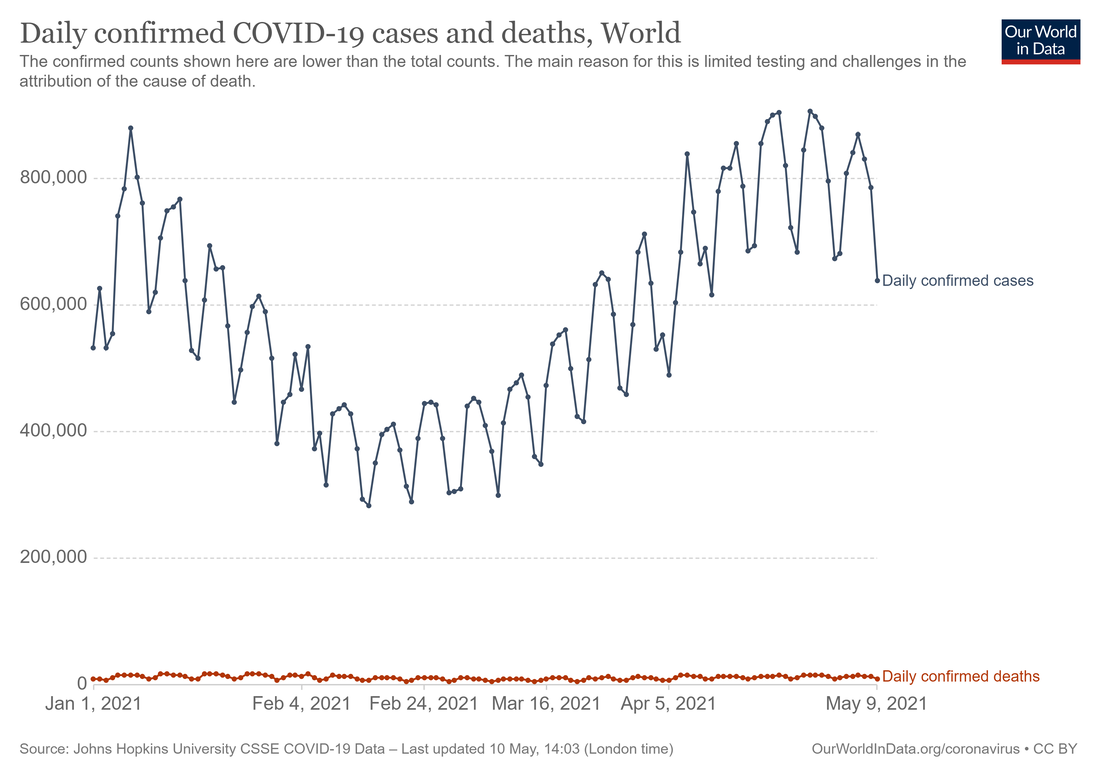

But there is a downside to this growth, at least in the near-term and that is COVID-19, which has been a plus for passive component demand over the last year. As Malaysia is a major production base for passive component production, the recent new outbreak of COVID-19 in the country has forced the shutdown of a number of component production facilities and the Malaysian government’s extension of the country’s lockdown to ‘indefinite’ have caused concern among component buyers as Murata, Taiyo Yuden (6976.TT) , AVX (6971.JP) and other suppliers have significant capacity in the country. The outbreaks do seem to be regional, so shutdowns might not affect all suppliers at the same time, but the recent daily new cases spikes have reset the country’s focus on slowing the spread of the virus. In most regions factories are exempted from the restrictions, but as has been the case in other countries, factory workers are not always in sync with government mandates, nor are all company managements, who, while not wanting to close factories at all, understand that a short-term closure is better than what could become a long-term one.

Some orders for MLCC’s and similar passive components can be shifted to other production locations, but the production of MLCCs is particularly specialized and capacity remains tight. While Murata management does expect some pricing weakness as inventory building is completed, the possibility exists that tighter capacity conditions could keep any price pressure to a minimum. It is harder for us in the US to get the perspective that other countries might have given the vast vaccine resources we have in the US, but to smaller or less privileged countries the prospects for slowing the rate of new COVID-19 infections is far more daunting than we might perceive.

RSS Feed

RSS Feed