Panel Pricing – Reading the Tea Leaves

First in line would be the panel producers themselves, a relatively limited number of players that can be categorized by their size and/or their product line-up, but as the supply chain for the display industry itself is a complex one, each sub-group, while they certainly have their own characteristics, is affected by display panel pricing, some of which are industry groups created specifically for the display industry. Display glass is one such industry, and while a subset of the overall glass industry, there are only a few players that produce commercial quantities of glass for displays. In a real sense there are only a few major players, Corning (GLW), Asahi Glass (5201.JP), Nippon Electric Glass (5214.JP), Avanstrate (500295.IN), Schott (pvt), and Rainbow (438.HK). Given that glass is the substrate or working production platform for almost every display, display prices, while not directly affecting display glass prices, can be a harbinger of demand for this particular ~$6b market.

LCD displays are driven by LED backlights, which are a subset of the overall LED manufacturing industry that includes LED lighting as its largest application (~33% in 2021). but if you add signage, consumer products, large displays, mobile displays, and Mini/Micro-LED displays, display applications are 38% of the LED market (sales), larger than lighting, making display pricing a key function of that ~$16b market. Display production equipment, another highly specialized industry, is a ~$10b industry that is closely tied to panel demand as reflected in panel pricing, and the causality of display price changes has a great influence on the electronics assembly business, where companies like Foxconn (2354.TT), Wistron (3231.TT), Pegatron (4938.TT) and Quanta (2382.TT), acting as assemblers or as ODM/OEMs, can see their business change radically as display pricing trends change.

Outside of the display supply chain, there is a litany of CE companies who must compete against each other to provide the most value to consumers, who have relatively little loyalty to brands and see CE products as ones that should always come down in price. Display choices by such brands are significantly affected by display panel prices as a major contributor to product BOM and margins, so there are few in the CE space that are not directly or indirectly influenced by display prices, the reason we have been collecting such data since 2009 and are a bit obsessive about tracking such data.

