Poking the Bear

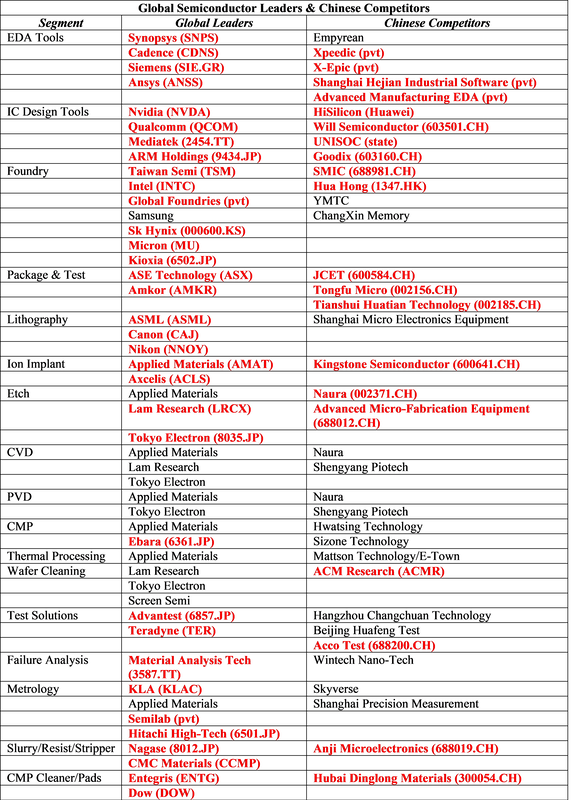

While the politics did create a bit of a rallying cry among the US population against China, it did far more in China itself, uniting the country to a common enemy, just as it did for the US during WWII. China found itself extremely dependent on US technology, particularly semiconductors, and while much of the CE industry had shifted assembly production to China because of its low-cost labor, the country was woefully behind in the development of the key components the US was restricting. Whether spurred by the Chinese government or by their own enlightened self-interests many Chinese CE companies saw what happened to Huawei and others as an omen as to further restrictions that might affect them more directly, and began a process of re-evaluating their supply chain. Here is one example:

Yangtze Memory Technologies (600345.CH) is a subsidiary of Tsinghua Unigroup (state) and the Hubei government that produces 3D NAND Flash memory products, both 64 and 128 layer. The company, which is under 5 years old, sends its top executives each month to Beijing to meet with China’s top economic organizations to update their progress on the process of removing their dependence on US technology and suppliers. In fact, even when Wuhan was shut down during the pandemic, those executives were the only ones allowed to travel by train to such meetings, and were picked up once a month by the same train that carried YMYC employees to the plant, the only train allowed to stop in Wuhan.

Under the eye of the government YMTC employs over 800 people that work full time to replace the company’s dependence on US suppliers, and not only is reviewing the origin of every component, system, and tool that goes into the production of their products, but does the same for its suppliers, down to each screw, nut, or bolt. Each supplier is assigned a risk level, and YMTC engineers are sent to suppliers for on-site reviews to verify the origin of every part, with US made parts assigned the highest risk, followed by Japan, and Europe, each with a declining risk level, followed by a ‘corrective action report’ that explains how source diversification can be improved and local alternatives found.

Now YMTC has stationed hundreds of engineers around the production campus who are working 24/7 to change production processes and replace as many non-Chinese tools as possible, raising local percentage targets almost every month. This represents a major opportunity for local process tool vendors and suppliers, as the government and other state-owned entities are offering massive subsidies and investments to almost anyone building or expanding a semiconductor line, as long as it has a minimum of 30% of its production tools sourced from local vendors. Such local companies are trying to mimic those US companies that dominate the field in almost every category of semiconductor manufacturing and the government has set a goal of 70% self-sufficiency in semiconductors by 2025, a goal that is far from ensured, given that the 2020 Chinese semiconductor production share was 15.9% according to IC Insights.

However, the point is that the Trump administration’s constant battle over trade with China and its continued push to stifle China’s semiconductor development, has not only lit a fire under the Chinese government, but has become a rallying cry for the Chinese population and even more importantly for Chinese component and tool buyers, who previously saw little reason to purchase from local suppliers. The earlier buyer thought process was “Why take a chance with a local vendor when I can buy the same tool that Samsung (005930.KS) or Intel (INTC) uses?” Now that such thoughts are either limited by US sanctions, unavailable due to demand, or are not able to receive government financing, local suppliers are given an opportunity to compete and develop more competitive products. We doubt that China will meet what is a very aggressive goal for 2025, but they are certainly trying and will continue to do so. “The wise man doesn’t poke a sleeping bear with a stick”, Stephen King – ‘Wolves of the Calla’

RSS Feed

RSS Feed