OLED Material Growth

There is some question about the materials that are included in OLED material sales data, and without the dataset, it is difficult to make sure they are what they say they are, especially when translations are concerned, but we present the data below as a reference point for better understanding the companies involved and the growth of the OLED industry itself.

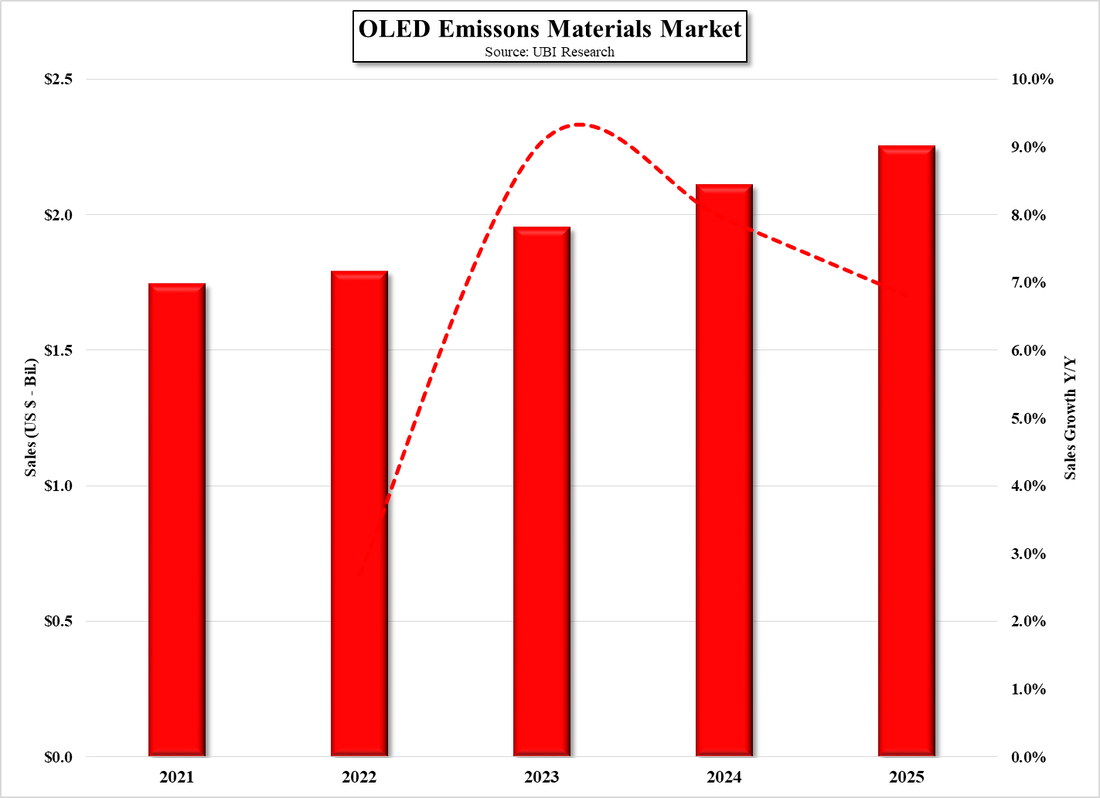

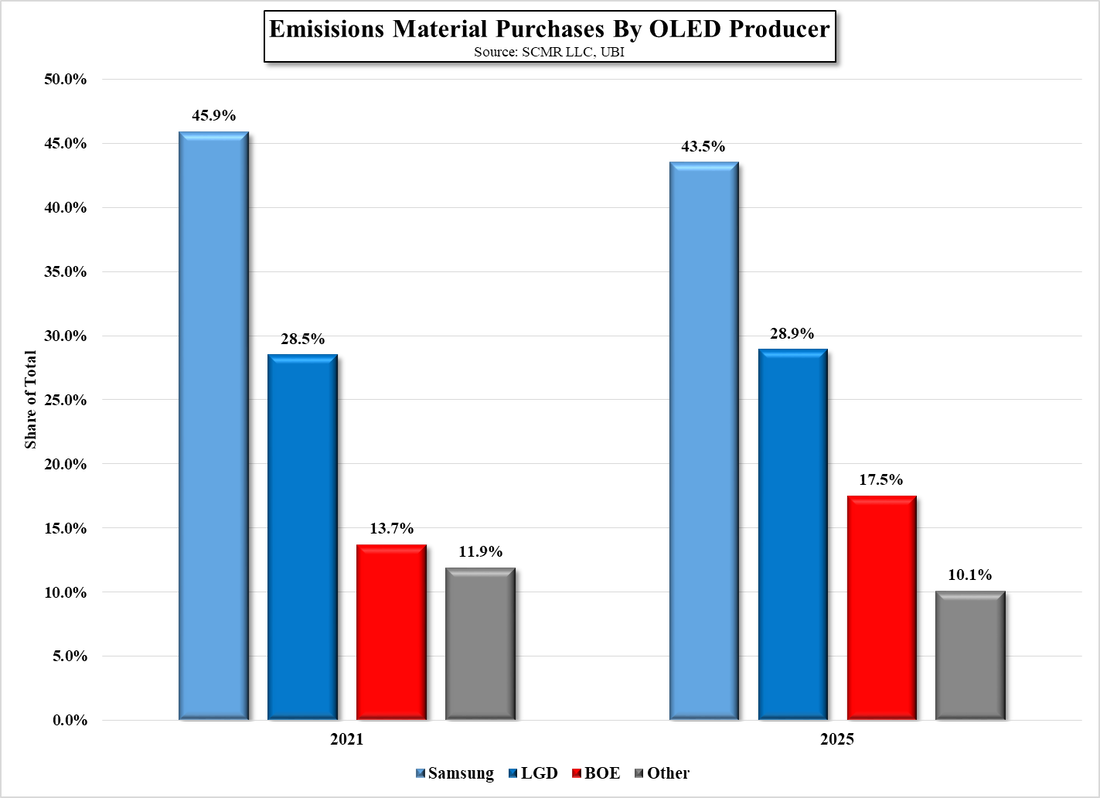

UBI expects the OLED emissive materials market to expand from $1.75b this year to $2.25b in 2025, or 29.1%, with y/y growth in 2022 through 2025 of 2.7%, 9.1%, 7.9%, and 6.8% respectively. While China will certainly increase their share of these materials, with BOE (200725.CH) leading the way, Samsung Display (pvt) and LG Display (LPL) combined will still be the largest purchasers, and as a country will purchase over 70% of total sales.. UBI goes further in saying that RGB OLED materials, essentially those used in all OLED displays other than OLED TVs will make up 78% of total OLED emission material purchases in 2025, down from 81.4% this year, while WRGB OLED emission materials, those used in OLED TVs, will increase from 18.3% currently, to 20.4% in 2025.

Again, without knowing exactly what materials and categories of materials are contained in the numbers, it is difficult to match them up with actual company results in order to derive the amount of actual emissive material sold and the portion of the total that are other stack materials. Universal Display, who through control of a considerable amount of OLED IP, owns 2/3 of the direct emission material RGB market (red and green) and half of the direct emission WOLED market yellow/green), is expected to generate over $300m in material sales this year. Based on our estimate of UDC’s share and UBI’s total sales estimate, UDC should see growth of at least ~29% in true emissive material sales during the period between 2021 and 2025, which we believe understates the potential growth for true emissive materials under the UBI scenario.

These are back-of-the-envelope estimates, but we note that all the way back in 2014 UBI made some similar forecasts, projecting OLED emission materials to grow from $540m in 2015 to $2.5b in 2020, and while we almost always look at longer-term estimates with skepticism, we expect they might have understated their case currently after overstating it years ago.

As Chinese panel producers did with LCD, expanding capacity to the point at which they are the dominant supplier and low cost producer, they will likely continue to do with small panel OLED, and the fact that BOE is currently ramping two Gen 6 OLED fabs and building out a 3rd, points to that conclusion. Korean producers, particularly Samsung Display, have the advantage of production experience, which gives them a lead in advanced OLED technologies, but they did have the same lead in LCD, and their exit from the large panel LCD space is a matter of record. Nothing happens overnight and there are always bumps along the way, but the investment already made in OLED panel production will keep it as a viable and growing display technology for years to come.

RSS Feed

RSS Feed