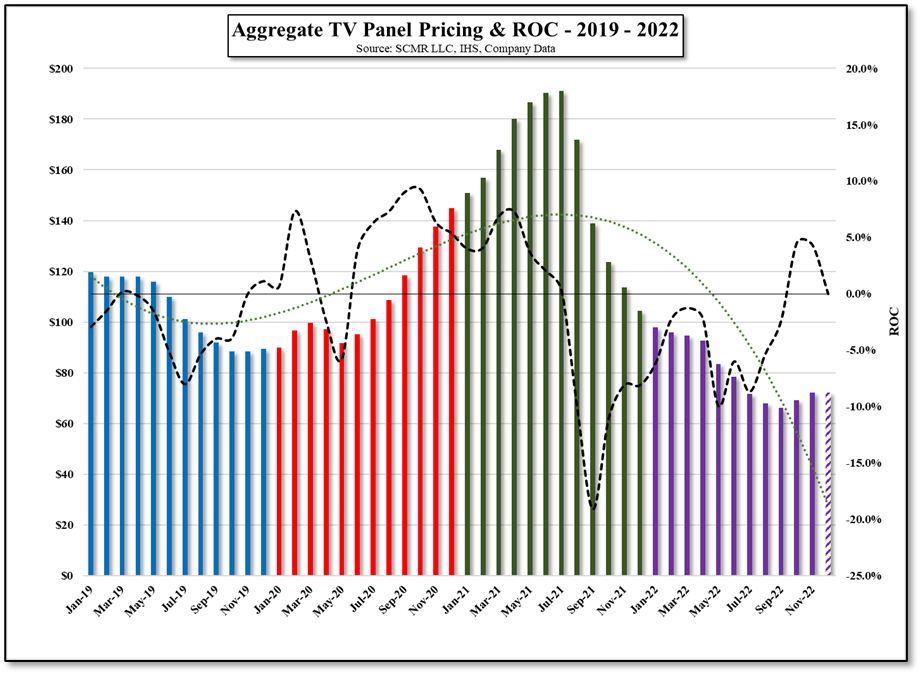

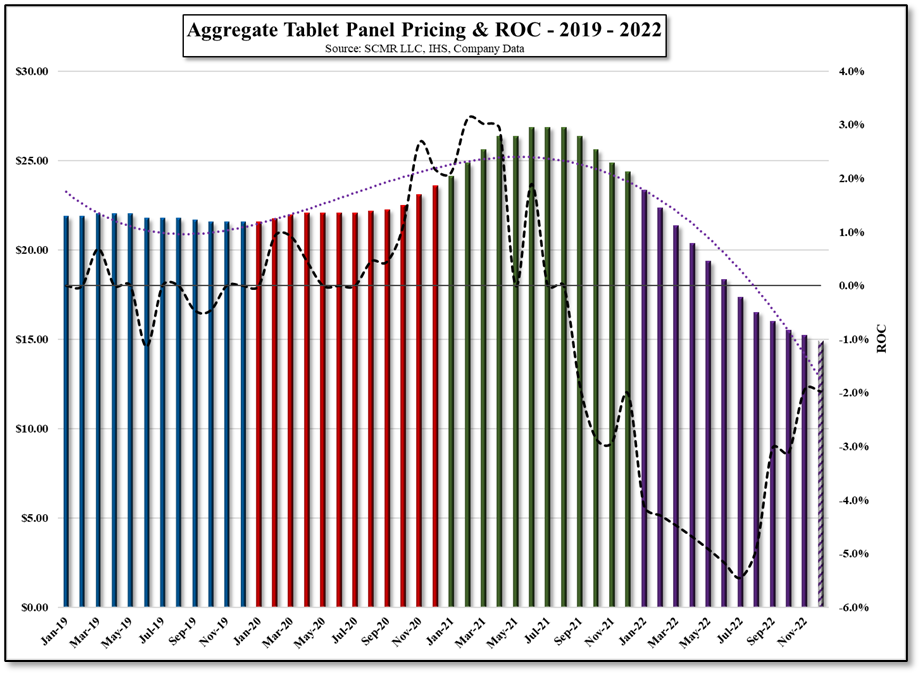

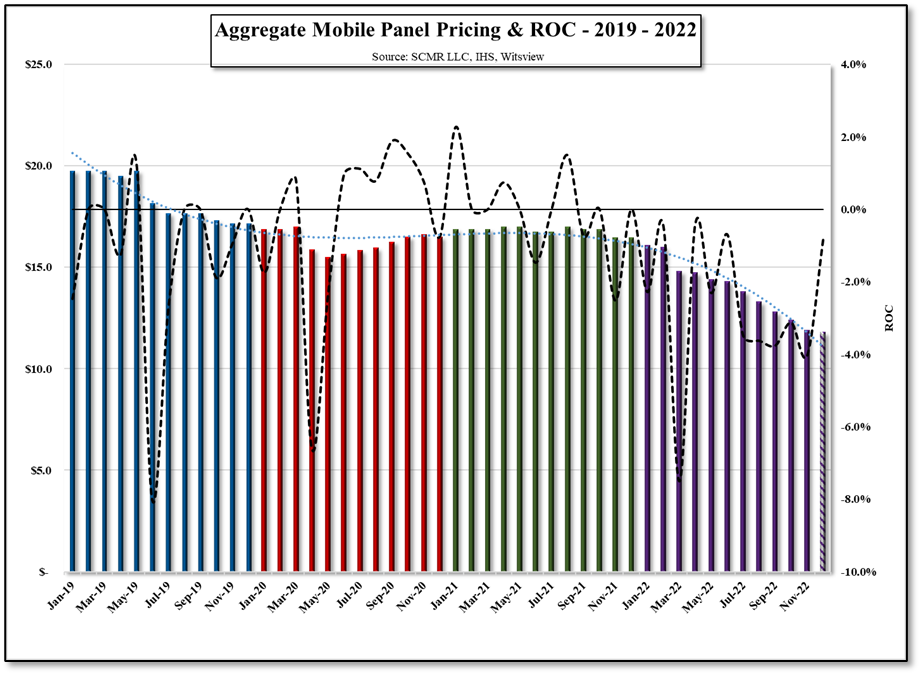

OK, enough self-justification… November display pricing was positive (m/m) for the first time this year, which many will take as a sign of a pricing recovery, however the overall increase was entirely the result of TV panel prices, which increased by 4.3% in the aggregate, while all other panel categories declined. TV panel prices, which began their climb during the early days of the COVID pandemic, started falling sharply last July as consumers began to venture from COVID confinement. IT panel (monitor, notebook, tablet) prices lagged as component shortages kept supply constrained, but peaked just two months after TV panel price peaks, and despite the industry’s insistence that we were experiencing a ‘new normal’, IT panel prices have continued to decline since.

