Mobile OLED – Numbers Game

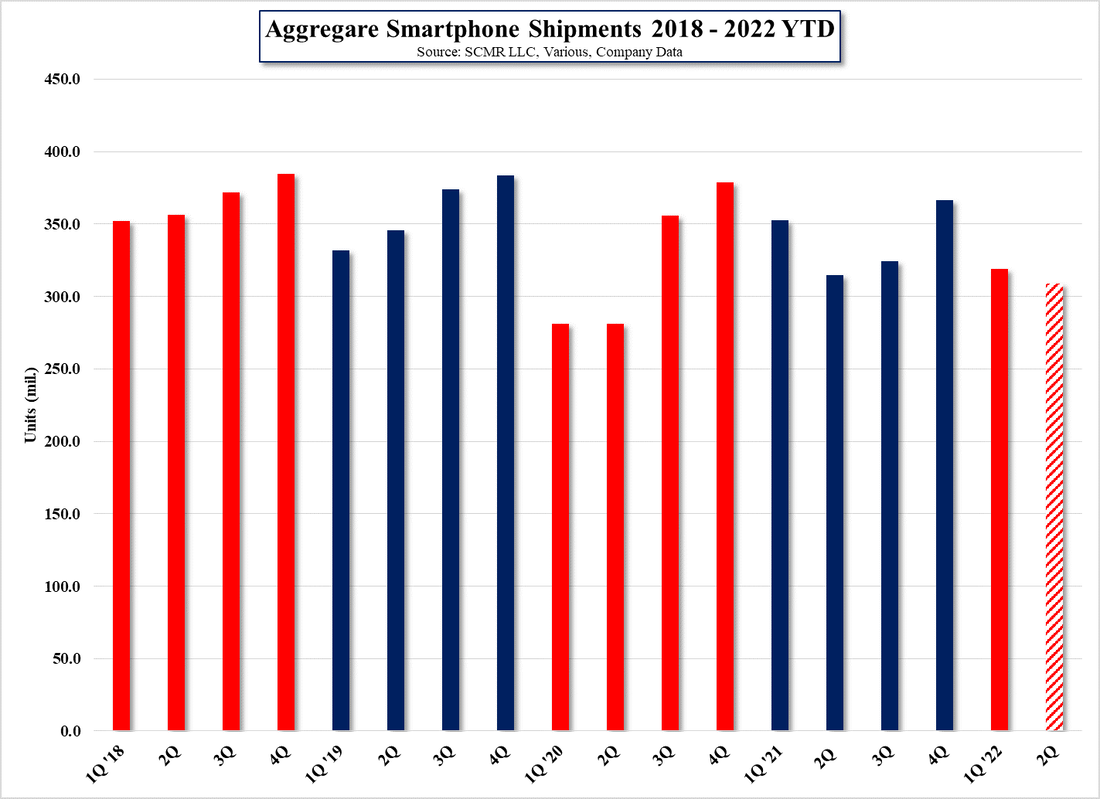

In the past OLED based smartphones have defied broader growth patterns for the broad smartphone market as share grew, but with OLED smartphone share reaching ~43% last year and continued share growth this year, OLED smartphones are mainstream and face macro challenges similar to those for LCD smartphone displays. This is made more understandable considering that the competitive nature of the OLED display space continues to increase with Chinese small panel OLED display producers pushing to gain share to prove their worth in the overall display market, as they have done in the large panel LCD space and Chinese rhetoric about how they are challenging the dominance of South Korean small panel OLED producers Samsung Display (pvt) and LG Display (LPL) with a bent toward the goal of ‘world dominance’.

