Off the Cliff?

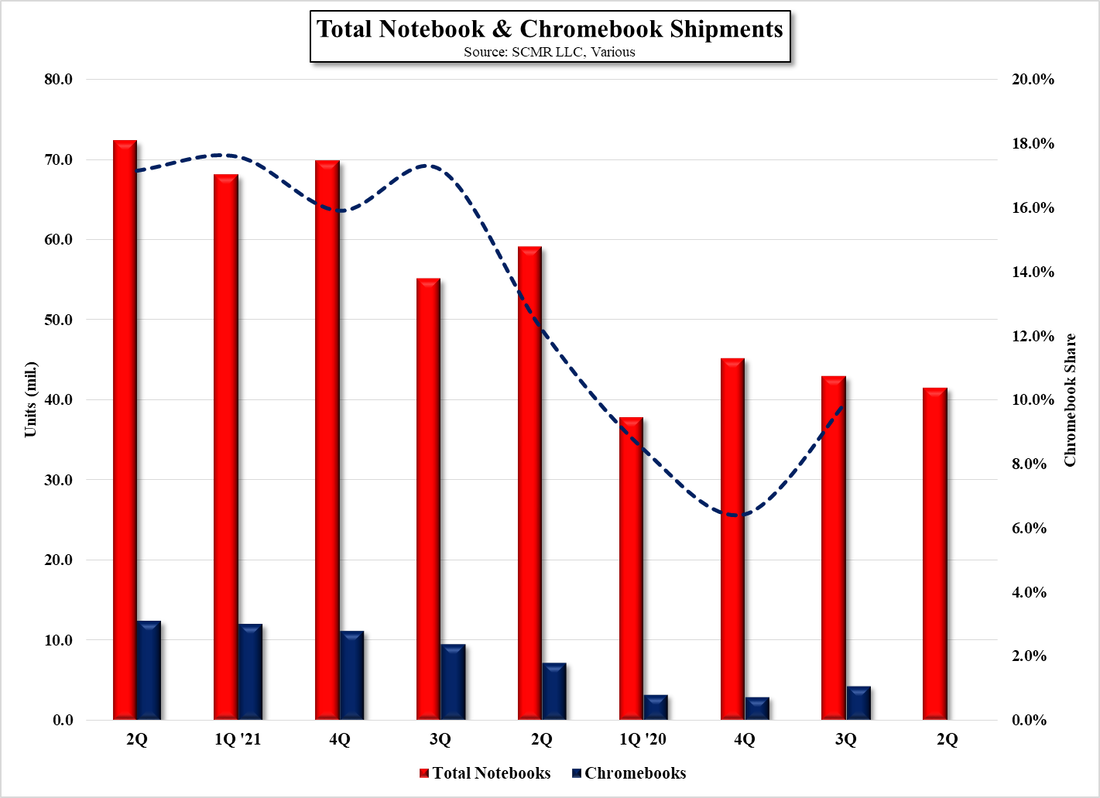

September is typically the strongest month (5 yr. avg.) for notebook panel sales, while March usually shows the biggest m/m sales gain, given that February typically records the lowest notebook panel sales month of the year. That leaves April sales typically down 8.8% m/m, as CE ‘March Madness’ ends after the Chinese holiday in February, typically the worst m/m decline of the year. What all of this is leading to is that one data source, Digitimes Research, is reporting that the top 5 notebook brands (excluding Apple) saw a 30% drop in m/m notebook sales in April, more than 3x the average and greater than any w/w April decline in notebook panel sales since at least 2011. DT cited strong short-term orders in March for the large April decline, but also noted ‘a lack of confidence in end demand’ and relatively high inventories in the retail channel.

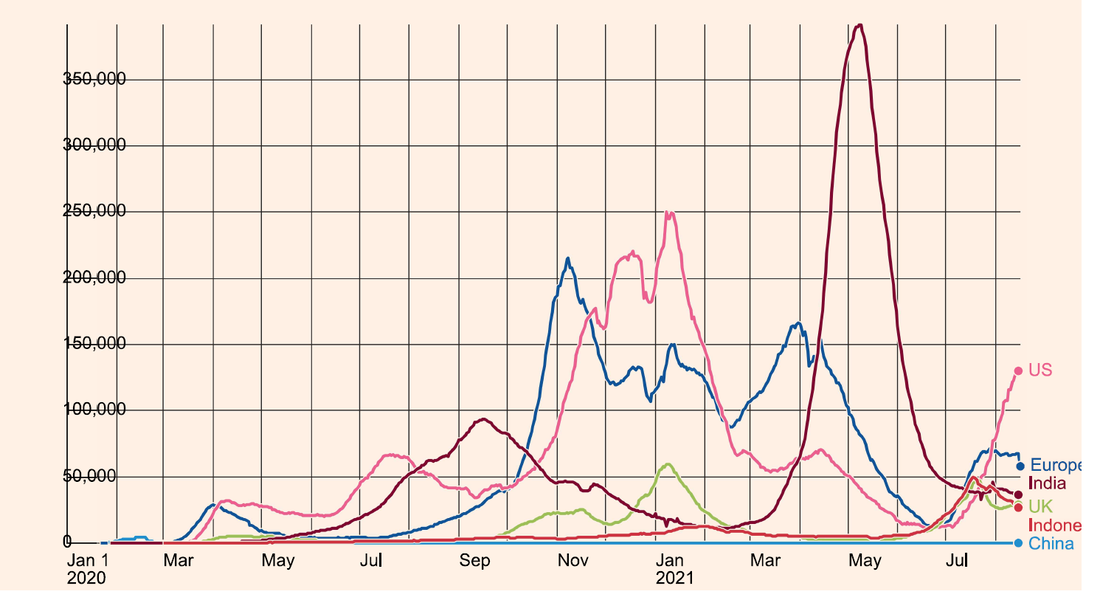

The DT data is only one source, and one that tends to be a bit on the aggressive side, but it was so far out of line with the tacit ‘gradual improvement’ scenario promoted by the industry, it is worthy of mention, although we are not surprised at the decline, only the magnitude as there has been little real change in demand after the category saw COVID pandemic demand peak in November of ‘2021. While notebook panel sales do not always track against retail sales, the implication of a 30% decline in April’s notebook panel shipments would bring notebook panel shipments to a point slightly lower than January shipments, which were only slightly higher than panel shipments in February of 2020, the first month of the COVID pandemic, which would not be a good omen for the gradual recovery scenario, at least for notebooks., which last year represented 26.95% of panel shipment unit volume.

Before taking possible scenarios for the remainder of the year any further, we need to confirm that data with other sources, which tend to show up toward the end of the month, so we will wait to see if other sources confirm the data drop. The top five notebook brands (excluding Apple, who would be #4 in 2022) are Lenovo (992.HK), Dell (DELL), HP (HPE), Acer (2353.TT), and Asus (2357.TT).

RSS Feed

RSS Feed