Panel Prices –September – A Ray of Sunshine or False Hope?

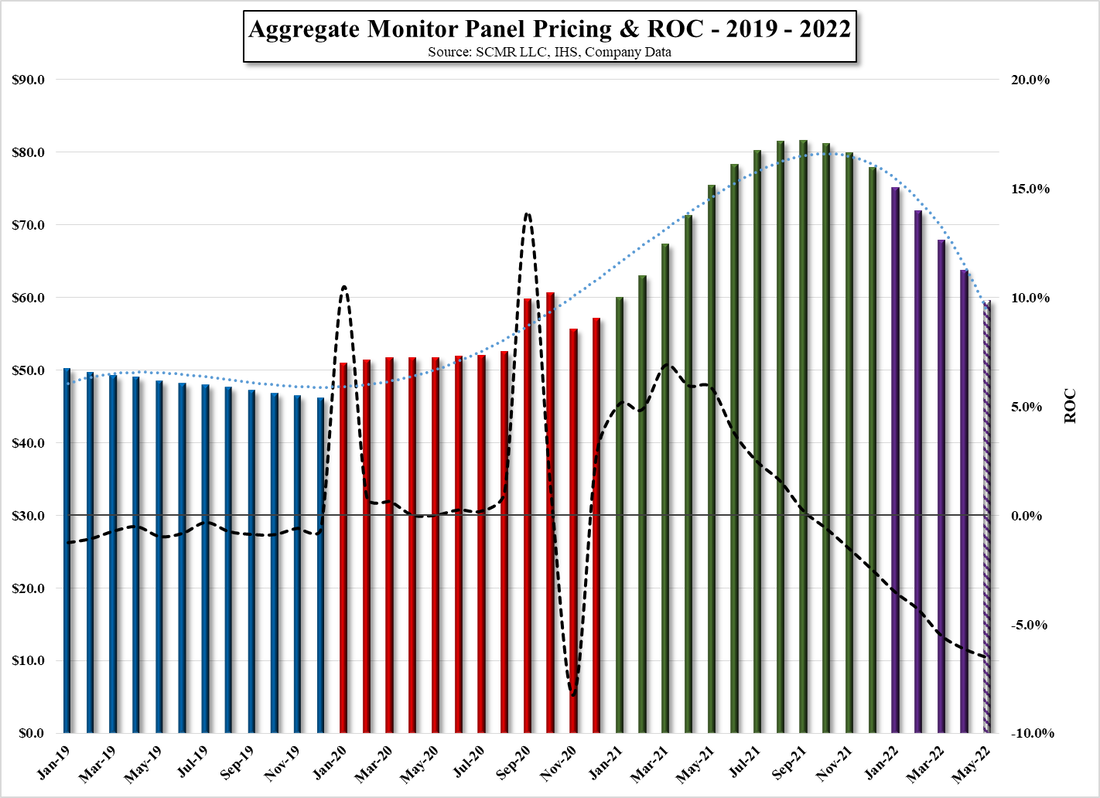

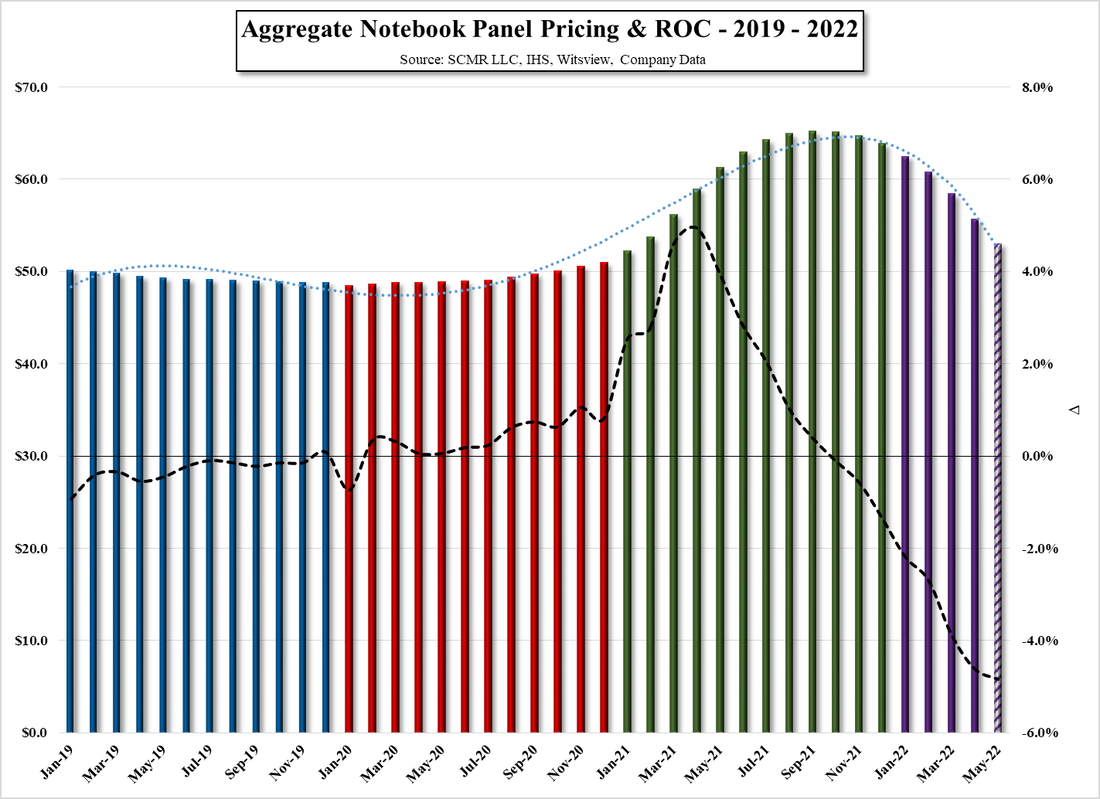

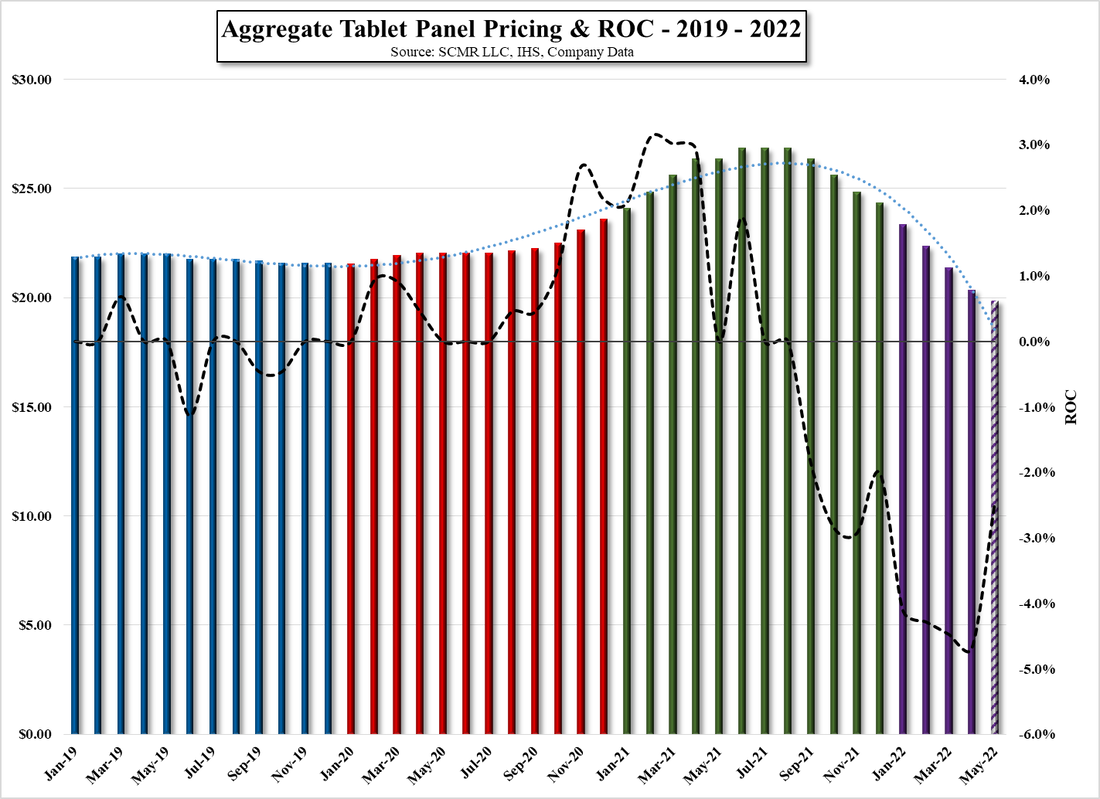

There has been little change in the balance between buyers and sellers with buyers certainly having the upper hand, while sellers are trying, mostly unsuccessfully, to keep prices from falling further. We expect there is some panel buying for Black Friday and the Chinese 11/11 holiday, but we temper our optimism with the global macro environment, which is doing little to stimulate consumer demand. Given that panel prices are at lows and that there has been some relief on transportation and component costs, there is the possibility that as lower utilization rates allow existing panel inventory to be sold, there will be room for lower priced products to enter the market for the holidays, which could stimulate some bargain hunting, but we are still would not raise our expectations substantially for the remainder of the year as there remain considerable negatives on the horizon.

All in, September was slightly better than expected, mostly in the TV panel space, as it peaked and started its decline earlier than other categories. Our modest sense of optimism, at least for October, is reflected in our October forecast, which portends a better (less negative) month across almost all categories. We hope our optimism extends more than one month but we take it one day/week/month at a time.

RSS Feed

RSS Feed