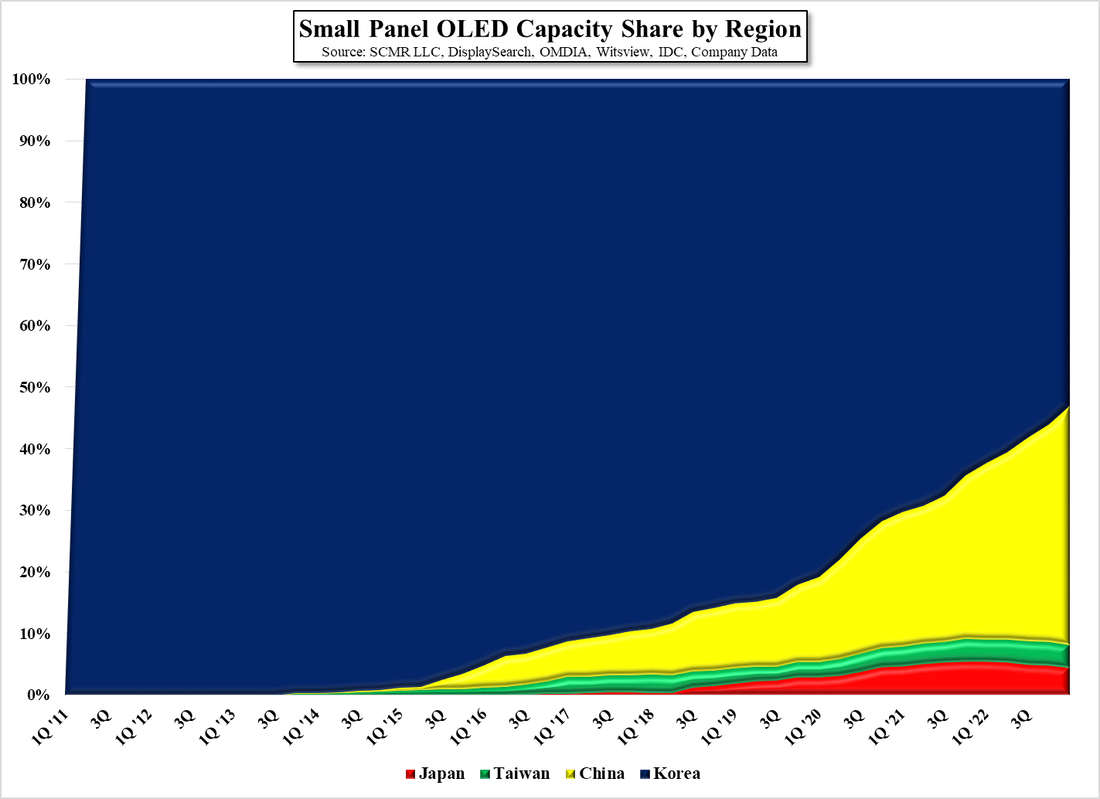

As we have previously noted, South Korean small panel OLED producers have a number of advantages over Chinese small panel OLED producers, primarily the production experience that comes from 15 years of small panel OLED fab operation and a broad supporting infrastructure, while Chinese players began what would barely be called commercial production 9 years ago. That said, Chinese small panel OLED producers do have one large advantage, and that is capital, which despite questionable operational profitability (without subsidies), seems to be readily available to OLED producers for expansion and to make up operational shortfalls. The expansion capital has allowed Chinese small panel OLED producers to add considerable capacity over the years as seen in Figure 2, and without question we expect Chinese small panel OLED producers to eclipse South Korean capacity some time over the next 2 – 3 years.

