Panel Pricing Paralysis

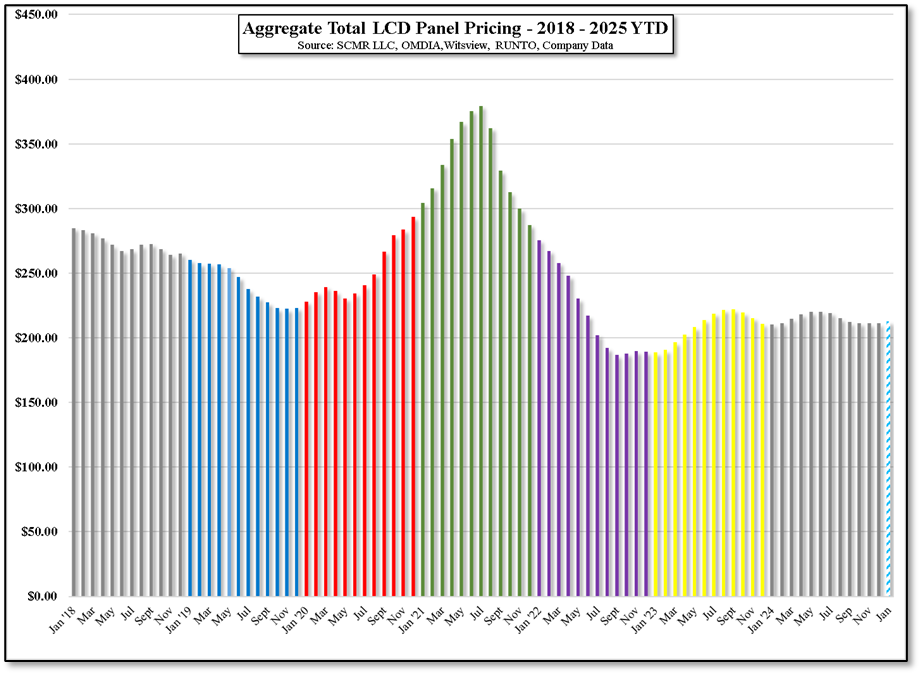

It is difficult to predict how panel prices will move in the 1st and possibly the 2nd quarters of this year as the potential for tariff changes that will affect demand in the US for CE products is, at this point, a bigger factor than the outlook for general CE product demand in the US. With only two LCD large panel producers outside of China, onerous tariffs on TV sets will determine whether Chinese panel producers will be profitable this year, and we expect they will have little choice but to raise set prices to offset additional tariffs. Consumers will see those landed price increases as inflationary, making it difficult to justify replacement cycle purchases, but the scale of the potential tariff changes is really the key as margins on LCD panels, particularly from Chinese producers are quite thin. Its just a waiting game until the big man makes up his mind.

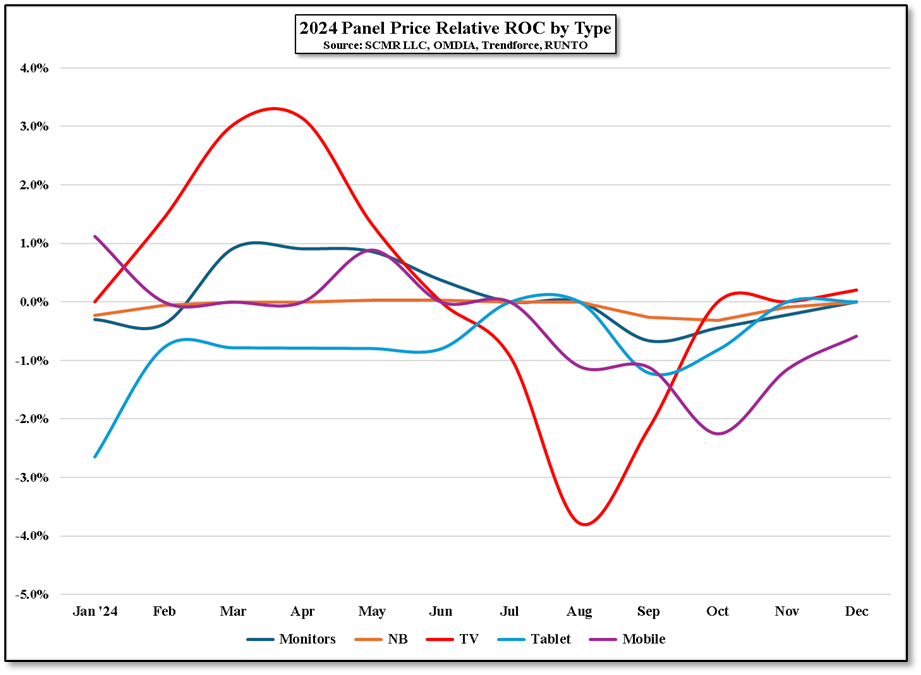

[1] Figure 1 zeros all panel prices at the end of 2023 and shows the relative m/m movements in each type of panel

RSS Feed

RSS Feed