Panel Pricing – April

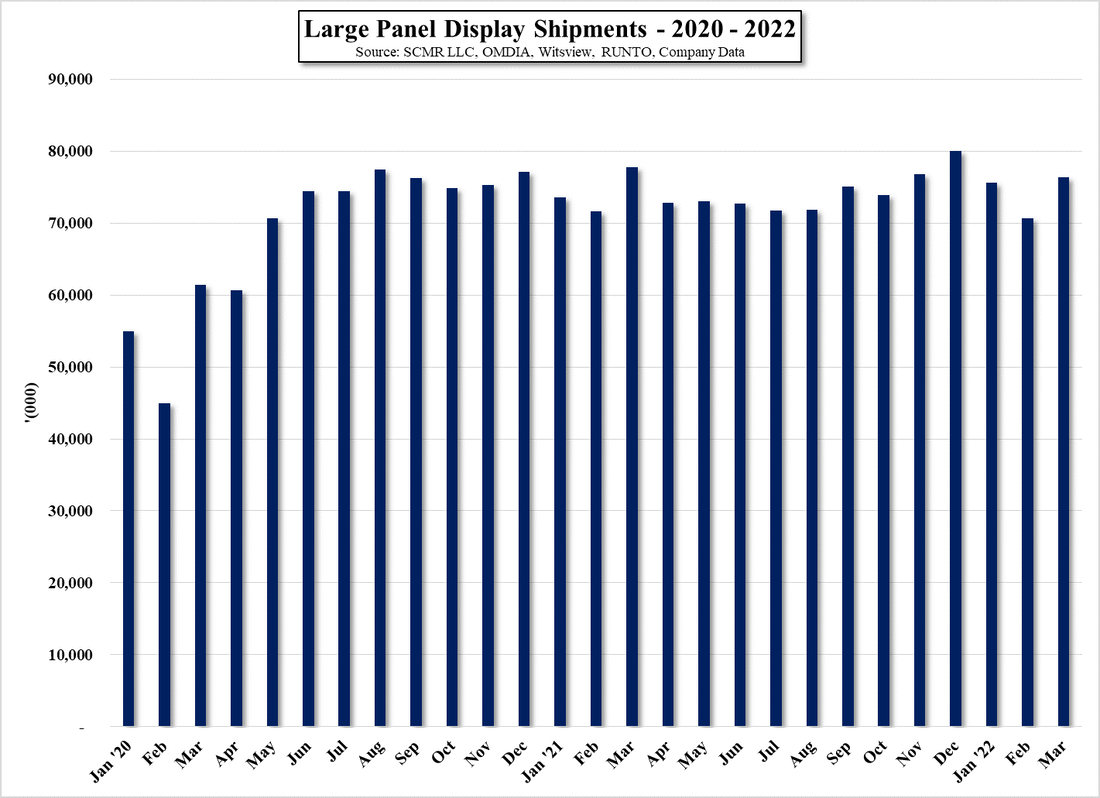

The only area where there seems to be some actual demand, not surprisingly, is the server space, where monitors are a necessary adjunct. However many monitor panel producers are still losing money on monitor panels and are reducing production whenever possible, leaving Chinese producers to pick up the slack. This has led to slight monitor price increases but was offset by weak pricing for notebooks and TVs, where tariff issues continue to keep brand demand weak. Pricing pressure overall has been modest, but brands will be looking for some panel price concessions as they absorb higher tariff costs, and that means both up and down the supply chain. Whether panel producers are willing to share in some of the tariff pain is still an open question, but at some point, the cost of components, both at the panel level and the module level, will add to their cost burden as it has for brand level products.

We expect addition stocking pull-ins as we get closer to the end of June, which, as we have previously noted, sets a poor tone for the 3rd and 4th quarters, typically the better half of the year for the CE space. The only hope right now is that those consumers who did not jump in and buy before the last tariff announcements might now feel the urge before July, assuming the potential for higher prices. We believe that most CE brands are looking to share tariff price increases with the supply chain, but those negotiations are ongoing and will have to account for the potential for additional tariffs in July, making price negotiations even more difficult than usual.

That said, we believe that while China will still remain a tariff focus, we expect most of the broad ‘reciprocal’ tariffs recently proposed will not be put into effect as promises of trade balancing are made, but whether those promises are fulfilled remains questionable. Right now, we expect panel prices to remain relatively flat for May as most take a wait and see approach to near-term planning.

RSS Feed

RSS Feed