Musical Chairs

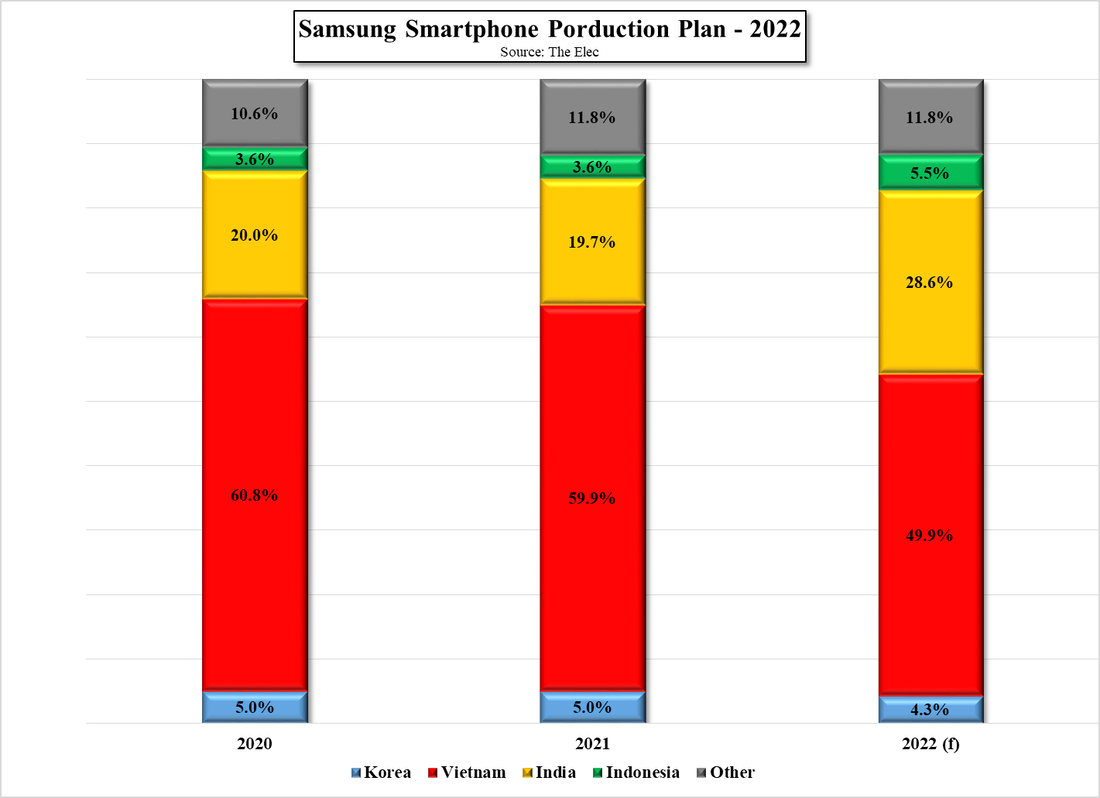

Vietnam became a valuable production location over the last two years as companies, including Samsung, migrated away from China, and Samsung’s two Vietnam assembly plants produce over 60% of Samsung’s global smartphone output, however both COVID-19 outbreaks, which led to factory closings and severe travel restrictions, along with increased wage requirements, have led Samsung to consider moving some of that production to other locations. It is expected that Samsung will reduce its Vietnam smartphone production exposure by ~10% in 2022, from ~182m units this year to ~163m units next year and will split the shifted production between facilities in India and Indonesia.

Samsung is expected to spend $90m to increase its production capabilities in India from 60m units to 93m units and will spend $50 to expand production in Indonesia from 10m units this year to 18m next year. This will raise production share in India from 20% this year to 29% next year, and will increase production share in Indonesia from 4% currently to 6% next year.

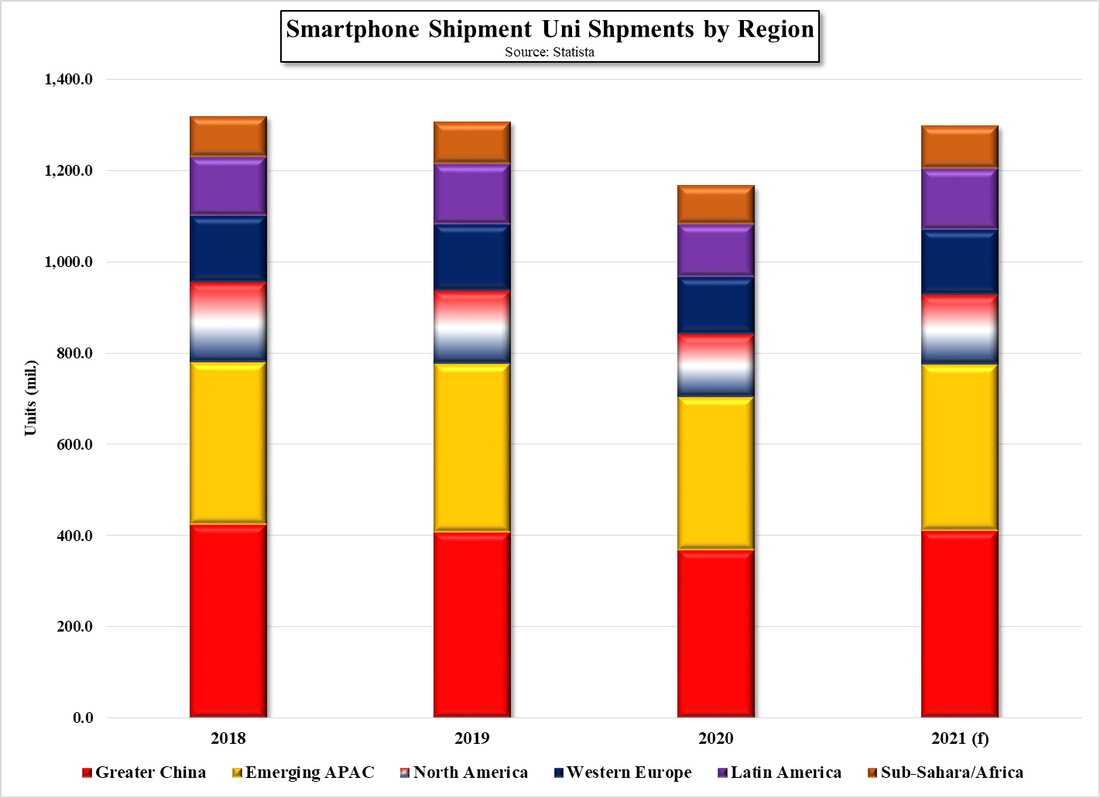

As the global smartphone market is struggling for growth, positioning production becomes more of a regional issue, while balancing labor costs and incentives to regional demand. Over the last few years (2018 – 2021 (f)) only three regions have shown positive CAGR, with Emerging APC the largest by just under 3x. This pushes smartphone producers to build out those regions, especially if labor costs are reasonable. Average salaries in India, Indonesia, and the Philippines are equal to or less than those in Vietnam and far below those in China, so while it might be expensive to play this game of musical chairs, it pays off in terms of production costs and country-wide tax incentives can compensate for some of the costs. COVID-19 is still a wild card that can become a factor, as it has in Vietnam, but over the next year it should become less of a factor as vaccines become available on a global basis.

RSS Feed

RSS Feed