Notebooks – Musical Chairs

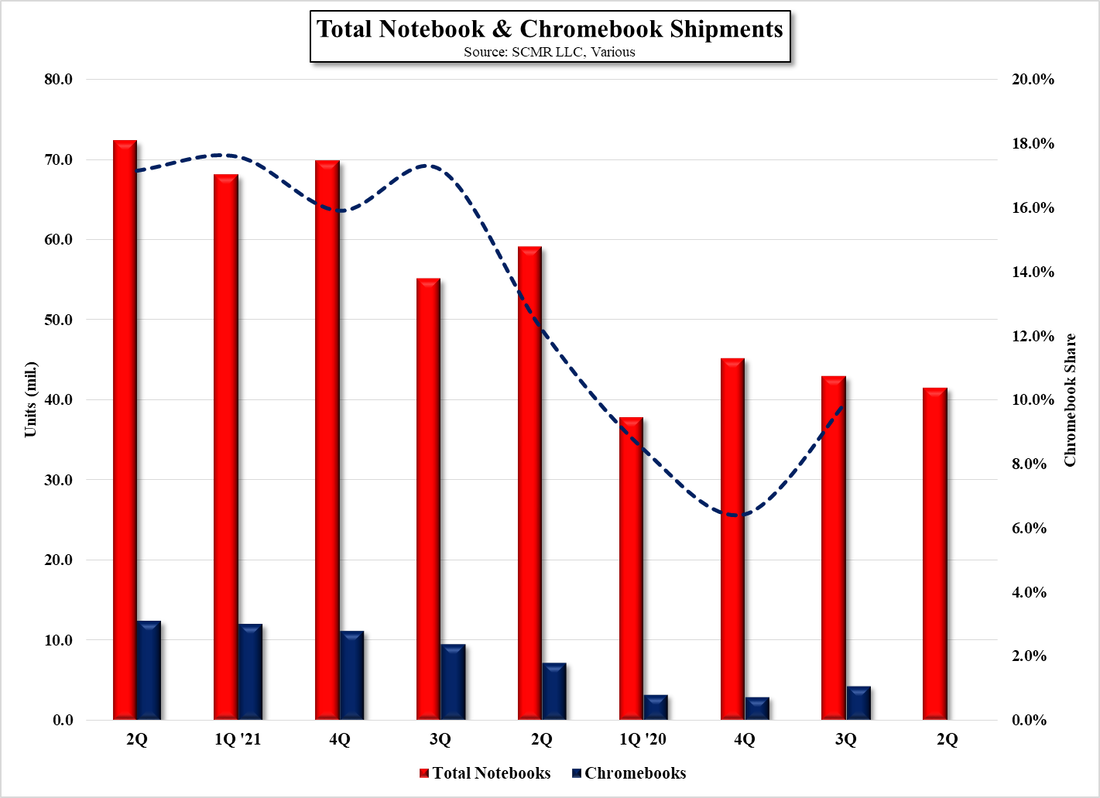

The recent price decreases seen for TV panels has begun to justify Samsung Display’s original large panel capacity reduction thesis and also helps to justify other panel producers’ decisions to increase capacity exposure to IT products, but along with that decision comes the higher risk toward IT panel pricing. Until recently that has not been an issue as IT panel prices continued to rise as TV panel prices declined, with continuing demand from brans, but two factors seem to be changing, both of which increase that risk further. Display driver shortages have been pushing brands to build IT panel inventory. Fear of a lack of product during the holiday season put brands in the position of paying up to get display module units, with targets based on the strong demand seen over the last year, but over the last two months demand seems to have weakened, first showing up as a slowdown in Chromebook shipments, and then as a broader slowdown in notebook demand.

There are some technical reasons for this slowdown as students begin to return to classrooms and remote schooling programs wind down, and display drivers have become more available, yet notebook panel shipments have continued to be strong, at least through 3Q. We expect that some of that 3Q IT order strength came from panel producers filling customer orders that had been delayed due to component shortages or had been under allocation, but hints from panel producers on 3Q calls that indicated a shift toward customers that supply IT products to corporate customers and away from those supplying retail, lead us to see a bit more concern about IT order patterns and there sustainability.

Typically (5 year average) the 4th quarter sees notebook panel shipments decline ~0.3% q/q but we have seen expectations for 4Q notebook panel shipments as low as -1.5%, and while we expect that might represent the extreme, anything significantly above the average would be troubling and would indicate potential notebook panel price weakness. At just under 34% of large panel quarterly unit volume, weaker notebook panel prices could jeopardize 4Q panel producer sales, especially if TV panel prices continue to decline. Notebook panel production plans are expected to be up between 15% and 19% in 2022, while recent expectations for notebook demand next year is for less than 1% unit volume growth. Panel producers always have the option of shifting production to monitors or back to TV panels if prices dictate, but it is beginning to look like a game of musical chairs.

RSS Feed

RSS Feed