Motivation

Economic & Trade Agreement (“Phase One”) Agreement) between the US Government and the government of the People’s Republic of China.

- BASICS: To Improve access in the agriculture and financial services sectors, refrain from problematic policies and practices related to IP and technology transfer and increase its (China) purchases of certain U.S. goods and services.

- The goals of the “Made in China 2025” program (a subset of the 10 year plan), are to develop ‘indigenous technologies, IP and know-how, substitute domestic technologies, products, and services for foreign ones, and to capture a larger share of worldwide markets. The US government sees these goals as problematic in that they are supported by more than $500 billion in governmental financial funding and would create excess capacity and cause ‘long-lasting damage to US interests’, although it is hard to understand why such incentives are different from those offered by the US government.

- Along with the subsidy issue, back in 2017 the US government began a Section 301 investigation into China’s IP practices. Specifically, the use of a variety of tools to require or pressure the transfer of technologies and IP to Chinese companies. This is viewed as a way of depriving U.S. companies of the ability to set market-based terms in technology licensing negotiations with Chinese companies, a valid complaint. The US took it further citing Chinese intervention in markets by directing or unfairly facilitating the acquisition of U.S. companies and assets by Chinese companies to obtain cutting-edge technologies and IP; and conducting or supporting cyber-enabled theft and unauthorized intrusions into U.S. commercial computer networks for commercial gains. Since then the US reviews all acquisitions of US companies to determine if the technology is sensitive or crucial to the US military or key industries. They have nixed many such deals.

- ISSUES: Tariffs have been a method for protecting industries from aggressive incursions by those who have a financial advantage and both the US and China use them. China’s trade tariff for MFNs was 7.5% in 2023, with an average of 14% for agricultural products and 6.4% for non-agricultural products, but China bound 100% of its lines to the WTO, which means the rates they set are the maximum rates they can collect. This while not perfect, gives a sense of stability to the tariff system, something the US (under th current administration) has decided not to do.

- The US government has been complaining that as of the end of 2024 China has not even met its import tariff rate quotas for most products, which are agreed upon levels that cannot be exceeded without triggering even higher tariffs. That said, those levels have been exceeded for corn and wheat imports from the US. The Phase One agreement also required that China make improvements in its administration of TRQs for wheat, corn, and rice, which the US government says that China has not done so.

- The US government has also been complaining about other trade barriers it believes China has set up to prevent US companies from developing share on the Chinese mainland, particularly regulations around standards for agriculture, cosmetics, and meats and poultry, along with the difficulties China presents to those external suppliers that wish to participate in the country’s Government procurement programs.

- Since the 2020 agreement, either individually or as part of the WTO the US and China have had innumerable meetings and discussions concerning the abovementioned issues and other policy complaints, particularly covering IP, trade secrets, trademark ‘squatting’, online piracy (movies, books, audio, etc.), counterfeit goods, and what the US government calls ‘indigenous Innovation’, essentially China’a favored approach to IP developed in China.

However we note that a quick check of US government subsidies shows that this year the US is estimated to be spending $42.4 billion in direct government farm payments and is expected to spend $181.8 billion for programs like crop insurance, risk coverage, and price loss over the next 10 years. Fossil fuel direct subsidies and tax breaks typically range from $10 billion to $52 billion each year, but if you count indirect subsidies that benefit the industry, the number climbs to ~$760 billion, and those are only two of many categories, making US complaints about Chinese subsidies a bit moot..

