More Trickle Down…

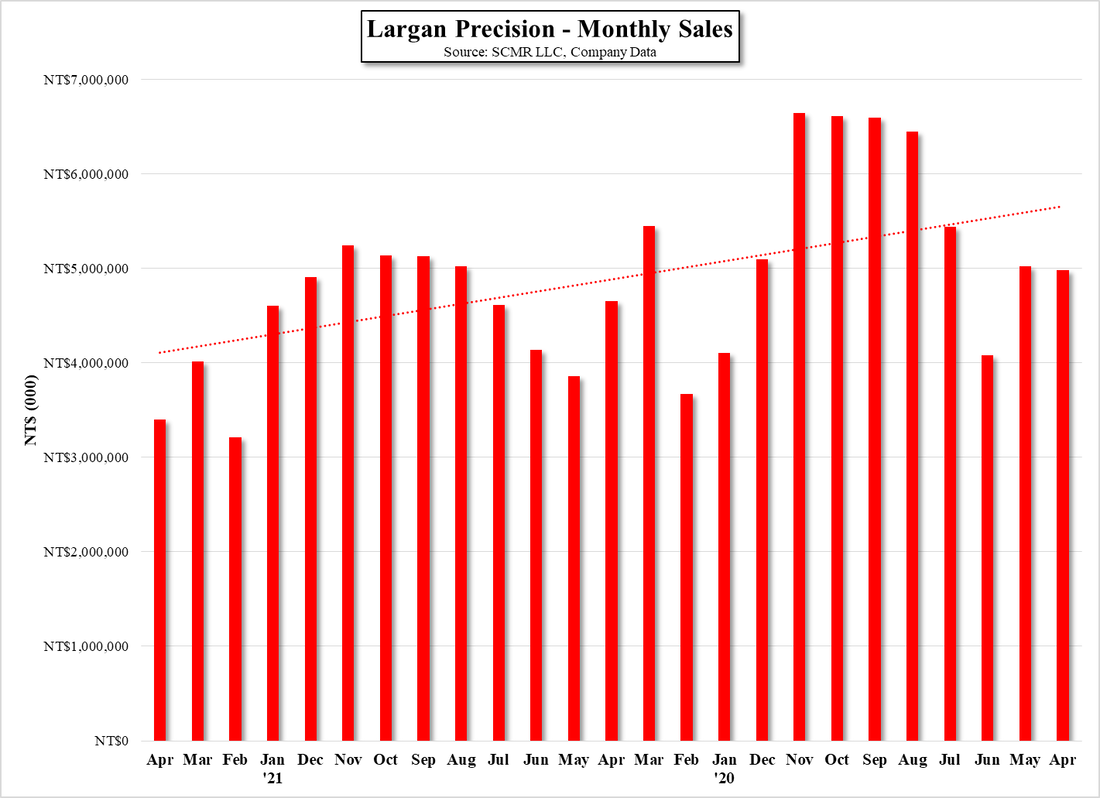

This was the weakest April for Largan since April 2016, and while it represents only a single data point in the broad CE market, what it tells us is that the effect of the semiconductor and other shortages continues to filter down through the CE ecosystem. Some are lucky enough to be able to institute price increases, especially raw material and intermediate suppliers, which help to offset the inability to deliver full unit volumes, but contractual obligations and aggressive price competition, keep many from recouping the additional production costs. Then there are those like Largan, who can offer to pay more for necessary components, but are limited by foundry capacity that is focused on the highest margin products.

We expect that CE producers that are able to shift the increased cost burden down the line have been reticent to pass that full cost to consumers. Of course there have been some segments of the CE space where price increases have been seen (TV), but they reflect an earlier stage of rising component prices. The more recent semiconductor capacity issues, such as the Samsung Austin plant shutdown, the fab fires at Renesas (6723.JP), and water issues in Taiwan have exacerbated an already difficult situation that has the potential to limit the growth that is expected of the consumer electronics space this year, outside of any changes from a more normalized lifestyle. We don’t mean to be harbingers of doom, but the CE space is facing what is a very unique set of circumstances and risk to the industry continues to rise, even as demand remains relatively solid, which makes every data point more valuable and increases the necessity to focus on all levels of production in the industry.

RSS Feed

RSS Feed