Panel Pricing Predictions

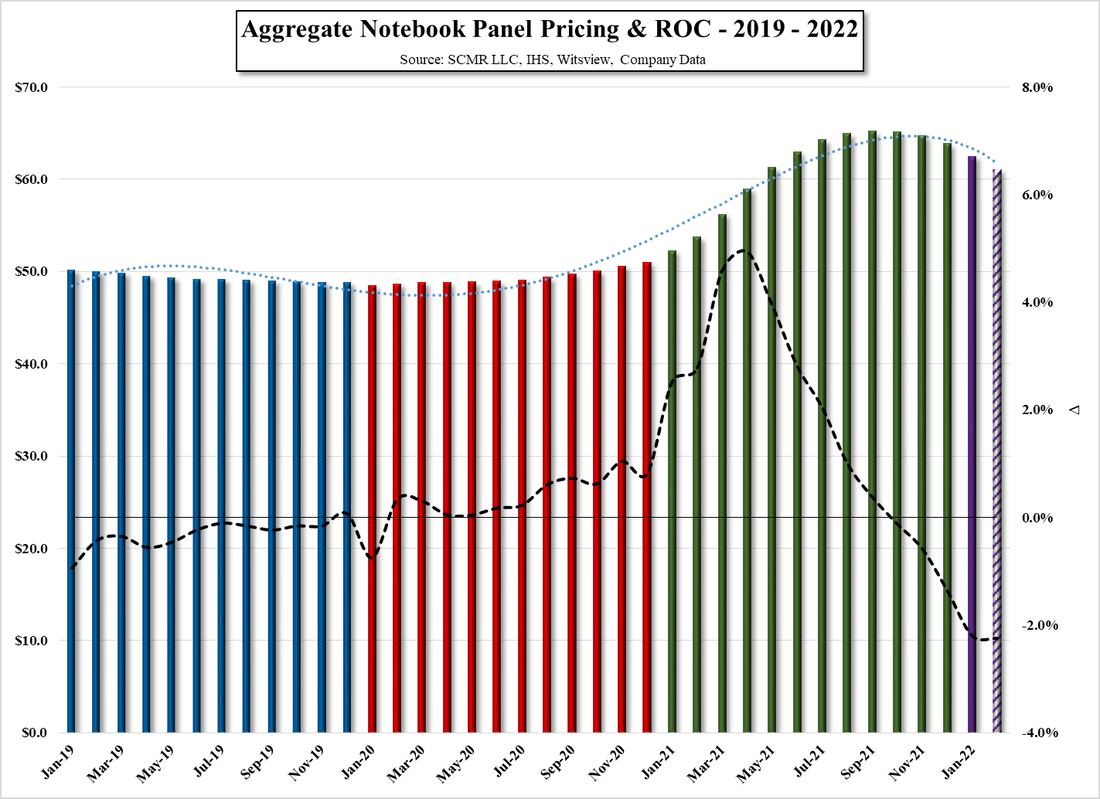

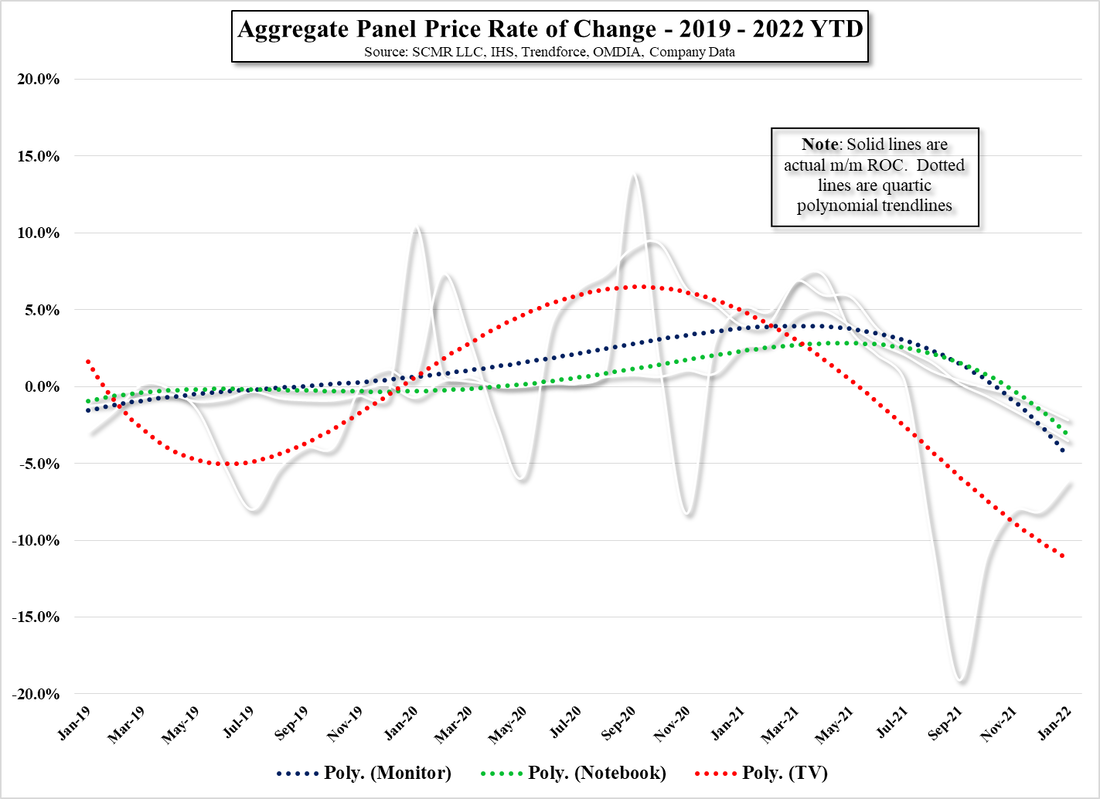

That said, as we have noted previously, TV panel prices began the downward pricing cycle in July of 2021 and have been declining precipitously since, while IT panel (Notebook, Monitor, Tablet) panel prices continued to rise. This pushed panel producers to accelerate a move from TV panel production to IT panel production to maintain margins, but that ‘lemming-like’ move also has consequences, that of oversupply, and IT panel prices have also been on the decline since last July, albeit at a much slower pace than TV panels. There are however resistance points when it comes to panel pricing, at that point is cash cost, at which point the producer has to decide whether to take an order that will generate little or no gross margin. Although cash cost varies with each producer, on a general basis the last time TV panels reach cash cost across the industry was in September of 2019, and since then there has been the usual cost reductions that panel producers work toward each year, along with both general inflation and the effects of component shortages, which we expect nets out as a panel cash cost a bit above the 2019 level.

The industry usually looks at the approach of cash costs for a particular panel type as the point at which panel prices stop falling, and rightly so in many cases as taking on money losing production tends to be done only when it is necessary to fulfill a commitment to a large customer, and with TV panel prices nearing cash costs, expectations are that prices will stop falling. This hope is fueled by the fact that there is less TV panel production than a year ago (the shift to IT), which tightens the market a bit, but there is also that balance between buyers (TV set producers) and sellers (panel producers), which was heavily in favor of panel producers until last July, forcing set manufacturers to eat the higher cost or raise prices and lose consumers. Historically, such a shift takes time to reset and has a tendency to encourage panel buyers to keep pushing for lower prices, even when they know they ‘sense’ that panel producers are hurting, and panel producers are also both competing with others and are want to keep as much of the fab utilized for as long as possible, so while cash cost levels are an indicator that TV panel prices ‘should’ stop falling, that can be a simplistic look at a complex equation.

