Mobile Shipments in China – A Bit Behind

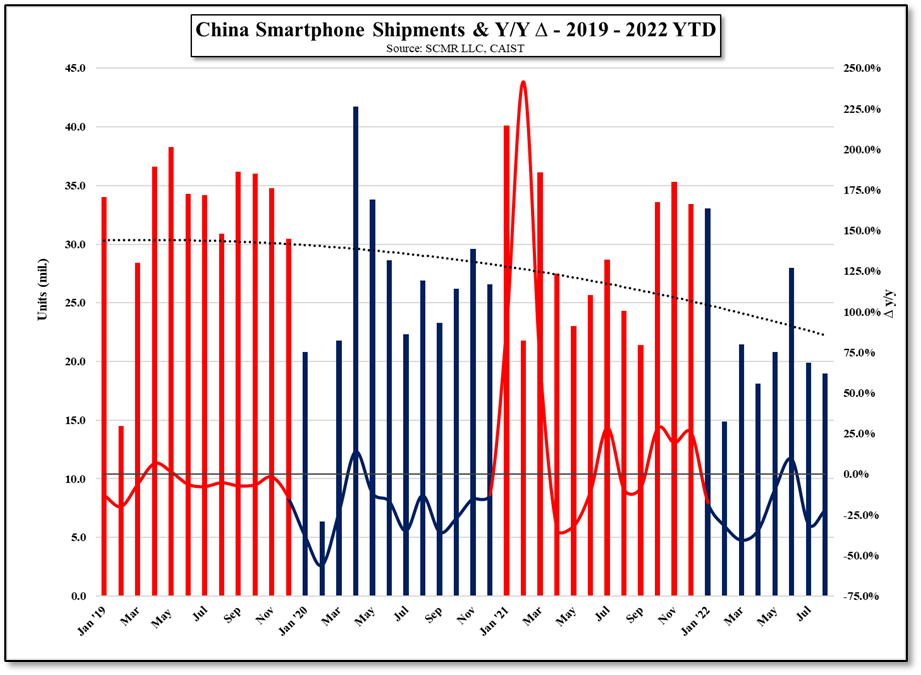

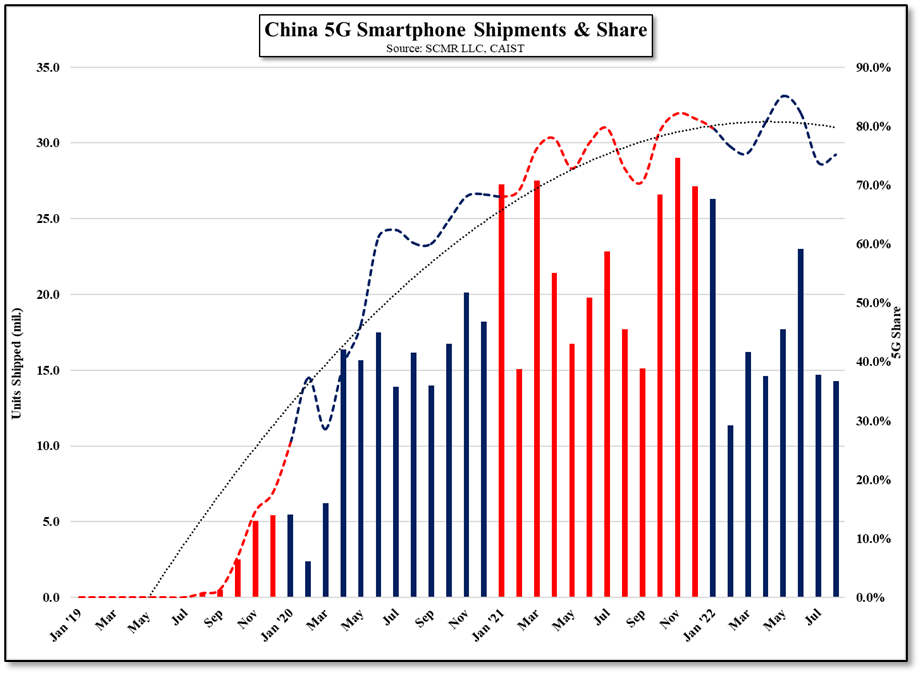

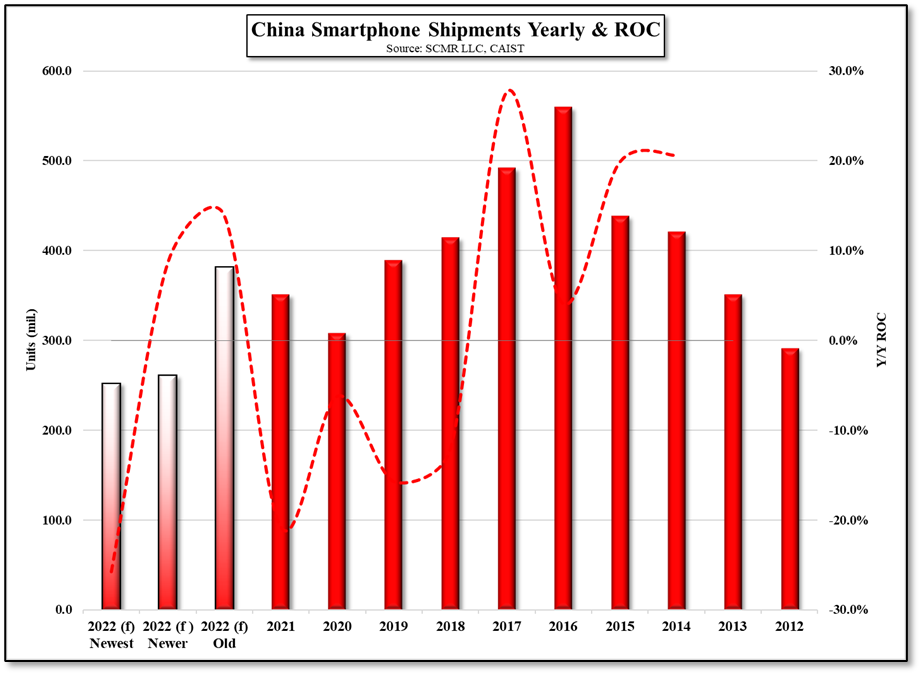

August saw mobile phone shipments in China decrease by 4.6% m/m and by 21.9% y/y to 18.979m units, a bit below our estimate of 19.08m units. Smartphone shipments were 18.135m units, down 5.1% m/m and down 21.5% y/y, while 5G phones represented 75.2% of total shipments, down 2.9% m/m and down 19.3% y/y. Domestic brand shipments were 17.87m units, down 2.3% m/m and down 21.6% y/y but represented 94.2% of total shipments, the highest level we have seen since 9/2021. We note that August data is rather opaque as it does not represent the most recent downward leg of the CE cycle, and our estimate for Chinese mobile shipments for the 2022 year drops a bit lower to 252m units, now down 28.2% y/y.

We would expect a continuation of the weakness seen to date in the Chinese smartphone market, with the only saving grace being a relatively large number of new models being released in August (albeit still down on a y/y basis), and the release of the iPhone 14 family, although as noted above, shipments of some models have been pushed to later in the quarter or into early 2023. 5G remains strong overall although y/y growth will be difficult for the remainder of the year as a strong 4Q last year will foil y/y growth and overall smartphone unit volume in China remains extremely weak.

RSS Feed

RSS Feed