More on Taiwan Semi…

Given that Taiwan Semiconductor (TSM) is the largest global semiconductor foundry, we have spent a bit more time looking at 1Q results, and more importantly guidance for some hints as to what to expect for the remainder of this year and next. Putting aside the typical company-speak, we summarize TSM’s comments and Q&A to give some perspective on what investors should expect from TSM going forward, not only as the largest foundry, but as a company with a large variety of customers. We refer back to our comments made yesterday for more data.

2Q Guidance

Revenue flat q/q

HPC up, offset by smartphones down – HPC up no surprise given both bitcoin and PC/Notebook demand, but smartphone weakness seems to not be reconciled with recent strong smartphone demand in China, which would likely lead to smartphone brands having more confidence in full year goals. 2Q smartphone foundry weakness could be just a lull before real 2H smartphone production demand sets in, or it could be the ‘Huawei effect’. If 3Q guidance for the smartphone segment is not better then it would give us doubt as to the conviction smartphone brands have toward the 2nd half.

Inventories

Up in 1Q – Typical seasonality story doesn’t play as well currently because of high utilization rates unless TSM is pre-building against 3Q delivery orders already on the books and is getting compensated for insuring full order delivery guaranties to large customers.

Should decline going forward – TSM also expects overall customer inventory levels to be higher than ‘historic seasonality levels’, which is certainly a positive for TSM demand, but also raises the risk at the customer level if there is any slowing in end-user demand. While the company was careful to restate how closely it works with its customers on order and inventory management, they did note that they cannot rule out the potential negative effect that overbooking might have, although they were not suggesting that currently.

Automotive – Expect automotive shortage to be ‘greatly reduced’ by next quarter – A bit hard to imaging how that would be the case unless automotive customers have already agreed to price increases that are higher than other components, or slower smartphone demand has freed up some capacity in 2Q that was not available in 1Q.

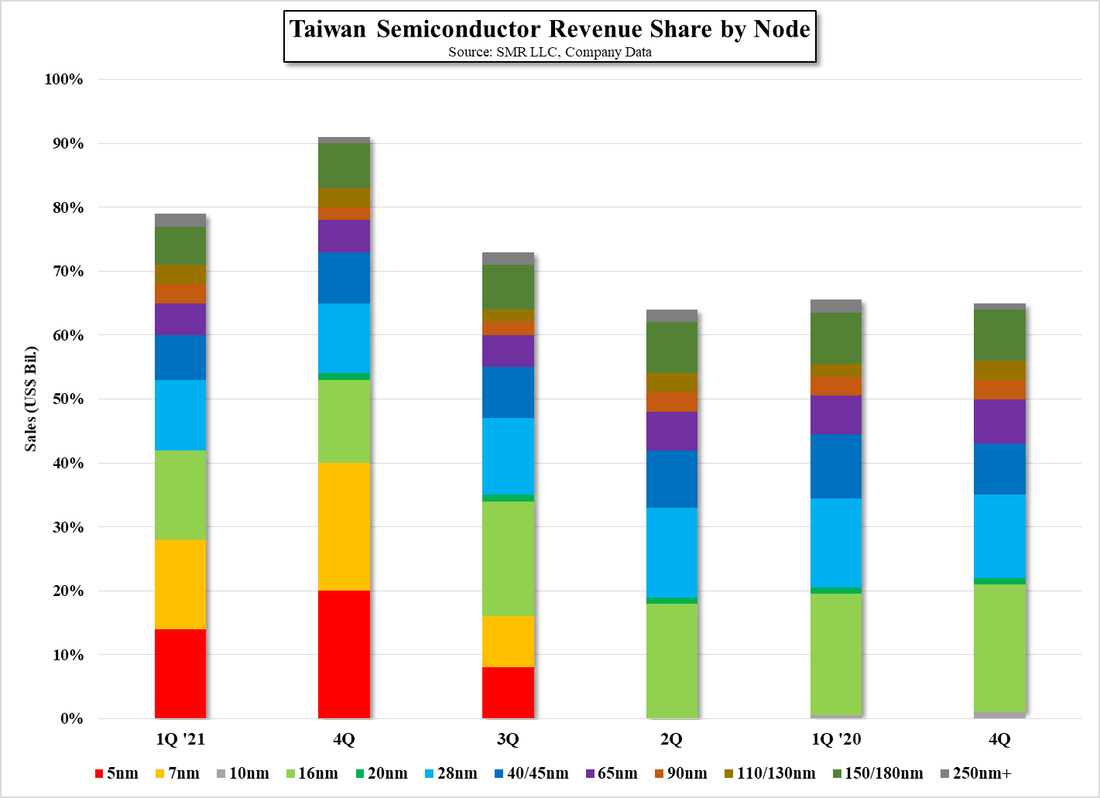

Margins – Pressure from increasing proportion of 5nm business, which currently has higher cost and lower efficiency than more mature nodes. As they expect 5nm to revenue to be 20% of revenue this year, that would imply considerable strength in the 5nm node for the remiander4 of the tear, as 1Q saw 14% od revenue from 5nm. Increasing the cost efficiency of the 5nm process will be key in seeing margin improvement since high utilization on other nodes makes it more difficult for TSM to improve process

Full Year Guidance

Semiconductor Market Growth (ex memory) – up 12%

Foundry Growth – up 16%

TSM Growth – up 20%

Expect overall demand to remain strong and for shortages to continue through this year and may extend into 2022.

Expect HPC and automotive to be higher than corporate average for 2021 – The company has seen demand strength from both segments over the last 3 months. As we noted yesterday, HPC strength is relatively easy to understand, but we wonder if automotive strength includes any overbooking as desperate customers vie for capacity.

Capex up to $30b from $26 previously

80% of 2021 capex on 3nm, 5nm, 7nm nodes

10% on Advanced packaging

10% on specialty technology

Will spend $100b over 2021 – 2023 period – Unusual in that they gave long-term capex guidance. Likely due to spending announcements by competitors Samsung (005930.KS) and Intel (INTC).

Customer interest in 3nm – 7nm nodes is increasing – Regardless of whether that translates into revenue as soon as TSM hopes, they have little choice but to spend on 3nm – 7nm nodes in order to try to stay ahead of Samsung, but moving up the learning curve will determine whether they can continue to generate record sales and profitability id utilization stays high.

All in, it was a good quarter for TSM, who should be generating peak sales and profits, even as 5nm grows. While the company was obviously optimistic about the next 12 months and the three year period encompassing 2021 to 2023, there were some points that would likely keep expectations from getting out of control. Aside from the margin pressure from 5nm, the slower pace of overall cost/process improvement because of the high utilization, which is a good problem to have, and a 30% increase in depreciation this year, along with the mention of over-ordering, point to some of the limiting factors that should keep estimates under control. On the other side of the equation demand remains strong and the positive effect of wafer price increases should allow TSM to meet its 20% growth target this year, barring any further exogenous variables or natural disasters.

RSS Feed

RSS Feed