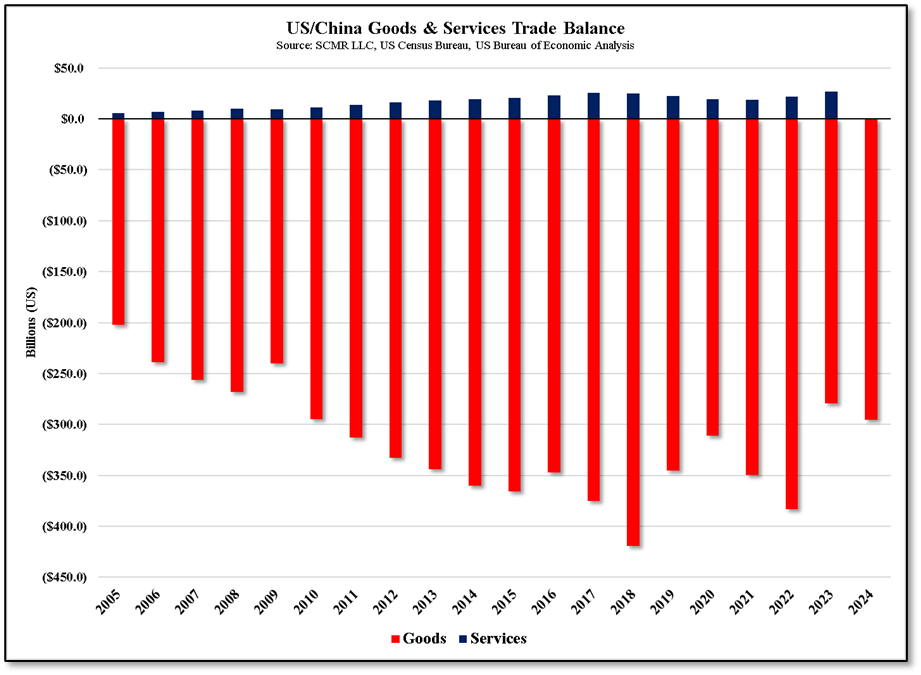

When it comes down to the current state of trade between the US and China, the true motivating factor is political. Yes, China has the largest trade deficit of any nation with the US, but it is also the largest market in terms of purchasing power parity and the 2nd largest in terms of GDP and is a heavily manufacturing oriented country with a relatively low consumer consumption rate. As the US consumer is less savings oriented than most other countries with high GDP’s, US consumers are going to want to buy more goods from manufacturing oriented countries like China than China buys from us[1]. Trying to balance trade with China by bringing production of googly eyes or sandbox toys into the US is a waste of time as most small business owners will confirm as it is quite difficult to compete in labor intensive markets. When threatened, as they are now, China and other manufacturing countries will agree to terms, make token gestures and continue on a similar path as they have been.

Trying to convince US consumers to buy only US made products, even if they are more expensive than those made in other countries only works in time of prosperity, and in most cases US consumers don’t examine everything they buy as to its country of origin. So expecting all goods that are manufactured in China to shift production to the US is a losing game. That said, the ratio of US services exported to China against goods imported from China has increased from 3.4% 20 years ago to 10.9% last year. In creasing that ratio will work toward reducing the US/Chinese deficit more realistically over the long-term, without forcing the US consumer to change habits, buy less from China, or pay more for goods manufactured in the US. We should certainly try to retore some manufacturing to the US, but it needs to be manufacturing things that are based exclusively on US technology, not generic products that have labor as their biggest cost.

For example, Semiconductors make sense, but not high volume mature node products that are relatively easy to manufacture, just leading edge products and the tools needed to produce them. When it comes to CE products, how can we compete with rows upon rows of factory workers who get paid (average factory worker) between $8,184[2] and $14,435/year to a US factory worker whose average salary is $53,416[3]. Even when adjusting for purchasing power parity, the US factory worker makes between 3.1x and 1.7x more than the Chinese worker, and that is only the labor cost. Tariffs are a way of trying to force long-term change in a short period and when it comes to responding China has shown that it can provide lip service for as long as necessary to prevent ‘stick damage’. They will likely do it again, so perhaps another method should be tried.

[1] We note that US consumption to gross GDP is 62%; China’s is 39%.

[2] National Bureau of Statistics of China, CEIC

[3] US Bureau of Labor Statistics

RSS Feed

RSS Feed