Panel Prices – “Elevator Out of Service”

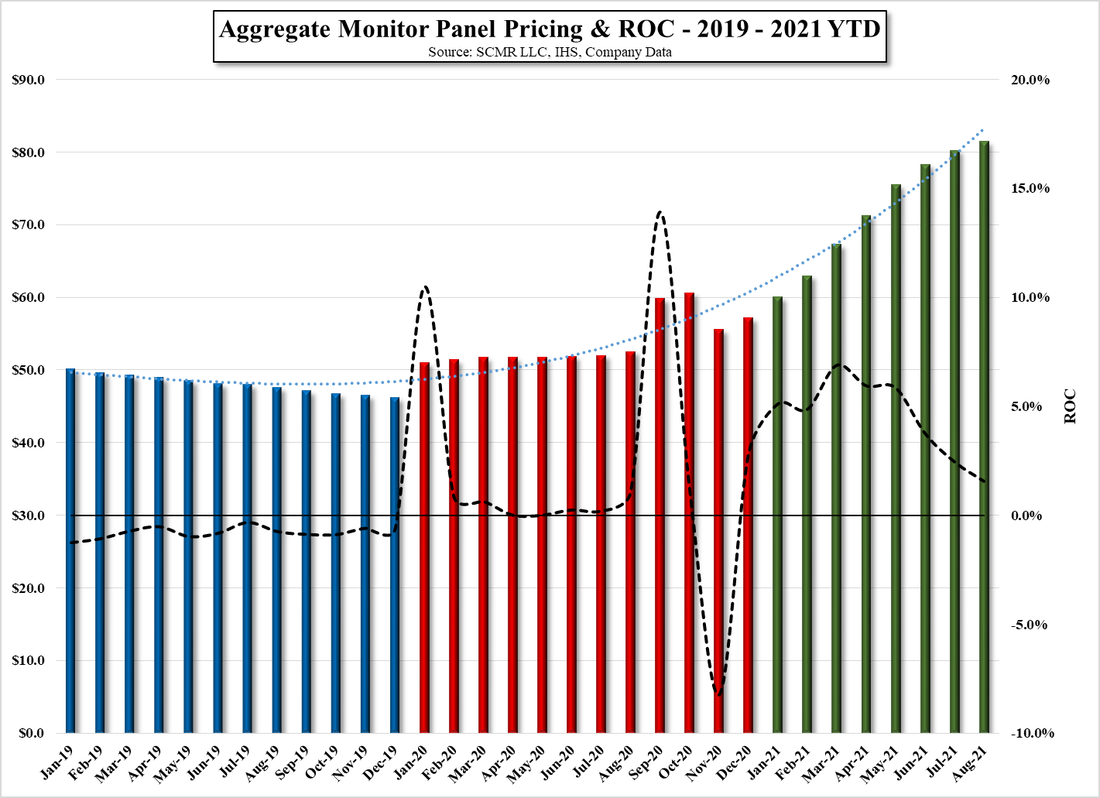

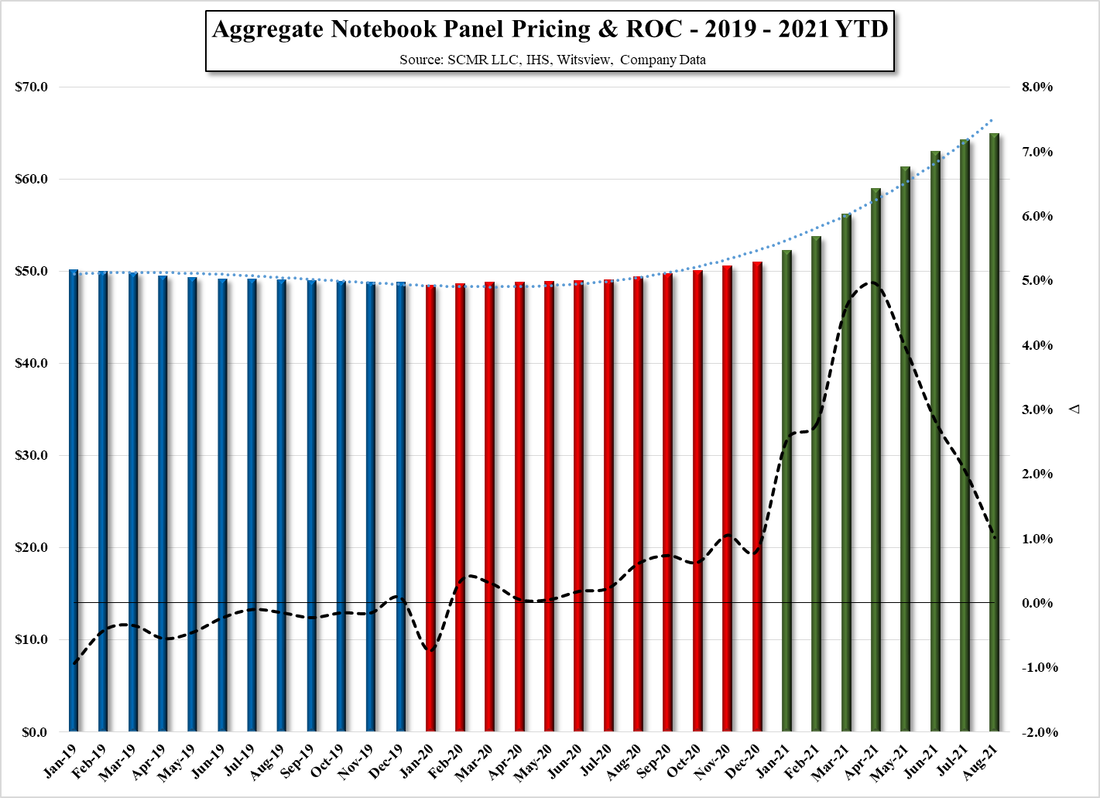

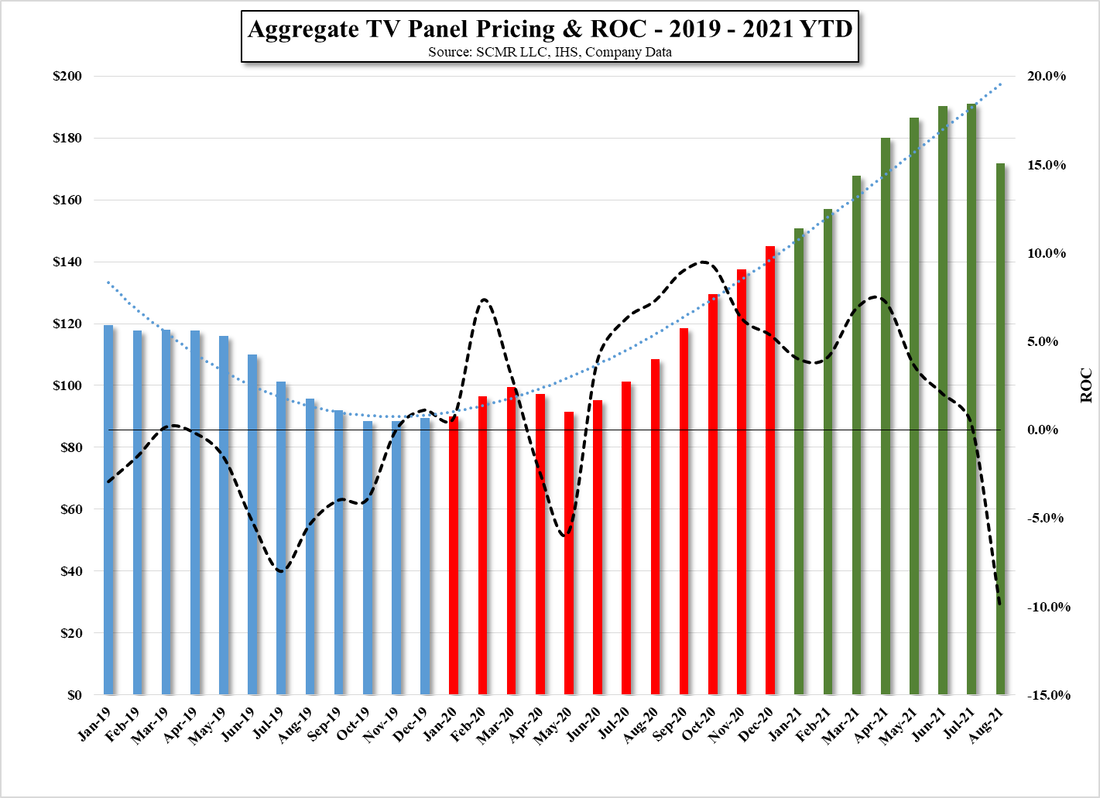

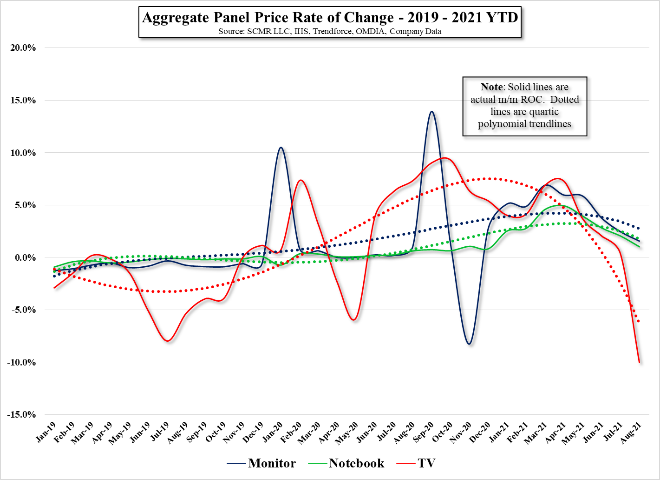

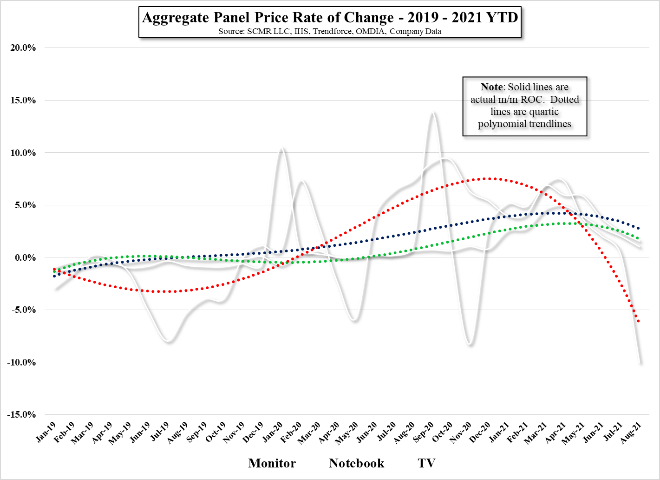

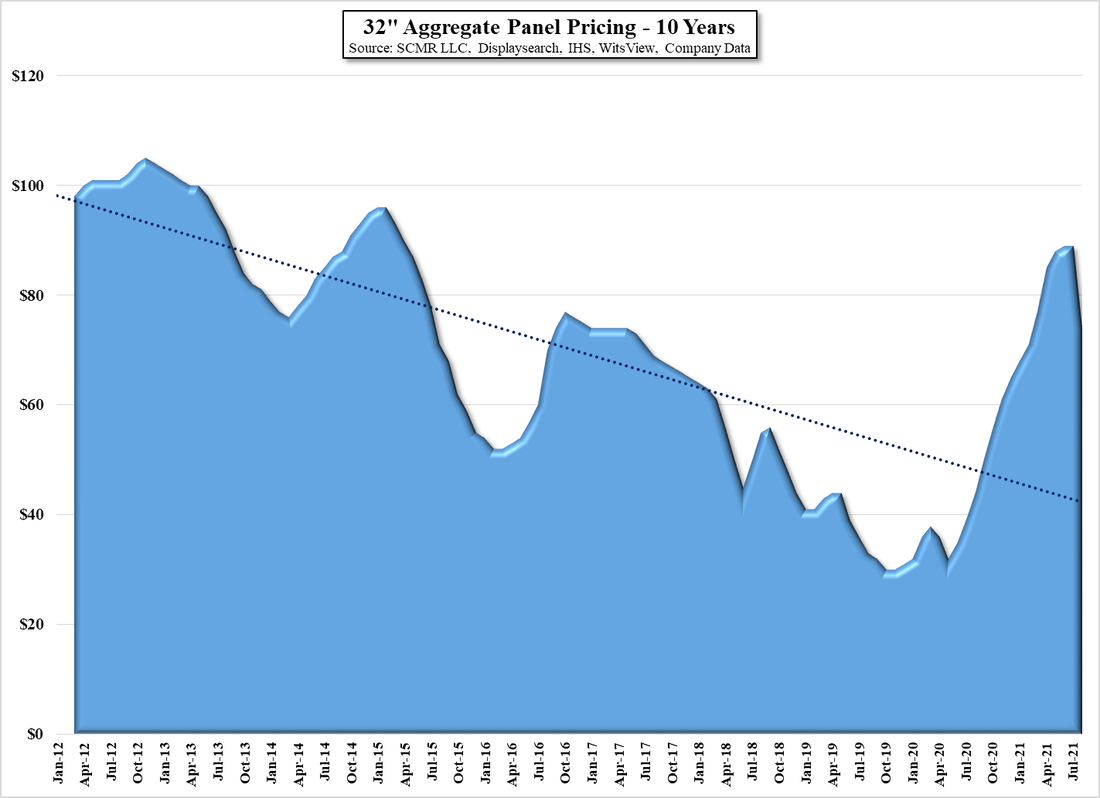

Our expectations for August were for relatively modest increases in IT product panel prices (Monitors & Notebooks), while TV panel prices were a bit more bifurcated, with the most price pressure on smaller TV panels, while demand for larger TV panels was a bit better and could see some increases, although the aggregate was down. We did note that panel producers have been shifting capacity away from TV panel production toward IT products, the leverage toward production of those panels has certainly been favorable for LCD panel producers, but at some point that leverage will work against panel producers should demand slow in that segment, more a matter of ‘when’ than ‘if’.

