OLED On the Seas

Unfortunately the OLED lighting business did not develop as quickly as expected, and along with a number of other early OLED lighting company projects (Panasonic (6752.JP), Philips (PHG), GE (GE), OSRAM (OSR.GR), etc.) the company pulled the plug on the OLED lighting business in early 2019, converting production to automotive OLED development. Since then the OLED lighting world has been a quieter one, with a few companies still producing OLED lighting panels, particularly OLEDWorks (pvt), Kaneka (4118.JP), Konica Minolta (4902.JP), and Lumiotec (7717.JP) while a number of lighting manufacturers, particularly Acuity Brands (AYI) incorporate OLED lighting offerings in their broad lighting product lines.

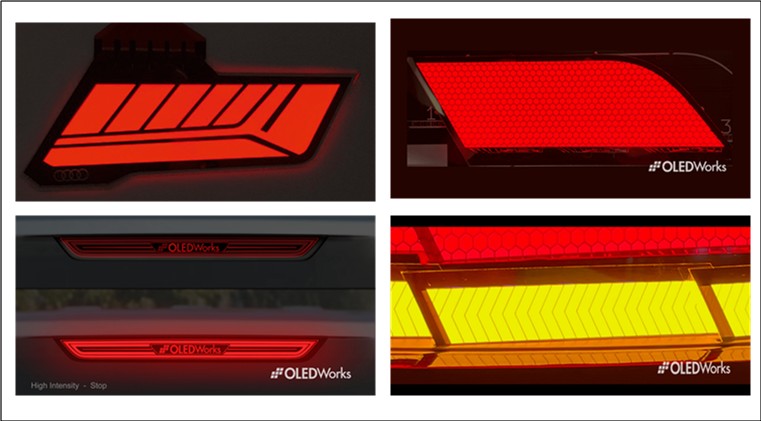

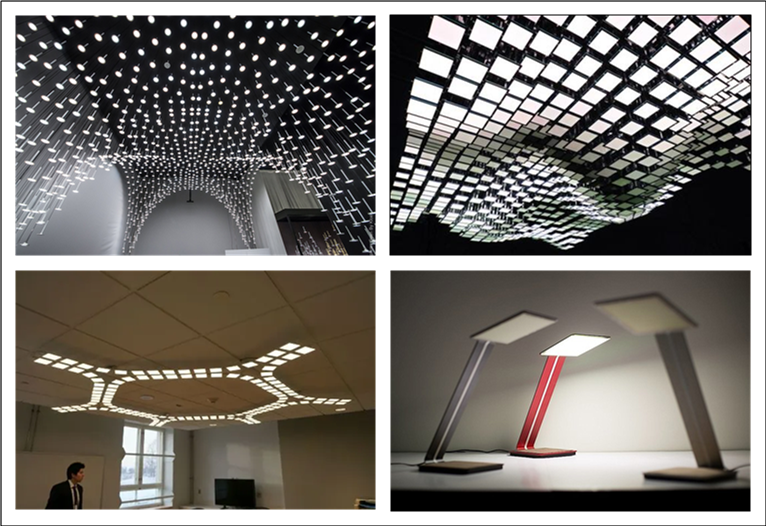

OLED lighting has been used a bit more extensively in the automotive space given its ability to be shaped, its light weight, a wide viewing angle, and its broad surface as opposed to a point light source, which give it an edge over incandescent and LED tail and signal lighting in high-end automotive taillight and signaling applications and makes it able to be ‘programmable’ down to the pixel level, allowing for truly customizable lighting patterns, as seen below, and OLED lighting has been used in a wide variety of architectural applications and commercial products.

