Next!

What points to the fervor of such a statement is the fact that SK Hynix is currently in the process of moving its 8” foundry capacity from its plant in Cheongju, South Korea to Wuxi, China, a daunting task, and last year took a 49.8% stake in Key Foundry, a company formed to purchase Magnachip’s (MX) Fab 4 foundry last September. With the real shortages facing foundries that are not focused on 3, 5, and 7nm nodes, but on more mature processes, one would expect SK Hynix to have an interest in building out those nodes to fill customer demand, but side comments by SK Hynix’s Chairman seem to indicate that his interest lies in competing with Samsung and TSM at the 12” wafer level, which implies more aggressive nodes.

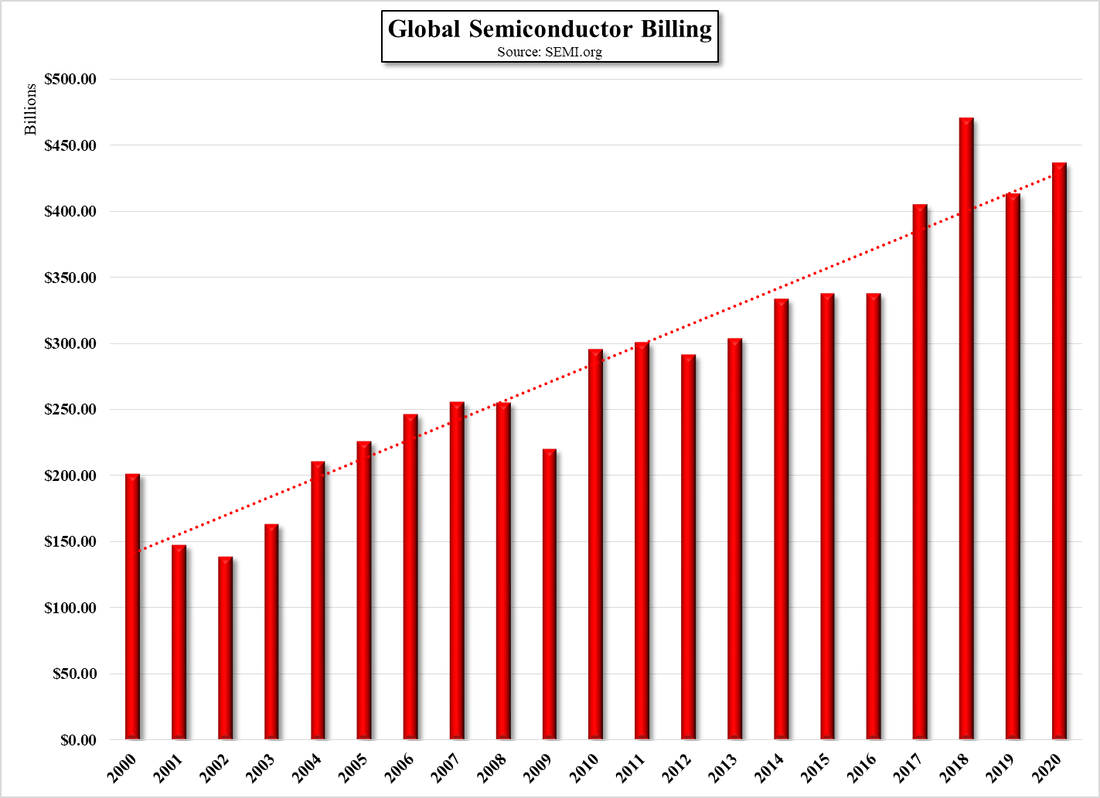

Given that the semiconductor industry as a whole is convinced that shortages will continue through 2021 and into 2022, we expect there will be even more talk of the need for additional capacity throughout the year, with those like SK Hynix, who have been focused on more narrow semiconductor production (in this case memory), looking to widen their customer base with foundry capacity outside of their traditional wheelhouse. Whether this proves to be a correct assessment in the long-term is far from clear and industry pundits citing a ‘new digital age’ and ‘this time is different’ is music to the ears of equipment vendors. That said, the semiconductor industry is cyclical, and while the trend line is certainly heading up, indicating that whatever undersupply or oversupply is the outcome of these moves toward new capacity across the industry, there will be times when the current enthusiasm will prove less then prescient. In the chart below, which represents semiconductor industry revenue over the last 20 years, 50% of those years have seen sales below trend line.

RSS Feed

RSS Feed