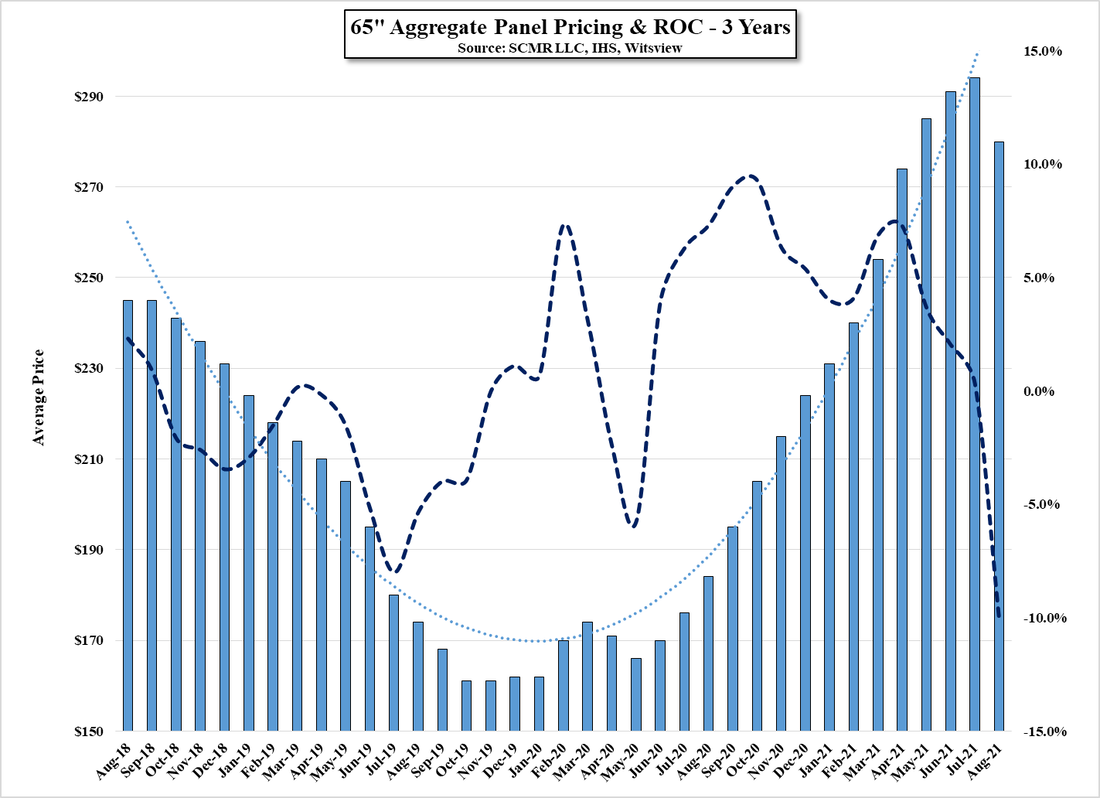

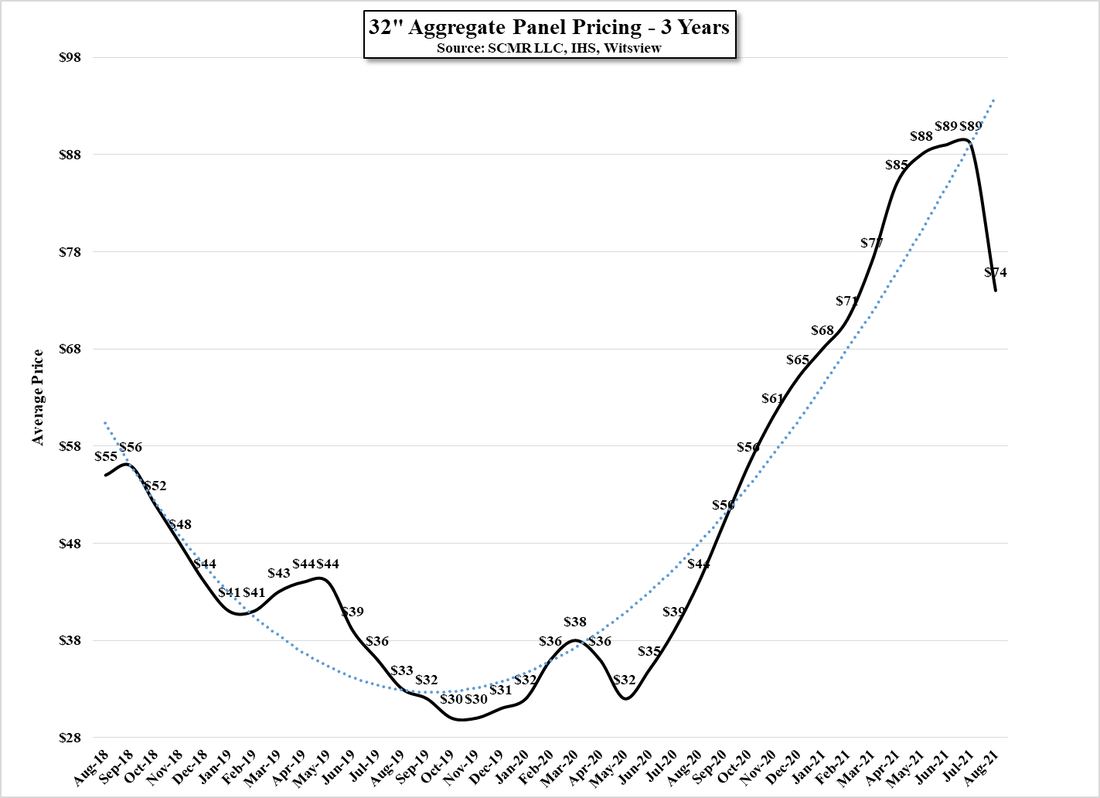

That was not the case in August for IT products, panel prices rose again, but it was the case for TV panels who saw the first aggregate TV panel price drop since May 2020, with prices down 10.1%. It is difficult to pinpoint which of the potential factors caused the greatest impact to TV panel prices, but we expect all of the contributing factors that we have mentioned in the past, including component shortages, higher logistics costs, and the realization that higher overall TV set prices would stifle consumer demand, finally became reality for TV set producers and their expectations for 3Q and the holiday season began to wither on the vine. In the case of TV panel prices, the withering was not just for smaller TV panel sizes but across the board and far greater than even our modestly pessimistic view had expected.

RSS Feed

RSS Feed