But, more important currently, given the transition mentioned above, are IT panel prices, as the IT production concentration of many panel producers is weighted toward such panel products. This makes the effect of IT panel pricing more sensitive to the display business than might normally be the case, and the recent slowdown in demand, as COVID-19 vaccines allow for some semblance of normality, has pressured IT panel prices. We have seen very recent trade press headlines indicating that IT panel prices in February are falling faster than TV panel prices, and while that might be attention grabbing, we went back to our data to see if such was really the case.

Aside from the headlines, we note that panel price estimates vary across a number of sources, and we use averages whenever possible. We also deal with variations in the type of panel, which can affect price estimates, and we caution that in most cases we do not have sample sizes from sources, but here’s what we found. Expectations for February TV panel pricing, sort of an ‘average of averages’ across sizes, indicated a decline in February of 3.0% while that same ‘average of averages’ for IT panels estimates a decline of 3.2% for February, so technically the headlines are correct in that IT panel prices in February are declining faster than TV panel prices. That said, the question is which is worse, TV panel price declines that could put some panel producers’ TV panel business in loss mode, or the increased effects of IT panel price declines in an industry concentrated toward IT panel production?

Neither is good, but if we had to pick one, we would say the continuing decline in TV panel prices (see Figure 7), even if they dip below cash costs, is the better of the two, as it gives TV set producers the ability to bring down set prices over the next few months, while IT panel prices are still a distance away from cash costs, giving them room to fall further, and considering the shift toward IT panel production over the last 7 or 8 months, the competition in that space could become brutal. February is an unusual month for the display industry as the Chinese New Year tends to slow production across the industry, so the trend in March will be a bit more telling, however we expect at least the 1st half of 2022 to be a difficult one for the display space, at least from the perspective of panel producers, so we look toward any data that might help us to understand how the CE space will look in 2022.

RSS Feed

RSS Feed