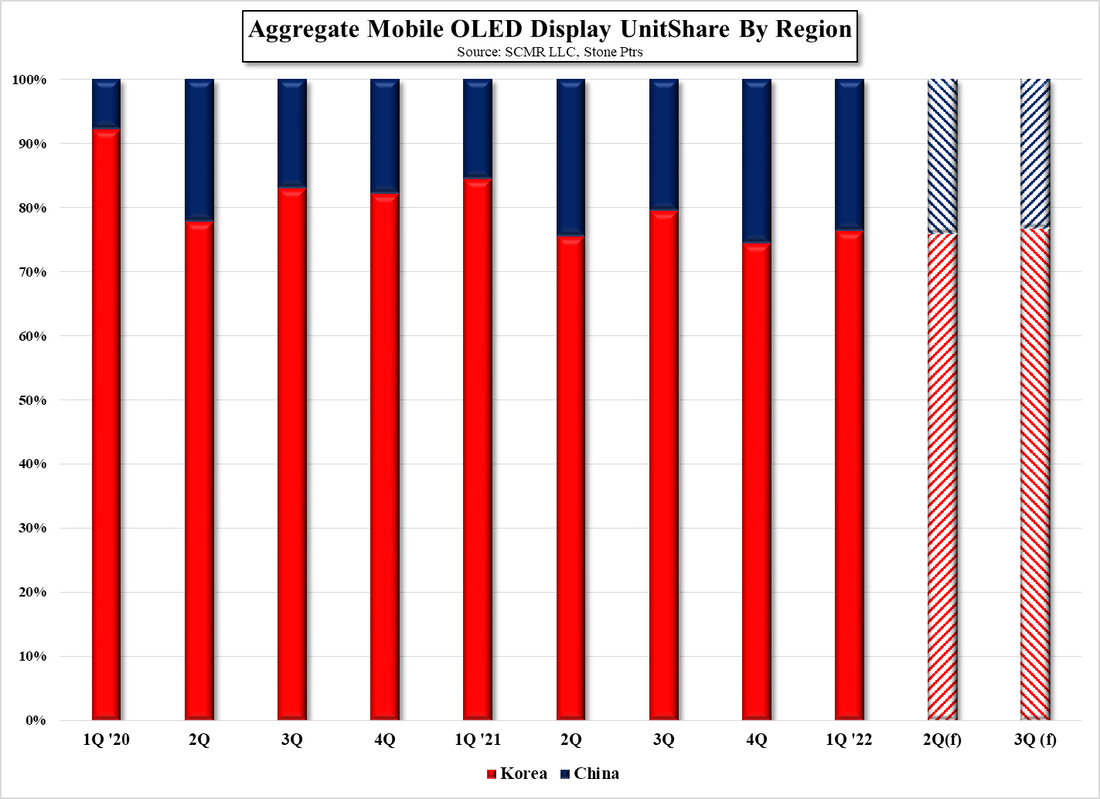

That said, while the numbers would indicate that Chinese small panel OLED producers can take over the lead position in production capacity from South Korean rivals, there are missing factors in Figure 2, and those are utilization and yield. Given Samsung Display and LG Display’s long-term small panel OLED production experience, they maintain high yield ratios, and while they vary according to how long a product has been in production and the complexity of the display, we believe South Korean small panel producers maintain higher yields than their Chinese rivals and are therefore able to produce more sophisticated small panel OLED displays. While such sophisticated displays carry a higher profit margin, the market for same is smaller than that of more generic small panel OLED displays, which theoretically should lead Chinese small panel OLED producers to higher utilization rates and higher unit counts, however this is not the case based on our data, and even with China’s largest OLED producer BOE (200725.CH) becoming part of the Apple iPhone OLED display supply chain, utilization rates at Chinese small panel OLED producers remain low, and given the weakness in the overall smartphone market, we expect relatively low utilization rates to continue into 3Q for most Chinese small panel OLED producers.

We expect composite small panel OLED demand to be up 8.7% q/q, but down 1.8% y/y, with only 4 of 8 smartphone brands (including ‘other’) seeing an increase q/q, with Apple the greatest increase based on the iPhone 14 estimated release dat. We do expect declines in small panel OLED displays from Huawei (pvt), Oppo (pvt), and Vivo (pvt) in 3Q, which would affect production at Visionox (002387.CH) and Tianma (000050.CH), while any Chinese branded smartphone order reductions at BOE will likely be offset by production for the iPhone 14, for which BOE is expected to produce 5m units. To put that in perspective BOE has been producing ~15m small panel OLED units on average, for the last 6 quarters, with SDC and LGD expected to produce 60m and 25m respectively, based on a 90m order from Apple, which seems to be the latest estimate.

While we are certainly not denigrating the competitive threat to South Korean small panel OLED suppliers from Chinese suppliers, we point to the fact that even with BOE’s participation in the iPhone 14, Chinese small panel OLED producers have maintained a relatively stable supply share of ~23.6% (6 quarter average including 2Q/3Q forecasts) while South Korean producer share has averaged 76.4% over the same period. Given our expectations for 23.2% and 76.8% respectively for 3Q, we see little change over the average. As we noted above, we do expect China’s small panel OLED share to increase as their capacity and experience grows, but we are far more willing to accept that change when factoring in utilization, yield, and profitability and given how rapidly the technology seems to be changing, we expect it will take more than subsidies and capacity for Chinese small panel OLED producers to overtake South Korean suppliers in the near to mid-term. After that, it’s anybody’s game…

RSS Feed

RSS Feed