That said, OLED lighting has faced a number of issues since its first lighting applications, with both cost and lifetime being the big stumbling blocks to mass adoption, and that has pushed the technology into more of a niche mode that it rightly deserves. Cost is still an issue as an OLED light source is more expensive than an LED light source, but when placed in a package (luminaire), where an LED luminaire would need a diffuser, heat sinks, and other components, the cost of OLED lighting becomes more comparable as it needs little else other than a driver to operate. While the lifetime issue has been a problem in the past, OLED lighting panel producers have worked around that issue by developing OLED lighting panels with multiple OLED ‘stacks’ (6 for some of OLEDWorks panels), that increase the panel lifetime to over 100,000 hours, which is more than comparable to LED lighting.

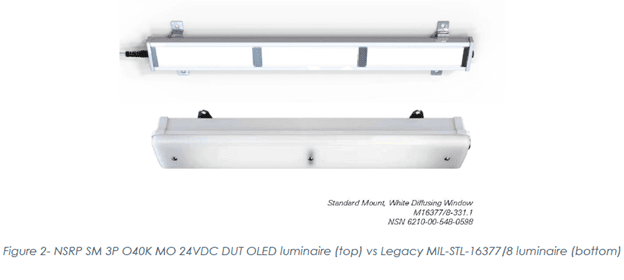

While all of the improvements in OLED lighting, and its innate abilities and characteristics should give it some momentum in the lighting world, there is such an infrastructure built around LED lighting and so little for OLED lighting that the technology tends to be used for lighting applications that are specific to its unusual characteristics. One such unusual application we found is a test of OLED lighting on the USS William Lawrence, a Guided Missile Destroyer. Typical Navy lighting is a two tube fluorescent fixture which operates on 120 Volt AC, which requires chassis bonding and grounding to prevent shock. OLED lighting operates on low-voltage DC current which does not have the potential power losses across long distances onboard and can be worked on without cutting power. More important is the fact that equivalent OLED lighting panels are 75% smaller and weigh 50% less than MIL Spec lighting, and are able to withstand the same vibration and shock tests as their fluorescent counterparts. OLED shipboard lighting’s smaller size gives it an advantage in narrow compartments and passageways and can more directly conform to bulkheads, increasing clearance, and the fact that it is cool to the touch adds to its advantage over fluorescent and LED equivalents, which generate more heat that must be eliminated.

The OLED lighting project on the USS William Lawrence has been jointly developed by OLEDWorks, a Rochester, NY company, and Atlanta based Acuity Brands in order to test the viability of OLED shipboard lighting, but the bottom line for the project is the relative cost of OLED lighting when compared to typical MIL Spec. While we have not seen the data, the companies involved have calculated that when including all of the advantages mentioned above, installation and maintenance, spare storage, and weight considerations, the cost of OLED lighting is 15% less than existing fixtures and saves 9 tons of weight.

The only issue that remains is the OLED panels tested in the lab fell short of the candlepower requirements by between 10% and 20% although in physical mock-up trials for offices, workshops and compartments the panels met specifications, and in areas that needed red or amber lighting OLED panels provided the same glare-free light which can be included in a white light OLED fixture and easily switched from white to color as opposed to fluorescents that would need separate fixtures. OLED light panel producers expect that they will be able to increase the light output for shipboard lighting within the next year or so, making OLED lighting an effective replacement for shipboard fluorescent lighting, and while military applications require an extensive qualification process, there are few applications that have a longer tail, which gives OLED lighting producers hope that the overall OLED lighting market will develop from niche applications to a large scale production market over the next few years.

While competing with LED lighting in the broad illumination market is a difficult game, such specialized applications can become the lifeblood of an industry and can provide the demand needed to expand OLED lighting and reduce costs. OLED lighting is still a niche product but as the OLED display market continues to expand, the OLED lighting market will take advantage of some of those production techniques and processes and adopt others that are more specific to lighting, such as roll-to-roll deposition, new OLED materials, or more efficient light extraction methodologies. Given the ability of OLED lighting to conform to any shape OLED lighting panels represent a transformative approach to traditional lighting and as costs are reduced should find its way into non-traditional lighting solutions where architecture become lighting.

RSS Feed

RSS Feed