MLCCs – Lead Times Movin’ on Up

Early in 2020 the COVID-19 pandemic caused vehicle sales to slow and consequently demand for many automotive components followed suit however demand returned as the year progressed and now capacity constraints in the semiconductor space are beginning to limit vehicle production. That said, with both the smartphone and automotive markets vying for MLCC capacity, MLCC lead times moved up about 20 weeks ago, after remaining flat for the early part of the year. While there are ~20 broad MLCC type categories, we noted that the lead time increase during that period increased by ~2 weeks to ~20 weeks. From that point forward lead times remained flat, however between 3 and 6 weeks ago MLCC lead times took another step up by another 2 to 3 weeks to ~23 weeks, meaning that orders for MLCCs placed today would not be received for almost a half year.

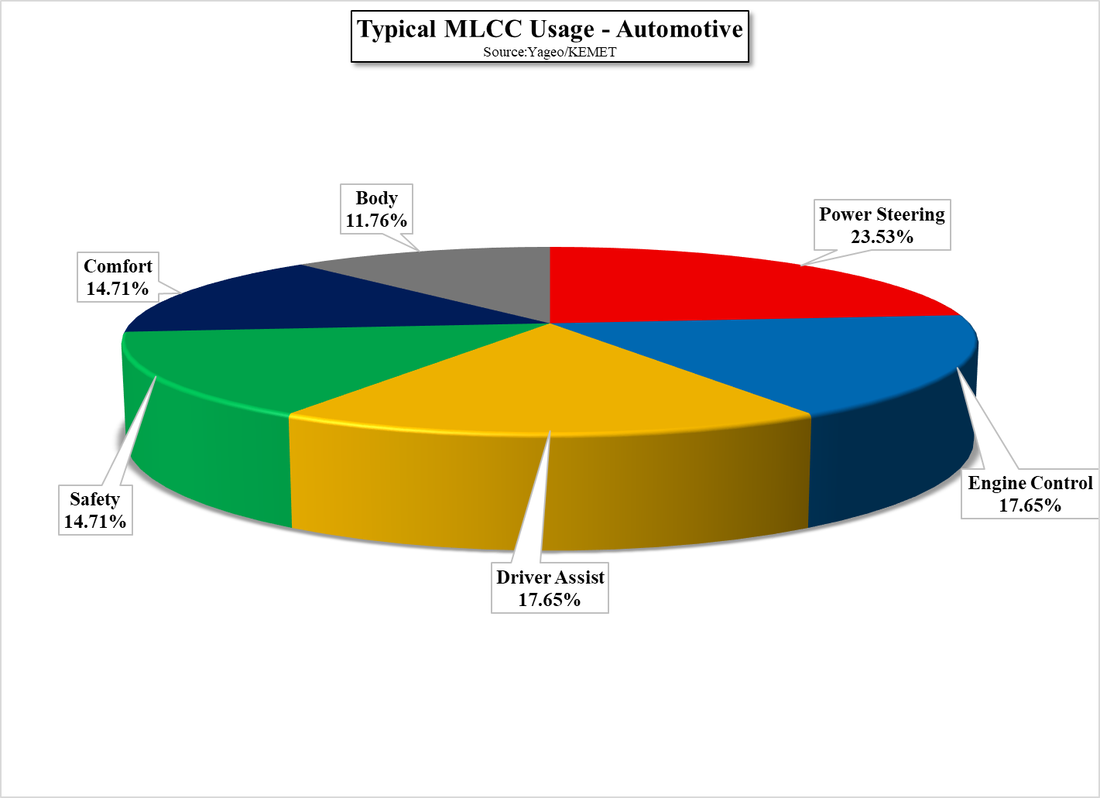

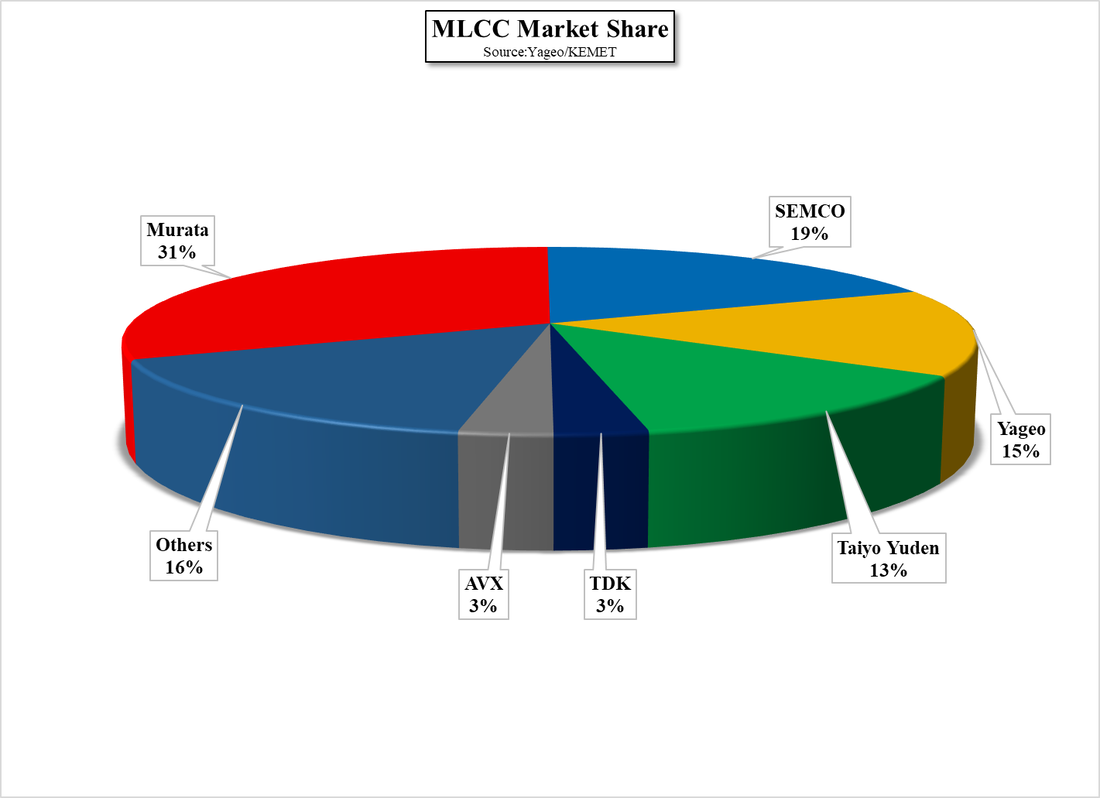

We believe that some of the lead time increase is due to increasing demand, particularly for hybrids and electric vehicles, but as component shortages in the automotive space become significant enough to limit production, we expect that some stockpiling is also occurring, and an increasing number of new 5G smartphones could be pushing smartphone brands and assemblers to be doing the same. While MLCCs are relatively simple devices their fabrication is not so the number of volume suppliers remains low, and while capacity is being added, mostly by incumbents, suppliers have been down this road before, only to see weak pricing after new capacity was added and are a bit more hesitant to expand, despite the bright demand prospects. All in, it is an ideal time for MLCC producers, which we expect will remain so for the remainder of the year.

RSS Feed

RSS Feed