TV panel prices not only retraced their pre-COVID lows but fell to levels that put them below cash costs for many panel producers, with the eventual result being lower panel fab utilization and in some cases panel producers went as far as to refuse orders that they believed would price out at a loss. In October TV panel producers saw an opportunity, in that lower TV panel production had seemed to tighten the market a bit, and used that opportunity to raise TV panel prices for the first time this year. TV brand panel buyers, with the understanding that TV panel prices were at historic lows, accepted the increase in October, however, panel producers saw that increase as a chance to salvage 4Q sales and profitability and pushed for more increases in November, as noted above. That said, the global macro environment continued to deteriorate in November and Chinese and US holiday results were lackluster, which brings us to December where we expect that TV panel prices will be relatively flat, while IT panel prices continue to decline on continued demand weakness and panel producers will meet with resistance from buyers toward further TV panel price increases, given the uninspiring demand environment.

Based on or estimates for panel prices in December, assuming our scenario plays out, this was not a good year for panel prices from a y/y perspective, and while some might say that a y/y comparison is not an accurate portrayal of the cycle given the COVID pandemic’s influence, we also calculated current panel prices (December) relative to the lowest point over a 3 year period. Current TV panel prices are the only ones that are appreciably above those lows, with the aggregate total (all categories) up less than 1% from the 3-year low set in September of this year.

Panel costs are difficult to estimate given that each model run or order are different, but the basic components and materials used in the panel production process typically allow a panel producer to reduce its costs by between 4% and 7% each year as products mature and production efficiency increases, especially as new capacity ramps up to mass production levels, but since early 2020 we have seen a considerable number of material and production costs rise rapidly, particular some of the basic materials used in displays. Copper was among the worst, with price increases over 25% in both 2020 and 2021, , while substrate glass saw incremental price increases in almost every quarter during the same period, along with energy and labor costs. Copper however has declined in price this year, and while down ~15% y/y, it is still up ~37% from its base price at the end of 2019. This makes the typical cost reductions panel producers typically used to allow them to lower panel prices impossible over the last three years, and while the higher volumes and higher panel prices seen during 2020 and the 1st half of 2022 allowed panel producers to generate record profits, the battle ground has changed considerably.

Costs will continue to be an issue for panel producers heading into 2023, although the weakness seen in certain segments of the semiconductor space could give panel producers a bit of help toward cost reductions that come close to price declines, so we are a bit more optimistic about the display space in 2023, looking at it from a cost/price perspective, but we still struggle for a demand driver that could push the display space back toward profitability. We expect less volatility toward panel pricing in 2023, and more rational behavior toward capacity expansion, particularly in China, both positives that could lead to a more stable and predictable display industry, but the display space is not noted for its stability, and we have come to expect irrational behavior from display producers as a matter of course and expect 2023 will have similar instances which could throw off our less frenetic feeling about display in 2023.

On a short-term basis, we look to the following to plan our 2023 display scenarios:

- December TV panel pricing – Do buyers walk away from panel price increase requests in December?

- Year-end inventory levels – The CE space has been plagued with excess supply this year, as it was slow to respond to a return to more ‘pre-COVID’ buying patterns.

- Results from holiday buying, particularly in North America and China.

- Results during Chinese New Year – Unless China relaxes COVID restrictions, it could be a poor Chinese New Year (1-22-23).

- CE brand forecasts for 2023 – While these are typically made in October, we expect CE brands will postpone 2023 targets as long as possible heading into the holidays. Hopefully those targets will be more reasonable for 2023 than they were this year, as they had to be revised 2 or 3 times, leading to rapid changes in production levels at suppliers.

- Do panel producers stick to new capacity postponements and cancellations, or do they return to the competitive over-building that is characteristic of the display space?

- Does the Chinese government, particularly at the local level, slow display project funding?

- Does Apple (AAPL) push into new product categories in 2023 (AR/VR) or is 2023 a ‘more of the same’ year for major CE brands?

- Do consumers completely abandon the ‘COVID lifestyle’ and return to typical CE buying patterns or have we migrated into a ‘modified-normal’ buying pattern, with a continuation of an increased focus on mobile, or does the populous get off the couch in 2023?

- Is inflation brought under control, giving consumers a bit of spending incentive?

RSS Feed

RSS Feed