OLED TV Update

There are many good points relative to large panel OLED displays, and a number of issues, but from the standpoint of overall picture quality, they are still considered the pinnacle of TV commercial technology. OLED TVs are more expensive than their LCD brethren, and do face direct and indirect competition from quantum dots and mini-LED technologies, but at least for now, we look at OLED TVs as Wagyu beef against the skirt steak of most LCD TVs. As LG Display (LPL) is the supplier of almost all large panel OLED displays and LG Electronics (066570.KS) is the premier OLED brand, we look at the company’s current line of OLED TVs, which were announced in late March to see how pricing has changed so far this year.

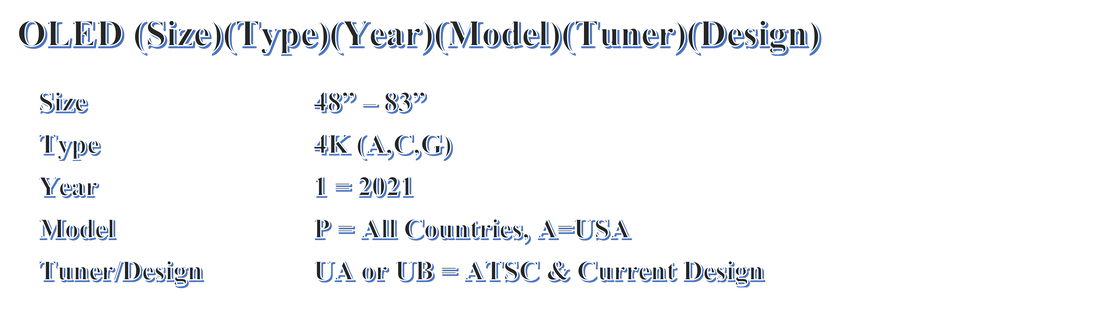

While there are many LG OLED TVs available on Amazon (AMZN) and sites like Best Buy (BBY) or Costco (COST), we are only looking at the current year’s models, all of which will have a model format that looks like this:

As noted, because LG Display is essentially the only producer of OLED TV panels, OLED TV panel pricing sees far less price competition than with LCD TV panels, however over the last few years, as LG Display increased production and consumers became familiar with OLED TVs, there has been a bit more sensitivity toward set and panel pricing., more a result of improvements in LCD technology rather than direct OLED TV competition. LG Display has also made improvements in its production methodology and built out capacity at its Guangzhou, China OLED fab, which has helped them to lower costs. How much of that savings gets passed on to customers remains within LGD, but OLED TV set prices have certainly declined over the last few years as the number of sizes increases (both smaller and larger).

LG Display, likely at the request of LGE, introduced 48” OLED TVs last year, creating a lower price point that has attracted consumers by lowering the OLED TV entry bar to ~$1,200, with short-term discounts by some retailers bringing the price down to just under $1,000, with 48” 4K TVs ranging in price from ~$1,200 to as low as $332 for comparison. This has caused gamers to look at 4K OLED TVs as potential oversized monitors, with LG promising to release an even smaller (42”) OLED TV specially designed for gamers later this year. However it looks like LG has postponed that release until 2022 to avoid it getting lost among sets being released for the 2021 holidays and is now expected to preview the new size at CES next January. LG already includes a few features that gamers desire, such as 120 Hz refresh rate, Dolby (DLB) Vision Gaming, but will add direct support for gaming consoles to the 42” model.

RSS Feed

RSS Feed